Breakoutwatch Weekly Summary 01/08/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Market Summary

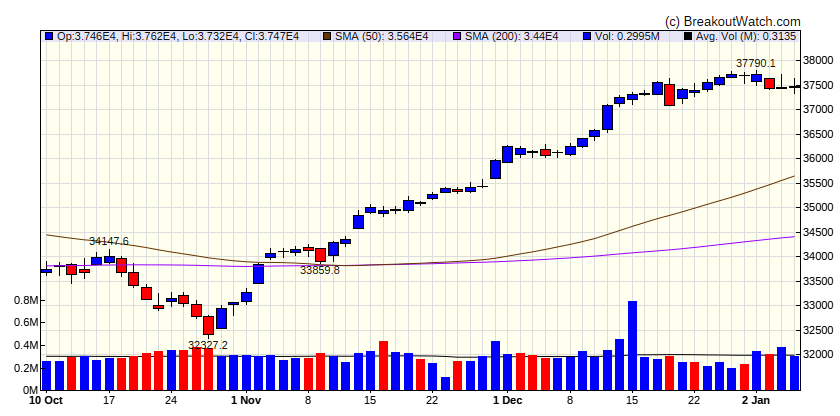

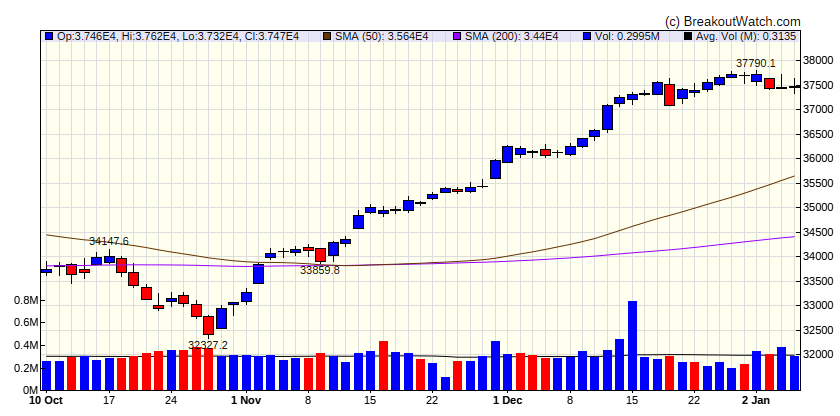

Stocks start 2024 on a down note

Stocks gave back a portion of the past several weeks’ solid gains as investors appeared to rotate into sectors that lagged in 2023, including utilities, energy, consumer staples, and health care. Conversely, a slide in Apple shares following an analyst downgrade weighed on the large-cap, technology-heavy Nasdaq Composite Index. The small-cap Russell 2000 Index also fell more than the broad market. T. Rowe Price traders noted that trading volumes were relatively muted over much of the holiday-shortened week, with markets shuttered on Monday in observation of the New Year’s Day holiday. [more...]

Major Index Performance

| Dow Jones

|

| Last Close

| 37466.1 |

| Wk. Gain

| -0.27 % |

| Yr. Gain

| -0.27 % |

| Trend

| Down |

|

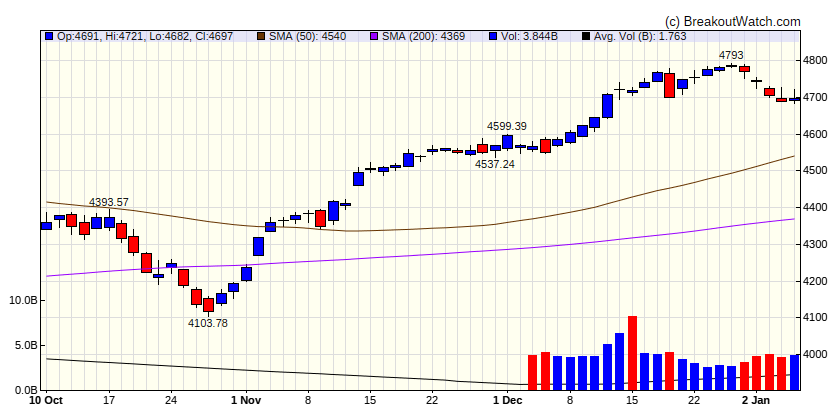

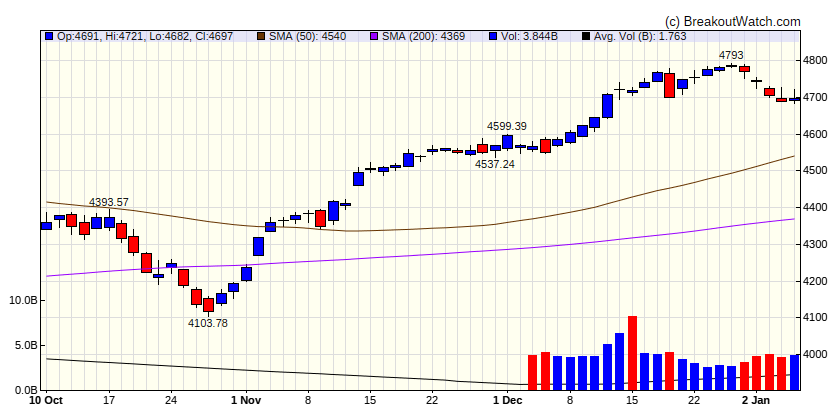

| S&P 500

|

| Last Close

| 4697 |

| Wk. Gain

| -1.01 % |

| Yr. Gain

| -1.01 % |

| Trend

| Up |

|

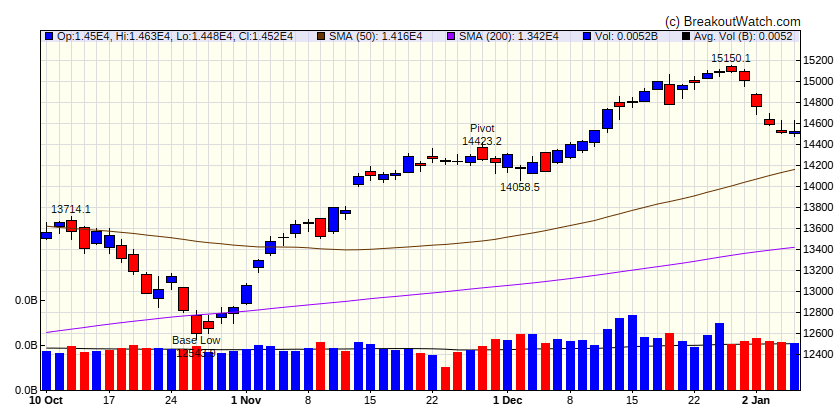

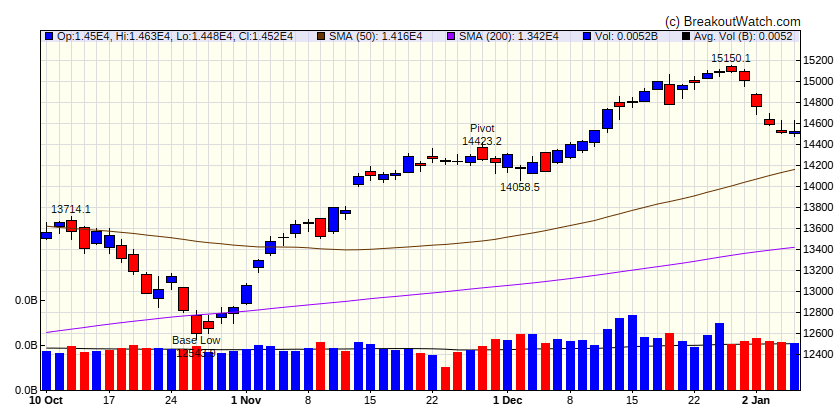

| NASDAQ Comp.

|

| Last Close

| 14524.1 |

| Wk. Gain

| -2.35 % |

| Yr. Gain

| -2.35 % |

| Trend

| Up |

|

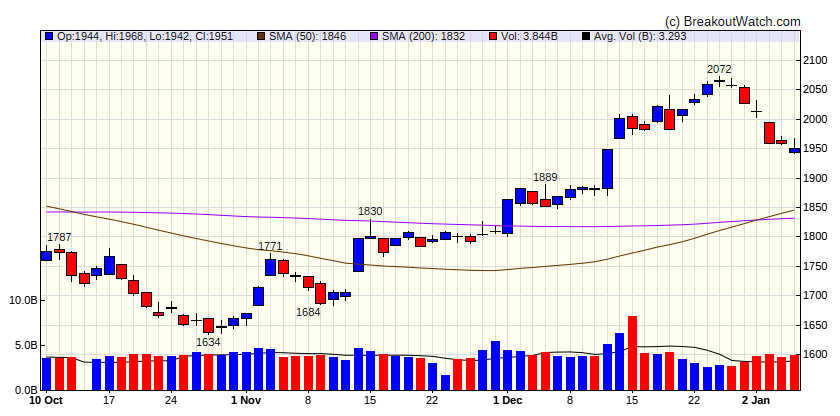

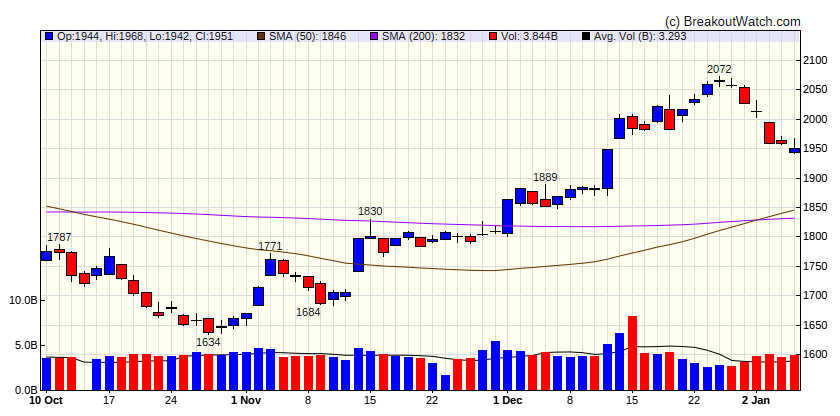

| Russell 2000

|

| Last Close

| 1951 |

| Wk. Gain

| -3.08 % |

| Yr. Gain

| -3.08 % |

| Trend

| Up |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

-3.21 |

-3.21 |

Down |

| Consumer Staples |

0.15 |

0.15 |

Down |

| Energy |

0.23 |

0.23 |

Down |

| Finance |

0.4 |

0.4 |

Down |

| Health Care |

1.98 |

1.98 |

Down |

| Industrials |

-2 |

-2 |

Down |

| Technology |

-3.35 |

-3.35 |

Down |

| Materials |

-1.15 |

-1.15 |

Down |

| REIT |

-1.63 |

-1.63 |

Down |

| Telecom |

-0.56 |

-0.56 |

Down |

| Utilities |

2.11 |

2.11 |

Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| CWH |

TK |

Teekay Corporation |

Apparel Retail |

80.1 % |

0.5 % |

| SQZ |

BBVA |

Banco Bilbao Vizcaya Argentaria S.A. |

Banks - Diversified |

78.5 % |

1.1 % |

| SQZ |

ETRN |

Equitrans Midstream Corporation |

Utilities - Regulated Electric |

75.5 % |

3 % |

| SQZ |

EOLS |

Evolus, Inc. |

Asset Management |

71.5 % |

2.9 % |

| CWH |

MG |

Mistras Group Inc |

Asset Management |

69.4 % |

4 % |

| CWH |

ASND |

Ascendis Pharma A/S |

Biotechnology |

68.4 % |

0.2 % |

| HTF |

TGTX |

TG Therapeutics, Inc. |

Biotechnology |

68 % |

4.1 % |

| SQZ |

TGH |

Textainer Group Holdings Limited |

Copper |

67.5 % |

0.1 % |

| SQZ |

MUSA |

Murphy USA Inc. |

Specialty Retail |

66.2 % |

0.5 % |

| CWH |

ELAN |

Elanco Animal Health Inco |

Biotechnology |

61.8 % |

2.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

FTK |

Flotek Industries, Inc. |

Shell Companies |

66.6 % |

-4.8 % |

| SS |

VTLE |

Vital Energy, Inc. |

Biotechnology |

55.5 % |

-2.6 % |

| SS |

IAG |

Iamgold Corporation Ordin |

Gold |

54.5 % |

-3.7 % |

| SS |

ZUO |

Zuora, Inc. |

Software - Infrastructure |

54.1 % |

-0.7 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

| There were no CWH stocks meeting our breakout model criteria |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week