Breakoutwatch Weekly Summary 04/05/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Market Summary

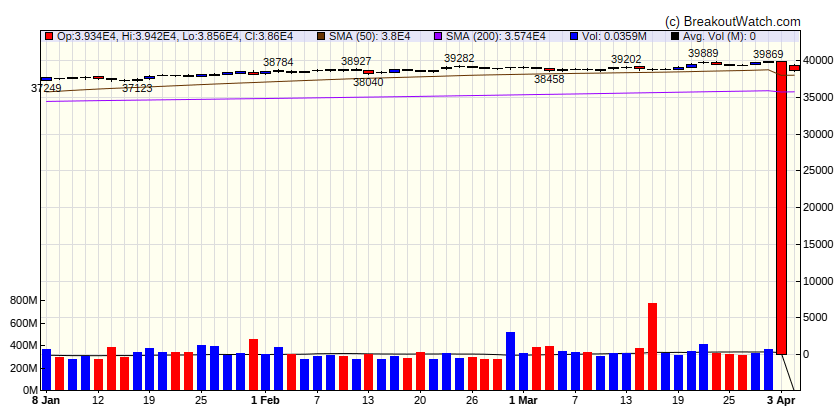

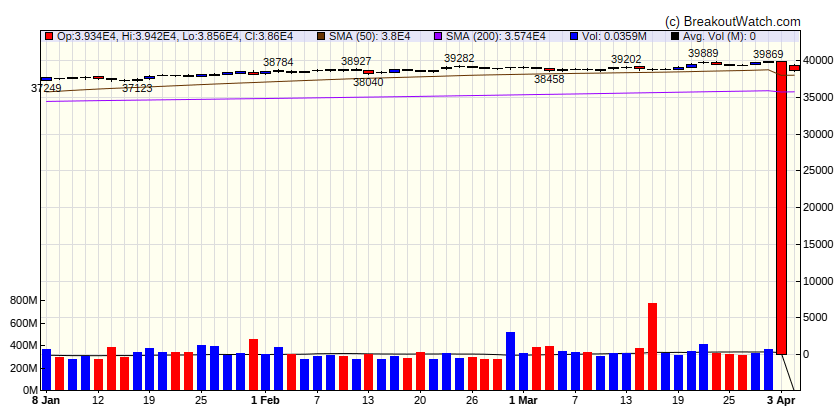

Stocks close out strong quarter with gains

Most of the major indexes advanced over the shortened trading week to end a quarter of strong gains. The S&P 500 Index recorded new closing and intraday highs to end the week. The market’s advance was notably broad, with an equal-weighted version of the S&P 500 Index gaining 1.64%, well ahead of the 0.39% increase in the more familiar market-weighted version. Small-caps also easily outperformed large-caps, and the Russell 1000 Value Index gained 1.79%, in contrast with the 0.60% decline in its growth counterpart. Markets were closed on Friday in observance of the Good Friday holiday but were scheduled to reopen on Monday in advance of many international markets. [more...]

Major Index Performance

| Dow Jones

|

| Last Close

| 38597 |

| Wk. Gain

| INF % |

| Yr. Gain

| 2.74 % |

| Trend

| Down |

|

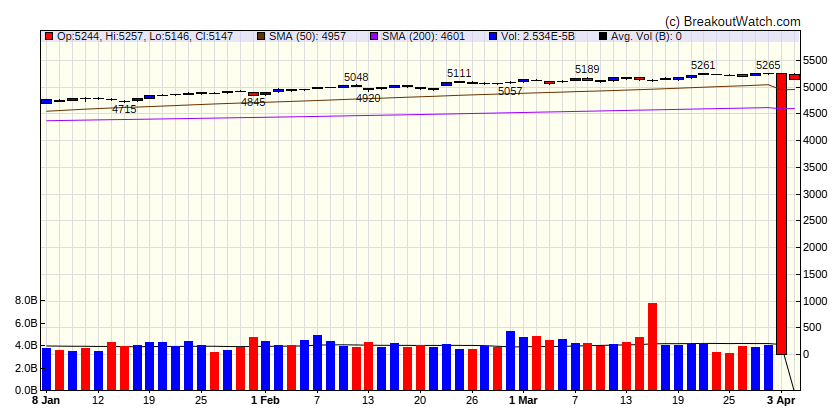

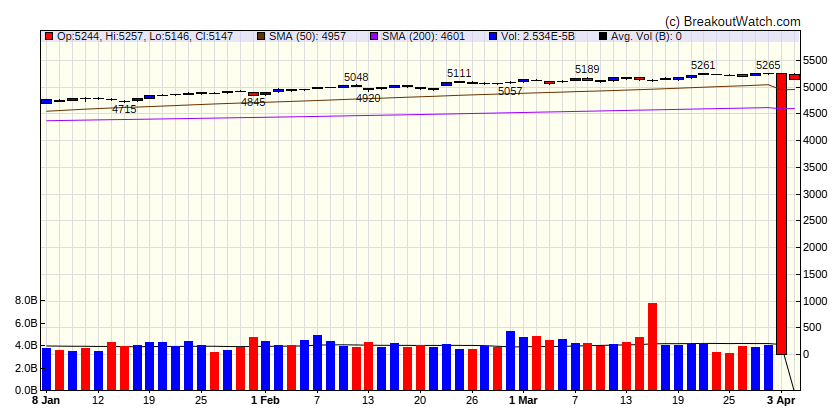

| S&P 500

|

| Last Close

| 5147.21 |

| Wk. Gain

| INF % |

| Yr. Gain

| 8.48 % |

| Trend

| Down |

|

| NASDAQ Comp.

|

| Last Close

| 16049.1 |

| Wk. Gain

| INF % |

| Yr. Gain

| 7.9 % |

| Trend

| Down |

|

| Russell 2000

|

| Last Close

| 16049.1 |

| Wk. Gain

| 7.9 % |

| Yr. Gain

| 697.27 % |

| Trend

| Up |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

-3.55 |

1.29 |

Up |

| Consumer Staples |

-2.94 |

4.11 |

Down |

| Energy |

2.4 |

14.64 |

Up |

| Finance |

-2.57 |

8.81 |

Up |

| Health Care |

-3.85 |

4.21 |

Down |

| Industrials |

-1.78 |

9.67 |

Up |

| Technology |

-2.45 |

7.14 |

Down |

| Materials |

-1.48 |

7.09 |

Up |

| REIT |

-3.72 |

-5.15 |

Down |

| Telecom |

0.2 |

12.25 |

Up |

| Utilities |

-1.14 |

3.48 |

Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| SQZ |

LPG |

Dorian LPG Ltd. |

Biotechnology |

78.5 % |

3.5 % |

| SQZ |

NSSC |

NAPCO Security Technologies, Inc. |

Medical Devices |

76.7 % |

1.6 % |

| SQZ |

FRO |

Frontline Plc Ordinary Sh |

Banks - Regional |

76.5 % |

3.8 % |

| CWH |

HUBS |

HubSpot, Inc. |

Software - Application |

75.6 % |

1.3 % |

| SQZ |

GEOS |

Geospace Technologies Corporation |

Restaurants |

75.1 % |

0.1 % |

| SQZ |

WEAV |

Weave Communications, Inc. |

Software - Application |

73 % |

1.9 % |

| SQZ |

ESEA |

Euroseas Ltd. |

Marine Shipping |

71.2 % |

1.3 % |

| SQZ |

LCUT |

Lifetime Brands, Inc. |

Biotechnology |

69.2 % |

1.8 % |

| SQZ |

AVDL |

Avadel Pharmaceuticals plc |

Agricultural Inputs |

68.6 % |

1.8 % |

| SQZ |

AVPT |

AvePoint, Inc. |

Software - Infrastructure |

66.6 % |

2.6 % |

| SQZ |

UEC |

Uranium Energy Corp. |

Uranium |

61.7 % |

2.7 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

SKT |

Tanger Inc. |

REIT - Retail |

76.7 % |

-2.6 % |

| SS |

YELP |

Yelp Inc. |

Software - Application |

66 % |

-0.6 % |

| SS |

NHC |

National HealthCare Corporation |

Medical Care Facilities |

65.9 % |

-3.5 % |

| SS |

PRDO |

Perdoceo Education Corporation |

Medical Devices |

63.7 % |

-1.5 % |

| SS |

CMT |

Core Molding Technologies Inc |

Specialty Chemicals |

59.5 % |

-2.2 % |

| SS |

NEO |

NeoGenomics, Inc. |

Real Estate Services |

54.9 % |

-3.6 % |

| SS |

TGI |

Triumph Group, Inc. |

Copper |

52.4 % |

-3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

| There were no CWH stocks meeting our breakout model criteria |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.