Breakoutwatch Weekly Summary 01/15/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

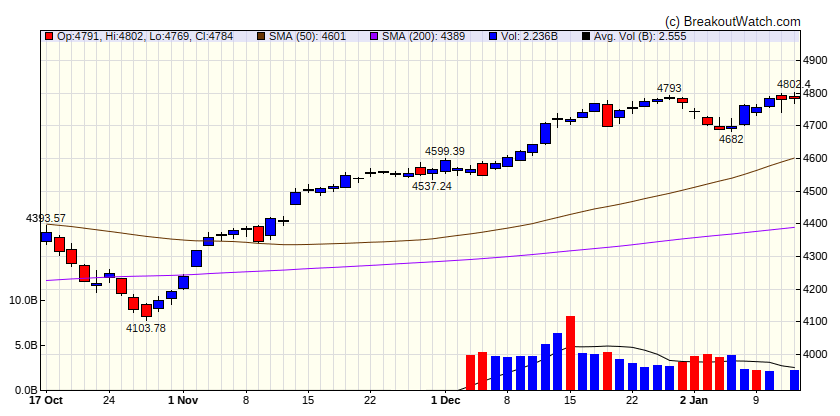

Market Summary

Stocks resume advance as earnings season kicks off

Stocks moved higher over the week, with large-cap growth stocks and the technology-heavy Nasdaq Composite Index outperforming the broader market. Several tech giants recorded solid gains, including Facebook parent Meta Platforms and chipmaker NVIDIA. Energy stocks underperformed as oil prices pulled back early in the week. The week brought the unofficial start of earnings season, with the nation’s four largest banks—JPMorgan Chase, Citigroup, Bank of America, and Wells Fargo—reporting fourth-quarter results on Friday. Markets were scheduled to be closed the following Monday in observance of the Martin Luther King, Jr. Day holiday. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 37593 |

| Wk. Gain | 0.71 % |

| Yr. Gain | 0.07 % |

| Trend | Up |

|

|

| S&P 500 | |

|---|---|

| Last Close | 4783.83 |

| Wk. Gain | 1.7 % |

| Yr. Gain | 0.82 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 14972.8 |

| Wk. Gain | 2.8 % |

| Yr. Gain | 0.67 % |

| Trend | Up |

|

|

| Russell 2000 | |

|---|---|

| Last Close | 1951 |

| Wk. Gain | 0.1 % |

| Yr. Gain | -3.08 % |

| Trend | Down |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 0.78 | -2.22 | Down |

| Consumer Staples | 1.18 | 1.39 | Up |

| Energy | -0.51 | -2.06 | Down |

| Finance | -0.59 | -0.24 | Up |

| Health Care | 1 | 3 | Up |

| Industrials | 0.84 | -1.42 | Down |

| Technology | 3.69 | 0.77 | Down |

| Materials | -0.75 | -2.24 | Down |

| REIT | 0.59 | -1.11 | Down |

| Telecom | 1.9 | 1.67 | Up |

| Utilities | -1.76 | 0.22 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | MSFT | Microsoft Corporation | Software - Infrastructure | 89.9 % | 1 % |

| SQZ | EME | EMCOR Group, Inc. | Asset Management | 81.7 % | 0.2 % |

| SQZ | DVA | DaVita Inc. | Medical Care Facilities | 80.4 % | 0.6 % |

| SQZ | ETN | Eaton Corporation, PLC Or | Specialty Industrial Machinery | 79.8 % | 1.1 % |

| SQZ | CDRE | Cadre Holdings, Inc. | REIT - Office | 79.3 % | 4.2 % |

| CWH | SMCI | Super Micro Computer, Inc. | Computer Hardware | 78.8 % | 3.7 % |

| DB | DLR | Digital Realty Trust, Inc. | REIT - Specialty | 76.3 % | 0.5 % |

| SQZ | AORT | Artivion, Inc. | Medical Devices | 74.8 % | 1.3 % |

| SQZ | FRHC | Freedom Holding Corp. | Capital Markets | 73.3 % | 0.7 % |

| SQZ | SPOT | Spotify Technology S.A. O | Health Information Services | 73 % | 1.1 % |

| CWH | TME | Tencent Music Entertainme | Medical Devices | 72.8 % | 2.1 % |

| SQZ | LTRX | Lantronix, Inc. | Communication Equipment | 69.6 % | 2.6 % |

| CWH | INSW | International Seaways, Inc. | Software - Application | 69.4 % | 3.1 % |

| SQZ | DBRG | DigitalBridge Group, Inc. | Real Estate Services | 68.6 % | 1.6 % |

| CWH | NCNO | nCino, Inc. | Software - Application | 68.4 % | 0.8 % |

| SQZ | TGH | Textainer Group Holdings Limited | Copper | 67.1 % | 0.1 % |

| CWH | TNGX | Tango Therapeutics, Inc. | Biotechnology | 65.7 % | 0.3 % |

| SQZ | USM | United States Cellular Corporation | Telecom Services | 63.7 % | 4.3 % |

| CWH | MRVL | Marvell Technology, Inc. | Semiconductors | 62.9 % | 1.9 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | VAL | Valaris Limited | Banks - Regional | 62.3 % | -1.2 % |

| SS | FATH | Fathom Digital Manufacturing Corporation Class A | Conglomerates | 57.3 % | -1.2 % |

| SS | MKFG | Markforged Holding Corporation | Computer Hardware | 35.5 % | -3.5 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

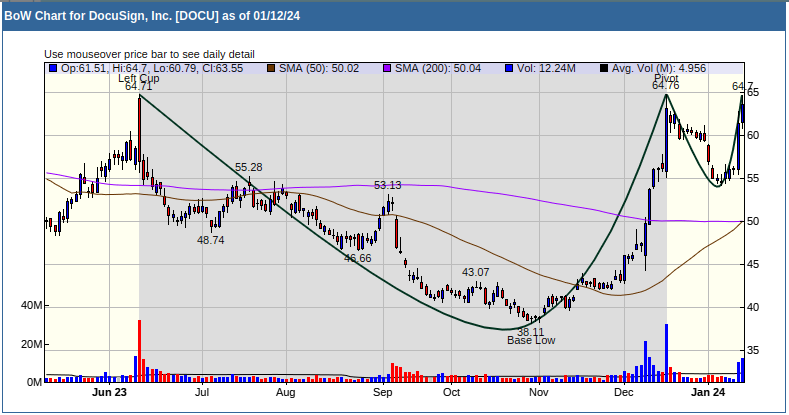

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| FSTR | 23.05 | L.B. Foster Company | Railroads | 93.00 | 97.48 | 72.5 |

| MFIN | 10.12 | Medallion Financial Corp. | Credit Services | 90.00 | 97.92 | 82.8 |

| DOCU | 64.76 | DocuSign, Inc. | Software - Application | 86.00 | 98.13 | 65.3 |

| EOLS | 10.96 | Evolus, Inc. | Asset Management | 86.00 | 96.26 | 71.9 |

| PVBC | 10.71 | Provident Bancorp, Inc. | Banks - Regional | 86.00 | 99.44 | 64.5 |

| EWBC | 74.61 | East West Bancorp, Inc. | Banks - Diversified | 85.00 | 96.22 | 74 |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week