Breakoutwatch Weekly Summary 02/23/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

Benchmarks mixed as small-caps and value shares outperform

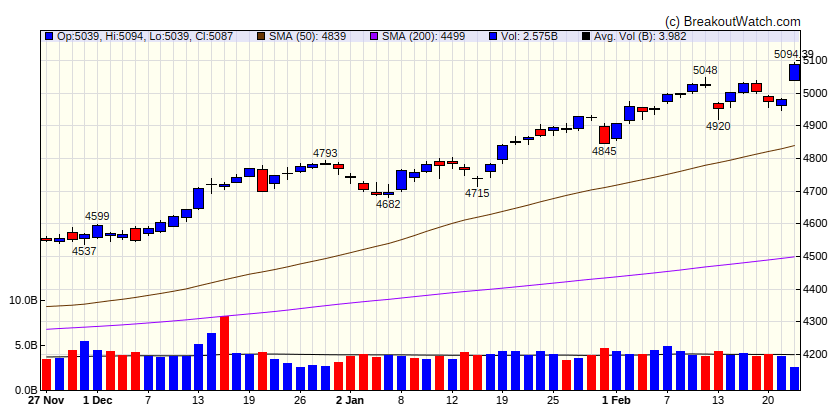

Some favorable earnings surprises balanced against discouraging inflation data left the major benchmarks mixed, with the S&P 500 Index recording its first weekly decline since the start of the year. The declines were concentrated in large-cap growth stocks, however, with an equally weighted version of the S&P 500 reaching a record intraday high on Thursday. After suffering its biggest daily drop since June on Tuesday, the small-cap Russell 2000 Index rebounded to lead the gains for the week. T. Rowe Price traders noted that trading volumes also picked up later in the week, after a very quiet start on Monday following the football weekend and with multiple markets shut for holidays, including the Chinese New Year and Carnival celebrations on the eve of the start of Lent on Wednesday. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 39069.1 |

| Wk. Gain | 1.28 % |

| Yr. Gain | 4 % |

| Trend | Up |

|

|

| S&P 500 | |

|---|---|

| Last Close | 5087.03 |

| Wk. Gain | 1.96 % |

| Yr. Gain | 7.21 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 16041.6 |

| Wk. Gain | 2.31 % |

| Yr. Gain | 7.85 % |

| Trend | Up |

|

|

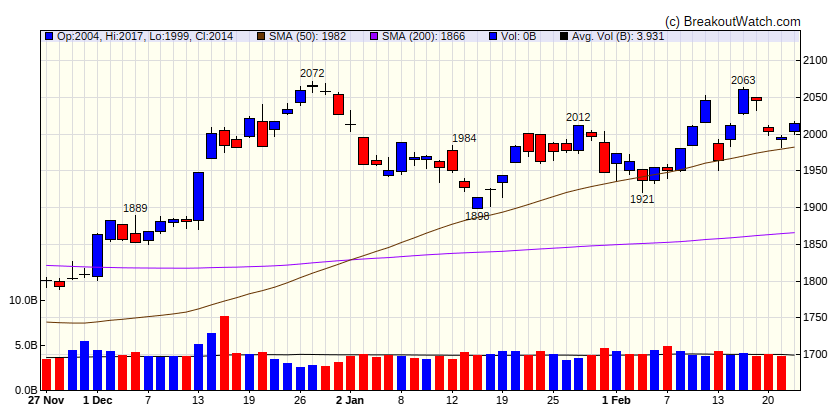

| Russell 2000 | |

|---|---|

| Last Close | 2013.84 |

| Wk. Gain | 0.24 % |

| Yr. Gain | 0.04 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 2.47 | 2.8 | Up |

| Consumer Staples | 0.88 | 3.74 | Up |

| Energy | 1.18 | 2.27 | Up |

| Finance | 1.67 | 5.91 | Up |

| Health Care | 0.93 | 7.79 | Up |

| Industrials | 1.42 | 5.29 | Up |

| Technology | 1.78 | 7.72 | Up |

| Materials | 1.61 | 0.92 | Up |

| REIT | 1.16 | -3.63 | Up |

| Telecom | 1.48 | 9.87 | Up |

| Utilities | 0.45 | -2.39 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | BBWI | Bath & Body Works, Inc. | Specialty Retail | 39.7 % | 2.8 % |

| SQZ | GIII | N/A | Apparel Manufacturing | 39.1 % | 3.2 % |

| SQZ | CRGX | CARGO Therapeutics, Inc. | Biotechnology | 38.8 % | 2.6 % |

| SQZ | KRTX | Karuna Therapeutics, Inc. | Biotechnology | 38.6 % | 0.2 % |

| SQZ | ZVRA | Zevra Therapeutics, Inc. | Biotechnology | 38.2 % | 1.6 % |

| SQZ | NGS | Natural Gas Services Group, Inc. | Biotechnology | 35.6 % | 0.8 % |

| SQZ | TZOO | Travelzoo | Advertising Agencies | 35.4 % | 3.2 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | MDXG | MiMedx Group, Inc | Biotechnology | 35.6 % | -0.1 % |

| SS | AVPT | AvePoint, Inc. | Software - Infrastructure | 34.7 % | -2 % |

| SS | SOFI | SoFi Technologies, Inc. | Credit Services | 33.4 % | -3.3 % |

| SS | NRDY | Nerdy Inc. | Software - Application | 25.9 % | -4.8 % |

| SS | AEHL | Antelope Enterprise Holdings Limited | Insurance - Diversified | 22.8 % | -0.5 % |

| SS | YEXT | Yext, Inc. | Software - Infrastructure | 15.4 % | -0.2 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| STRL | 85.35 | Sterling Infrastructure, Inc. | Biotechnology | 92.00 | 97.15 | 39.6 |

| FEIM | 11.25 | Frequency Electronics, Inc. | Communication Equipment | 91.00 | 97.33 | 41.5 |

| LFVN | 7.23 | Lifevantage Corporation | Packaged Foods | 89.00 | 96.54 | 39.7 |

| ARHS | 13.14 | Arhaus, Inc. | Home Improvement Retail | 86.00 | 96.58 | 39.8 |

| CVCO | 375.87 | Cavco Industries, Inc. | Residential Construction | 86.00 | 97.17 | 38.3 |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.