Breakoutwatch Weekly Summary 12/23/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

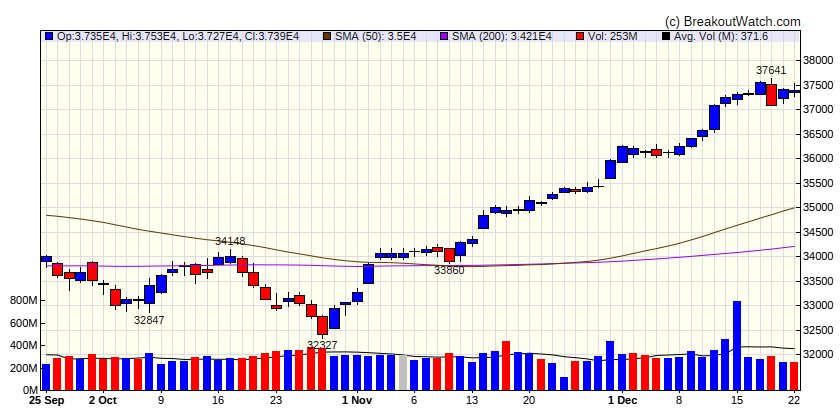

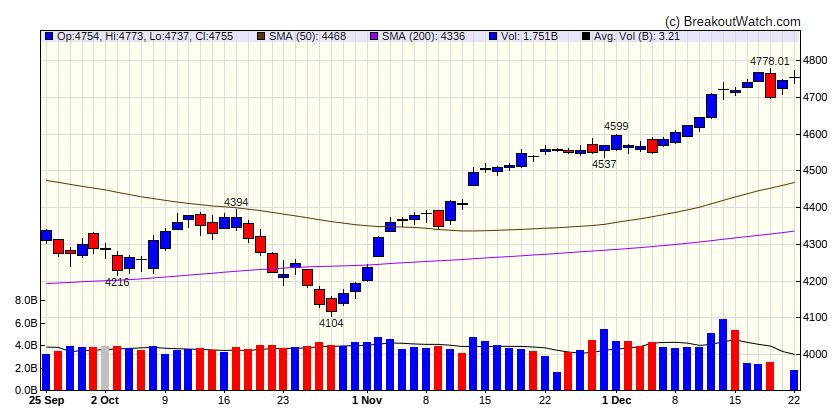

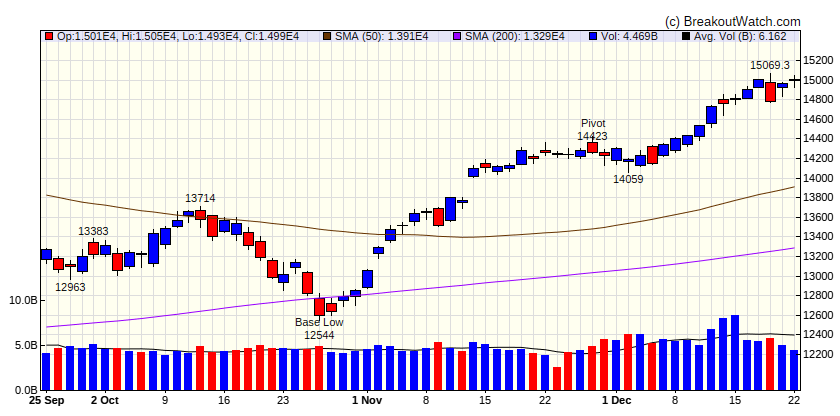

Nasdaq 100 and Dow advance further into record territory

Stocks continued their weekly winning streak—the longest since 2017—as investors appeared to grow more assured that the economy would skirt a recession in the coming months. The S&P 500 Index briefly moved within 84 basis points (0.84 percentage points) of its all-time intraday high at the start of 2022, while the Nasdaq 100 Index and Dow Jones Industrial Average managed new records. Communication services stocks led the gains within the S&P 500, boosted by rises in Google parent Alphabet and Facebook parent Meta Platforms. Energy shares also outperformed as oil prices rose in response to worries over attacks on shipping in the Red Sea. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 37386 |

| Wk. Gain | 0.15 % |

| Yr. Gain | 12.78 % |

| Trend | Up |

|

|

| S&P 500 | |

|---|---|

| Last Close | 4754.63 |

| Wk. Gain | 0.61 % |

| Yr. Gain | 23.4 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 14993 |

| Wk. Gain | 1.21 % |

| Yr. Gain | 41.95 % |

| Trend | Up |

|

|

| Russell 2000 | |

|---|---|

| Last Close | 2033.96 |

| Wk. Gain | 2.13 % |

| Yr. Gain | 14.91 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 0.23 | 40.47 | Up |

| Consumer Staples | -0.56 | -1.62 | Up |

| Energy | -0.49 | -0.71 | Up |

| Finance | -0.39 | 11.13 | Up |

| Health Care | 0.7 | 0.32 | Up |

| Industrials | 0.14 | 20.26 | Up |

| Technology | 0.37 | 52.92 | Up |

| Materials | 0.76 | 11.84 | Up |

| REIT | -1.12 | 6.34 | Up |

| Telecom | 2.28 | 44.85 | Up |

| Utilities | -1.97 | -12.41 | Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | TBBK | The Bancorp, Inc. | Banks - Regional | 83.3 % | 0.3 % |

| CWH | FLS | Flowserve Corporation | Specialty Industrial Machinery | 82 % | 1.5 % |

| SQZ | GSHD | Goosehead Insurance, Inc. | Insurance - Diversified | 82 % | 0.5 % |

| SQZ | EME | EMCOR Group, Inc. | Asset Management | 81.3 % | 0.9 % |

| CWH | BR | Broadridge Financial Solutions, Inc. | Information Technology Services | 80.2 % | 1.6 % |

| CWH | AGM | Federal Agricultural Mortgage Corporation | Credit Services | 79.9 % | 2.4 % |

| SQZ | MFIN | Medallion Financial Corp. | Credit Services | 79.4 % | 0.6 % |

| SQZ | APP | Applovin Corporation | Software - Application | 79.3 % | 3.1 % |

| SQZ | PBPB | Potbelly Corporation | Restaurants | 76.8 % | 5 % |

| CWH | ALG | Alamo Group, Inc. | REIT - Retail | 76.5 % | 3 % |

| SQZ | PR | Permian Resources Corporation Class A | Asset Management | 75.8 % | 0.3 % |

| CWH | MTRN | Materion Corporation | Biotechnology | 75.1 % | 2.9 % |

| SQZ | MNDY | monday.com Ltd. | Software - Application | 75.1 % | 0.2 % |

| SQZ | PETQ | PetIQ, Inc. | Software - Application | 75.1 % | 0.3 % |

| CWH | BWMN | Bowman Consulting Group Ltd. | Asset Management | 74.7 % | 3.8 % |

| CWH | CRVL | CorVel Corp. | Insurance Brokers | 74.5 % | 3.9 % |

| SQZ | OSCR | Oscar Health, Inc. | Healthcare Plans | 74 % | 1.8 % |

| SQZ | FSTR | L.B. Foster Company | Railroads | 72.9 % | 0.2 % |

| SQZ | NWLI | National Western Life Group, Inc. | Insurance - Life | 72.1 % | 0.2 % |

| CWH | SNFCA | Security National Financial Corporation | Mortgage Finance | 71.5 % | 2.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | PLTR | Palantir Technologies Inc. | Software - Infrastructure | 77.8 % | -3.5 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| MLTX | 62.01 | MoonLake Immunotherapeutics | Biotechnology | 98.00 | 97 | 59 |

| LINC | 10.15 | Linco | Specialty Chemicals | 94.00 | 97.24 | 67.6 |

| KRT | 24.59 | Karat Packaging Inc. | Biotechnology | 93.00 | 98.37 | 78.5 |

| BLBD | 26.96 | Blue Bird Corporation | Auto Manufacturers | 91.00 | 96.14 | 80.3 |

| AMPH | 62.72 | Amphastar Pharmaceuticals, Inc. | Communication Equipment | 89.00 | 97.13 | 84.4 |

| NFLX | 500.89 | Netflix, Inc. | Entertainment | 88.00 | 97.18 | 85 |

| FTDR | 36.97 | Frontdoor, Inc. | Personal Services | 87.00 | 97.54 | 77.7 |

| MQ | 7.14 | Marqeta, Inc. | Software - Infrastructure | 87.00 | 96.92 | 60.1 |

| ABCB | 53.64 | Ameris Bancorp | Banks - Regional | 85.00 | 97.91 | 72.9 |

| NMIH | 30.39 | NMI Holdings Inc | Insurance - Specialty | 85.00 | 98.65 | 73.4 |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week