Breakoutwatch Weekly Summary 03/04/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Market Summary

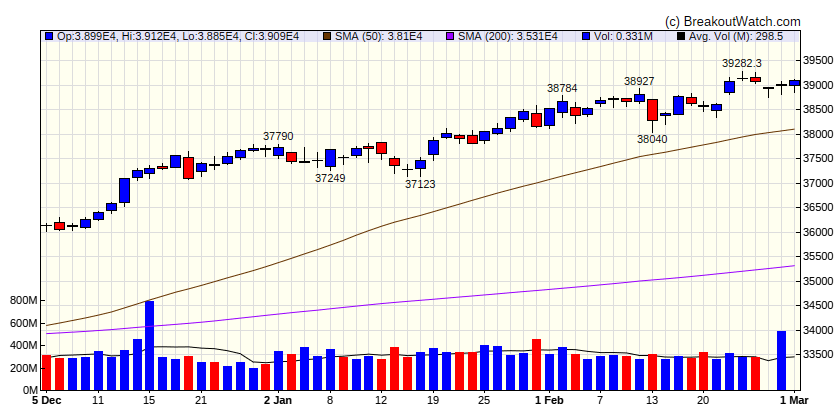

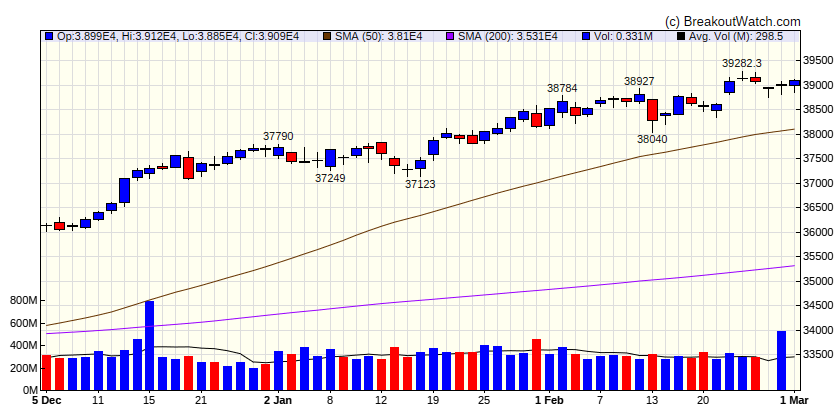

Stocks end mostly higher following favorable inflation news

Most of the major benchmarks ended the week higher, with the Nasdaq Composite joining the S&P 500 Index in record territory for the first time in over two years. The month also closed a strong February, with the S&P 500 marking its strongest beginning two months of the year since 2019, according to The Wall Street Journal. The week’s gains were also broad-based, with an equal-weighted version of the S&P 500 Index modestly outperforming its more familiar market capitalization version. For the year-to-date period, however, the capitalization-weighted version of the index remained ahead by 409 basis points (4.09 percentage points), reflecting the outperformance of large, technology-oriented growth stocks. [more...]

Major Index Performance

| Dow Jones

|

| Last Close

| 39087 |

| Wk. Gain

| -0.15 % |

| Yr. Gain

| 4.05 % |

| Trend

| Up |

|

| S&P 500

|

| Last Close

| 5137 |

| Wk. Gain

| 0.86 % |

| Yr. Gain

| 8.26 % |

| Trend

| Up |

|

| NASDAQ Comp.

|

| Last Close

| 16275 |

| Wk. Gain

| 1.63 % |

| Yr. Gain

| 9.42 % |

| Trend

| Up |

|

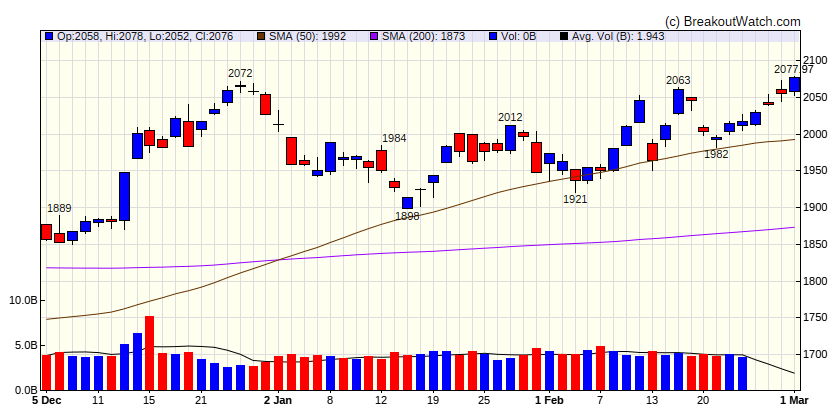

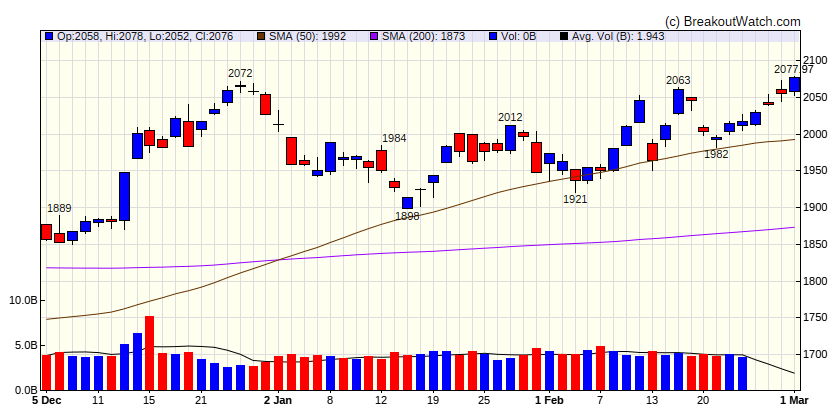

| Russell 2000

|

| Last Close

| 2076.39 |

| Wk. Gain

| 3.15 % |

| Yr. Gain

| 3.15 % |

| Trend

| Up |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

2.05 |

4.71 |

Up |

| Consumer Staples |

-0.11 |

4.17 |

Up |

| Energy |

1.54 |

3.15 |

Up |

| Finance |

0.42 |

6.71 |

Up |

| Health Care |

-0.59 |

7.53 |

Up |

| Industrials |

1.28 |

7.23 |

Up |

| Technology |

2.29 |

10.33 |

Up |

| Materials |

1.5 |

2.74 |

Up |

| REIT |

2.34 |

-1.68 |

Up |

| Telecom |

0.77 |

10.01 |

Up |

| Utilities |

0.22 |

-1.9 |

Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

TNK |

Teekay Tankers Ltd. |

Biotechnology |

72.2 % |

-0.1 % |

| SS |

OII |

Oceaneering International, Inc. |

Asset Management |

70.6 % |

-0.6 % |

| SS |

WST |

West Pharmaceutical Services, Inc. |

REIT - Retail |

65.5 % |

-1.1 % |

| SS |

VAL |

Valaris Limited |

Banks - Regional |

57.4 % |

-0.4 % |

| SS |

JILL |

J. Jill, Inc. |

Apparel Retail |

56.5 % |

-0.2 % |

| SS |

NICK |

Nicholas Financial, Inc. |

Credit Services |

50.7 % |

-2.2 % |

| SS |

MTEM |

Molecular Templates, Inc. |

Biotechnology |

42.5 % |

-2.6 % |

| SS |

FLUX |

Flux Power Holdings, Inc. |

Gambling |

38.1 % |

-4.8 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

| There were no CWH stocks meeting our breakout model criteria |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.