Breakoutwatch Weekly Summary 11/23/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Market Summary

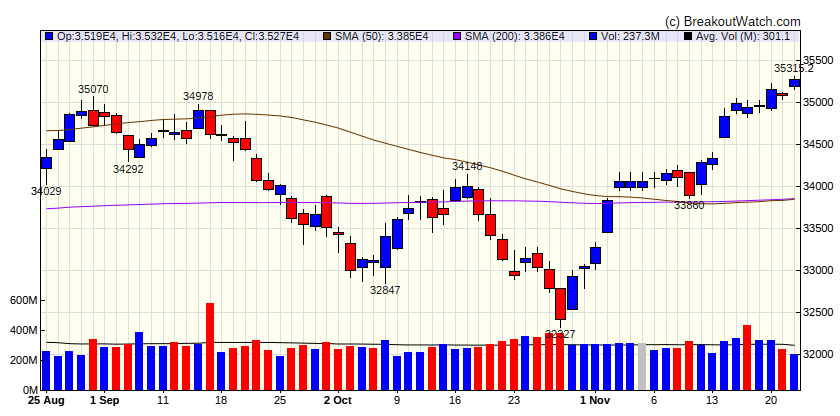

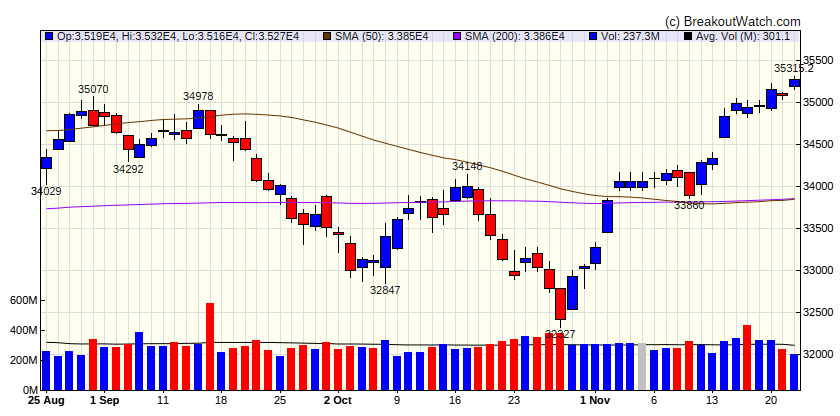

Stocks build on gains in broad advance

The S&P 500 Index built on its strong gains over the previous two weeks and moved above the 4,500 barrier for the first time since September. The week’s advance was also notably broad, with an equally weighted version of the S&P 500 Index outperforming its market-weighted counterpart by a full percentage point. The Russell 1000 Value Index also outperformed its growth counterpart and moved back into positive territory for the year to date. The small-cap indexes also outperformed. [more...]

Major Index Performance

| Dow Jones

|

| Last Close

| 35273 |

| Wk. Gain

| 0.88 % |

| Yr. Gain

| 6.41 % |

| Trend

| Up |

|

| S&P 500

|

| Last Close

| 4556.62 |

| Wk. Gain

| 1.03 % |

| Yr. Gain

| 18.25 % |

| Trend

| Up |

|

| NASDAQ Comp.

|

| Last Close

| 14265.9 |

| Wk. Gain

| 1.17 % |

| Yr. Gain

| 35.07 % |

| Trend

| Up |

|

| Russell 2000

|

| Last Close

| 1795.54 |

| Wk. Gain

| 0.59 % |

| Yr. Gain

| 1.44 % |

| Trend

| Up |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

1.34 |

30.36 |

Up |

| Consumer Staples |

0.78 |

-3.39 |

Up |

| Energy |

0.93 |

-1.04 |

Down |

| Finance |

1.03 |

3.48 |

Up |

| Health Care |

1.32 |

-4.29 |

Up |

| Industrials |

0.54 |

11.63 |

Up |

| Technology |

1.11 |

45.54 |

Up |

| Materials |

0.47 |

4.05 |

Up |

| REIT |

-0.41 |

-3.58 |

Up |

| Telecom |

1.62 |

40.21 |

Up |

| Utilities |

-0.08 |

-13.13 |

Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| CWH |

RYAAY |

Ryanair Holdings plc |

Airlines |

82.8 % |

0.5 % |

| CWH |

WING |

Wingstop Inc. |

Restaurants |

82.4 % |

0.8 % |

| SQZ |

AGI |

Alamos Gold Inc. |

Gold |

74.2 % |

1.2 % |

| SQZ |

CME |

CME Group Inc. |

REIT - Office |

74.2 % |

0.4 % |

| SQZ |

IRS |

IRSA Inversiones Y Representaciones S.A. Global De |

Real Estate Services |

74.1 % |

3.7 % |

| CWH |

CLBT |

Cellebrite DI Ltd. |

Software - Infrastructure |

73.1 % |

1.4 % |

| CWH |

MNDY |

monday.com Ltd. |

Software - Application |

69.9 % |

0.7 % |

| CWH |

RITM |

Rithm Capital Corp. |

REIT - Mortgage |

69.2 % |

0.4 % |

| CWH |

OC |

Owens Corning Inc |

Banks - Regional |

67 % |

0.2 % |

| SQZ |

NVGS |

Navigator Holdings Ltd. O |

Asset Management |

66.4 % |

1.2 % |

| CWH |

AMD |

Advanced Micro Devices, Inc. |

Semiconductors |

63.4 % |

0.3 % |

| CWH |

DELL |

Dell Technologies Inc. |

Computer Hardware |

63.4 % |

0.3 % |

| CWH |

DAC |

Danaos Corporation |

Marine Shipping |

63.2 % |

0.3 % |

| CWH |

CVRX |

CVRx, Inc. |

Medical Devices |

57.7 % |

0.4 % |

| SQZ |

OPAD |

Offerpad Solutions Inc. |

Real Estate Services |

55.3 % |

2.3 % |

| SQZ |

ATLX |

Atlas Lithium Corporation |

Banks - Regional |

49.4 % |

1.4 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

HUBB |

Hubbell Inc |

Asset Management |

73.3 % |

-0.4 % |

| SS |

DAL |

Delta Air Lines, Inc. |

Airlines |

68.9 % |

-0.1 % |

| SS |

HUBS |

HubSpot, Inc. |

Software - Application |

66 % |

-0.1 % |

| SS |

SQSP |

Squarespace, Inc. |

Software - Infrastructure |

62.4 % |

-3.7 % |

| SS |

BKTI |

BK Technologies Corporation |

Communication Equipment |

53.8 % |

-0.8 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Stocks Likely to Breakout next Week

| Symbol |

BoP |

Company |

Industry |

Relative Strength Rank |

Within x% of BoP |

C Score* |

| IDYA |

0 |

Zuora, Inc. |

Software - Infrastructure |

41.00 |

|

53.4 |

| BCC |

115.13 |

Boise Cascade, L.L.C. |

Building Materials |

93.00 |

99.49 |

67.9 |

| YELP |

|

|

|

|

|

72.6 |

| VEON |

21.00 |

VEON Ltd. |

Telecom Services |

89.00 |

93.38 |

53.1 |

| ALTR |

74.60 |

Altair Engineering Inc. |

Software - Infrastructure |

89.00 |

96.17 |

57 |

| MTH |

146.29 |

Meritage Homes Corporation |

Residential Construction |

90.00 |

97.09 |

70 |

| MUFG |

8.85 |

Mitsubishi UFJ Financial Group, Inc. |

Banks - Diversified |

90.00 |

96.27 |

73.6 |

| JELD |

|

|

|

|

|

66.2 |

| SWI |

11.73 |

SolarWinds Corporation |

Software - Infrastructure |

88.00 |

98.21 |

67.3 |

| MTSI |

84.62 |

MACOM Technology Solutions Holdings, Inc. |

Semiconductors |

88.00 |

99.5 |

66.7 |

| ASX |

|

|

|

|

|

70.6 |

| MNDY |

|

|

|

|

|

69.9 |

| GIL |

36.00 |

Gildan Activewear, Inc. |

Apparel Manufacturing |

88.00 |

98.81 |

71.9 |

| GES |

|

|

|

|

|

52.6 |

| OC |

|

|

|

|

|

67 |

| TIPT |

|

|

|

|

|

64.2 |

| TPH |

30.44 |

Tri Pointe Homes, Inc. |

Residential Construction |

86.00 |

96.35 |

68.6 |

| MTRN |

117.50 |

Materion Corporation |

Biotechnology |

83.00 |

96.61 |

71.7 |

| WSR |

11.14 |

Whitestone REIT |

REIT - Retail |

86.00 |

99.37 |

71.9 |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

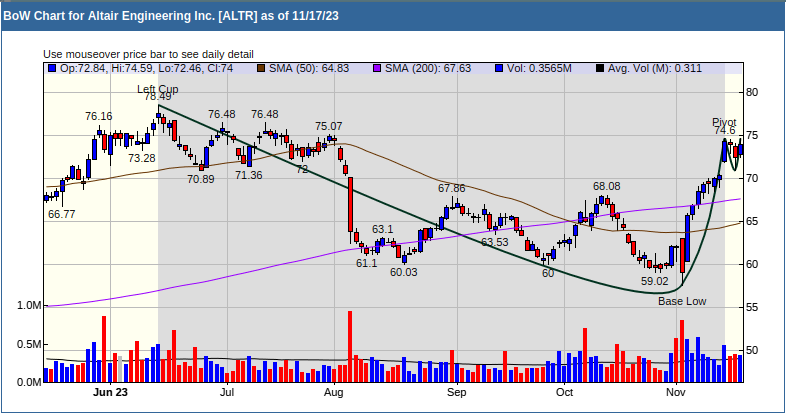

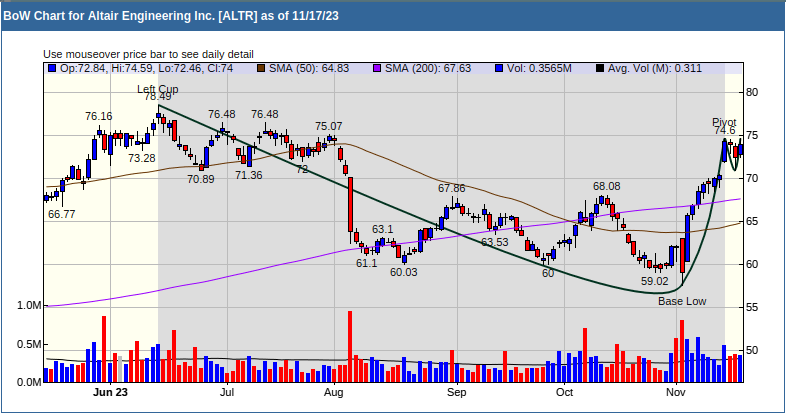

Cup and Handle Chart of the Week

Altair Engineering Inc. (ALTR), in recent weeks has followed the typical scenario we like to see in a stock that has the potential to break out in the near future. After a strong performance while ascending the right side of the cup, weak holders took profits while those investors who provided the right side cup momentum have resumed accumulation. ALTR closed just 0.8% below the pivot on Friday and has a strong relative strength rank of 91. For an analysis of how and why a cup and handle pattern forms, see our tutorial Anatomy of a Cup-with-Handle Chart Pattern