Breakoutwatch Weekly Summary 02/11/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

S&P 500 Index breaches 5,000 for first time as narrow advance continues

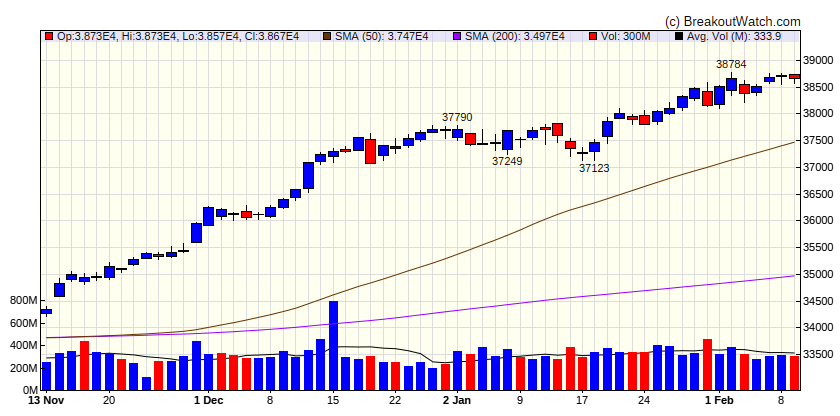

Most of the major indexes moved higher over the week, with the S&P 500 Index reaching new highs and breaching the 5,000 threshold for the first time. The advance remained relatively narrow, however, with an equally weighted version of the index significantly trailing the standard market-weighted version for the fourth time in five weeks. T. Rowe Price traders also noted a downward trend in the number of stocks that remained above their 50-day moving average. The narrowness may have reflected in part a relative dearth of economic data, leaving investors to focus more on individual companies’ earnings reports. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 38672 |

| Wk. Gain | 0.32 % |

| Yr. Gain | 2.94 % |

| Trend | Down |

|

|

| S&P 500 | |

|---|---|

| Last Close | 5027 |

| Wk. Gain | 1.41 % |

| Yr. Gain | 5.94 % |

| Trend | Down |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 15990.7 |

| Wk. Gain | 2.41 % |

| Yr. Gain | 7.51 % |

| Trend | Down |

|

|

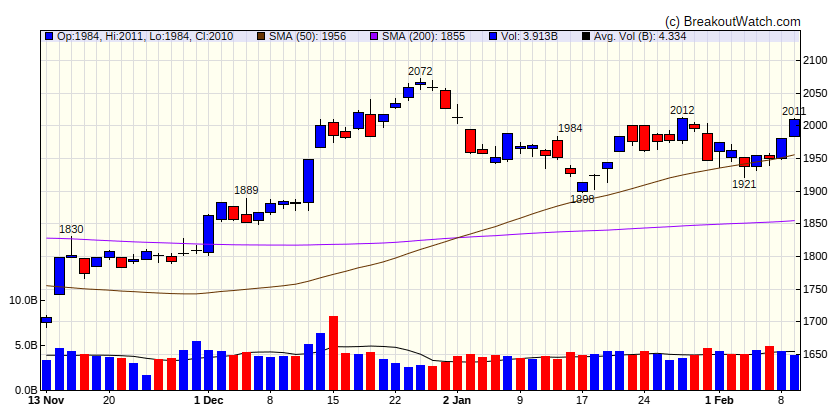

| Russell 2000 | |

|---|---|

| Last Close | 2010 |

| Wk. Gain | 2.97 % |

| Yr. Gain | -0.15 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 2.53 | 1.63 | Up |

| Consumer Staples | -1.26 | 1.81 | Up |

| Energy | 0.44 | -1.65 | Up |

| Finance | 0.93 | 3.27 | Up |

| Health Care | 1.32 | 5.51 | Up |

| Industrials | 1.81 | 3.31 | Up |

| Technology | 2.76 | 9 | Up |

| Materials | 1.77 | -2.59 | Down |

| REIT | 1.3 | -4.17 | Down |

| Telecom | -0.23 | 9.38 | Up |

| Utilities | -0.92 | -4.3 | Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | STRL | Sterling Infrastructure, Inc. | Biotechnology | 80.4 % | 4.9 % |

| CWH | FTNT | Fortinet, Inc. | Software - Infrastructure | 79.7 % | 4.6 % |

| SQZ | SSD | Simpson Manufacturing Company, Inc. | Banks - Regional | 79.7 % | 1 % |

| SQZ | STNE | StoneCo Ltd. | Software - Infrastructure | 79.2 % | 1 % |

| CWH | MCO | N/A | Asset Management | 78.7 % | 0.5 % |

| SQZ | CECO | CECO Environmental Corp. | Chemicals | 78.7 % | 0.9 % |

| CWH | COOP | Mr. Cooper Group Inc. | Mortgage Finance | 77.6 % | 4.2 % |

| SQZ | CE | Celanese Corporation | Chemicals | 77.5 % | 0.7 % |

| SQZ | OSW | OneSpaWorld Holdings Limited | Leisure | 77.3 % | 3.3 % |

| SQZ | DY | Dycom Industries, Inc. | Industrial Distribution | 75.3 % | 1.8 % |

| SQZ | IOT | Samsara Inc. | Software - Infrastructure | 74.7 % | 3.4 % |

| SQZ | KTB | Kontoor Brands, Inc. | Apparel Manufacturing | 74.6 % | 0.5 % |

| SQZ | TIMB | TIM S.A. American Depositary Shares (Each represen | Telecom Services | 73.9 % | 1.1 % |

| SQZ | COLL | Collegium Pharmaceutical, Inc. | REIT - Industrial | 73.4 % | 0.4 % |

| DB | OLED | Universal Display Corporation | Electronic Components | 72.2 % | 1.3 % |

| CWH | TGLS | Tecnoglass Inc. | Building Materials | 72 % | 2.2 % |

| CWH | BRZE | Braze, Inc. | Software - Application | 70.5 % | 3.5 % |

| DB | COIN | Coinbase Global, Inc. | Capital Markets | 70.3 % | 3.7 % |

| SQZ | CNXN | PC Connection, Inc. | Information Technology Services | 70.2 % | 2 % |

| SQZ | ROKU | Roku, Inc. | Entertainment | 70.2 % | 2.5 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | YEXT | Yext, Inc. | Software - Infrastructure | 15.5 % | -0.2 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| TLSI | 9.80 | TriSalus Life Sciences, Inc. | Medical Devices | 92.00 | 99.18 | 62.7 |

| FEIM | 11.20 | Frequency Electronics, Inc. | Communication Equipment | 91.00 | 96.16 | 71.8 |

| RDNT | 38.28 | RadNet, Inc. | Insurance - Specialty | 87.00 | 98.48 | 72.9 |

| CARG | 24.22 | CarGurus, Inc. | Banks - Regional | 85.00 | 98.76 | 68.9 |

| LCUT | 9.05 | Lifetime Brands, Inc. | Biotechnology | 85.00 | 96.69 | 64.1 |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.