Breakoutwatch Weekly Summary 02/06/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Market Summary

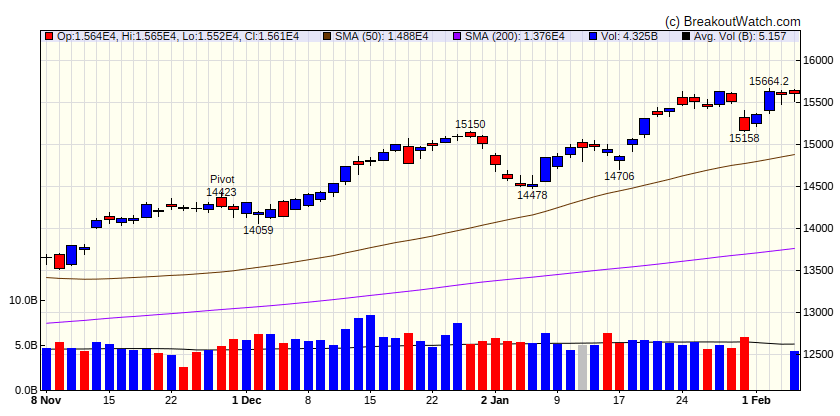

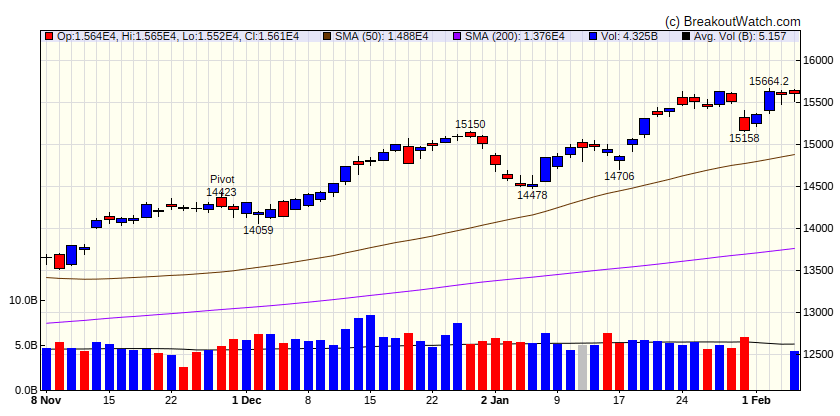

Large-cap benchmarks hit new highs, but small-caps struggle

The major indexes ended the week mixed amid a slew of significant earnings reports and economic data. The S&P 500 Index and Dow Jones Industrial Average moved to intraday highs, but the small-cap indexes recorded losses. The advance was also narrow, with an equally weighted version of the S&P 500 Index recording a modest loss. The week closed out the month of January with the S&P 500 advancing 1.6% over the month, while the equal-weight S&P 500 fell 0.90%, and the small-cap Russell 2000 Index declined nearly 4.0%. [more...]

Major Index Performance

| Dow Jones

|

| Last Close

| 38521.4 |

| Wk. Gain

| 0.91 % |

| Yr. Gain

| 2.54 % |

| Trend

| Up |

|

| S&P 500

|

| Last Close

| 4954.23 |

| Wk. Gain

| 1.92 % |

| Yr. Gain

| 4.41 % |

| Trend

| Up |

|

| NASDAQ Comp.

|

| Last Close

| 15609 |

| Wk. Gain

| 2.33 % |

| Yr. Gain

| 4.94 % |

| Trend

| Up |

|

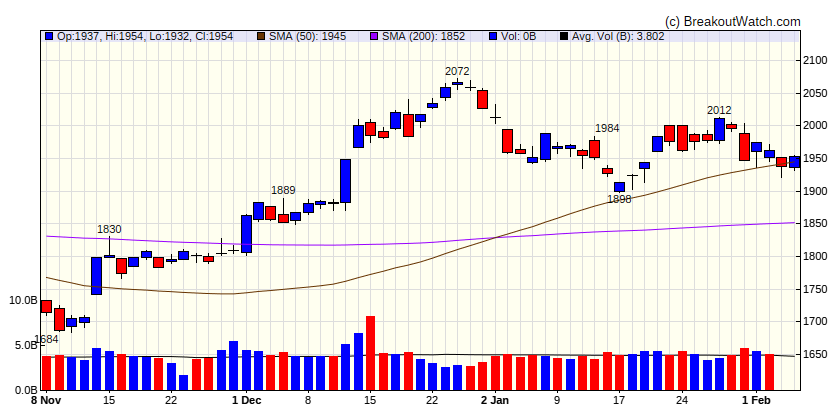

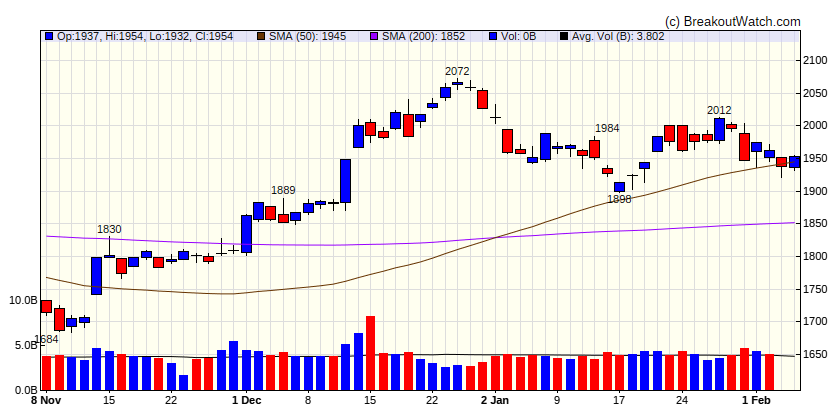

| Russell 2000

|

| Last Close

| 1953.63 |

| Wk. Gain

| -0.32 % |

| Yr. Gain

| -2.95 % |

| Trend

| Up |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

2.23 |

-0.85 |

Up |

| Consumer Staples |

1.3 |

2.7 |

Up |

| Energy |

-0.68 |

-1.47 |

Down |

| Finance |

0.04 |

2.42 |

Up |

| Health Care |

2.4 |

5.39 |

Up |

| Industrials |

1.87 |

2.04 |

Up |

| Technology |

1.64 |

5.55 |

Up |

| Materials |

-1.26 |

-3.54 |

Down |

| REIT |

-0.13 |

-4.95 |

Down |

| Telecom |

2.83 |

8.59 |

Up |

| Utilities |

-1.13 |

-4.17 |

Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| SQZ |

EDU |

New Oriental Education & Technology Group, Inc. |

Biotechnology |

81.8 % |

3.2 % |

| CWH |

FTNT |

Fortinet, Inc. |

Software - Infrastructure |

80 % |

0.2 % |

| SQZ |

CECO |

CECO Environmental Corp. |

Chemicals |

79.9 % |

0.3 % |

| SQZ |

EXPE |

Expedia Group, Inc. |

Travel Services |

77.2 % |

1.7 % |

| CWH |

MIXT |

MiX Telematics Limited Am |

Software - Application |

76.5 % |

2.2 % |

| CWH |

SURG |

SurgePays, Inc. |

Software - Application |

75.7 % |

4 % |

| DB |

CAAP |

Corporacion America Airports SA |

Banks - Diversified |

75.4 % |

3.2 % |

| SQZ |

CSL |

Carlisle Companies Inco |

Solar |

74.5 % |

1.1 % |

| SQZ |

FROG |

JFrog Ltd. |

Software - Application |

73.8 % |

2.8 % |

| CWH |

HUBB |

Hubbell Inc |

Asset Management |

72.8 % |

0.9 % |

| CWH |

TME |

Tencent Music Entertainme |

Medical Devices |

70.1 % |

2.3 % |

| SQZ |

SP |

SP Plus Corporation |

Specialty Business Services |

70 % |

0.1 % |

| SQZ |

CARG |

CarGurus, Inc. |

Banks - Regional |

69.4 % |

1 % |

| CWH |

ASND |

Ascendis Pharma A/S |

Biotechnology |

68.2 % |

0.6 % |

| CWH |

SNOW |

Snowflake Inc. |

Software - Application |

67.6 % |

1.6 % |

| SQZ |

OC |

Owens Corning Inc |

Banks - Regional |

66.9 % |

0.7 % |

| CWH |

TNGX |

Tango Therapeutics, Inc. |

Biotechnology |

64.5 % |

1.9 % |

| CWH |

PIPR |

Piper Sandler Companies |

Capital Markets |

63.6 % |

0 % |

| SQZ |

LEN |

Lennar Corporation Class A |

Residential Construction |

62.7 % |

0.9 % |

| CWH |

PI |

Impinj, Inc. |

Communication Equipment |

62.1 % |

2 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

NGS |

Natural Gas Services Group, Inc. |

Biotechnology |

73.6 % |

-1.5 % |

| SS |

PR |

Permian Resources Corporation Class A |

Asset Management |

73 % |

-1 % |

| SS |

REKR |

Rekor Systems, Inc. |

Software - Infrastructure |

67.3 % |

-1.6 % |

| SS |

OII |

Oceaneering International, Inc. |

Asset Management |

65.4 % |

-2 % |

| SS |

MARA |

Marathon Digital Holdings, Inc. |

Capital Markets |

64 % |

-3.7 % |

| SS |

HAL |

Halliburton Company |

Packaged Foods |

61.4 % |

-4.6 % |

| SS |

SOFI |

SoFi Technologies, Inc. |

Credit Services |

57.3 % |

-4.9 % |

| SS |

FSP |

Franklin Street Properties Corp. |

REIT - Office |

55.4 % |

-3.6 % |

| SS |

UDMY |

Udemy, Inc. |

Telecom Services |

36.1 % |

-2.9 % |

| SS |

ULBI |

Ultralife Corporation |

Real Estate Services |

32.2 % |

-3.5 % |

| SS |

TRDA |

Entrada Therapeutics, Inc. |

Biotechnology |

27.4 % |

-4.7 % |

| SS |

WOR |

Worthington Enterprises, Inc. |

Metal Fabrication |

25.9 % |

-2.3 % |

| SS |

VTLE |

Vital Energy, Inc. |

Biotechnology |

21.8 % |

-4.3 % |

| SS |

YEXT |

Yext, Inc. |

Software - Infrastructure |

15.7 % |

-1.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Stocks Likely to Breakout next Week

| Symbol |

BoP |

Company |

Industry |

Relative Strength Rank |

Within x% of BoP |

C Score* |

| GRPN |

0 |

UFP Technologies, Inc. |

Medical Devices |

79.00 |

|

64.9 |

| SURG |

|

|

|

|

|

75.7 |

| PRCT |

|

|

|

|

|

57.4 |

| MKSI |

112.66 |

MKS Instruments, Inc. |

Insurance - Property & Casualty |

85.00 |

95.76 |

67.5 |

| CG |

41.40 |

The Carlyle Group Inc. |

Asset Management |

87.00 |

98.36 |

65.7 |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week

MKS Intruments obtained the best score in my cup and handle breakout model. Although SURG has a higher CAN SLIM score, MKSI is closer to breakout.