Breakoutwatch Weekly Summary 04/17/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Market Summary

Inflation disappoints on the upside in U.S. and on the downside in China

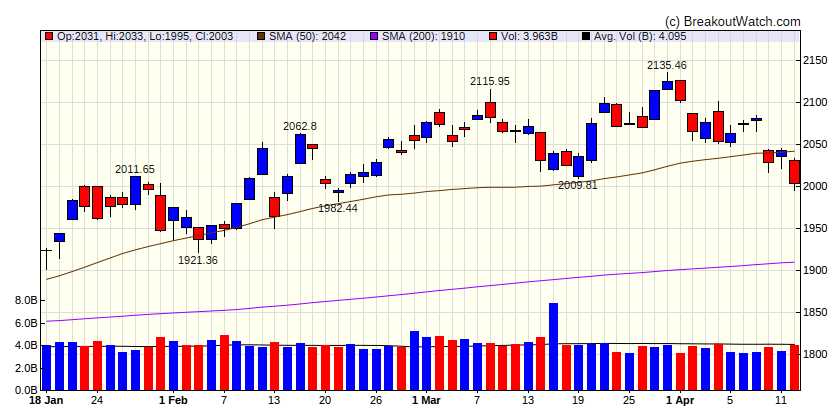

The major equity benchmarks retreated for the week amid heightened fears of conflict in the Middle East and some signs of persistent inflation pressures that pushed long-term Treasury yields higher. Large-caps held up better than small-caps, with the Russell 2000 Index suffering its biggest daily decline in almost two months on Wednesday and falling back into negative territory for the year to date. Growth stocks also fared better than value shares, which were weighed down by interest rate-sensitive sectors, such as real estate investment trusts (REITs), regional banks, housing, and utilities. [more...]

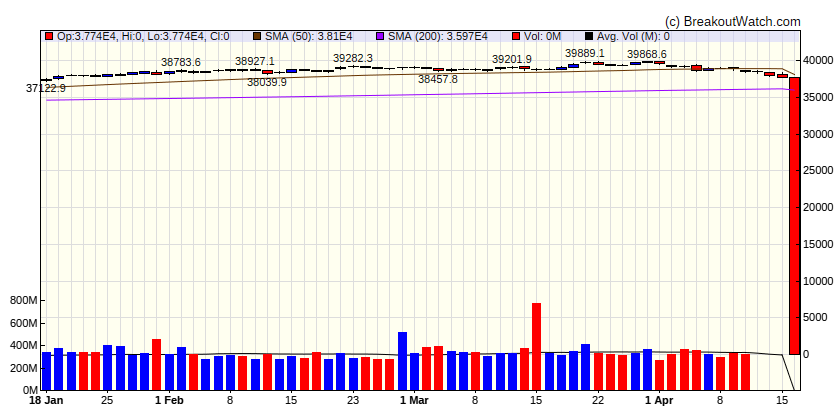

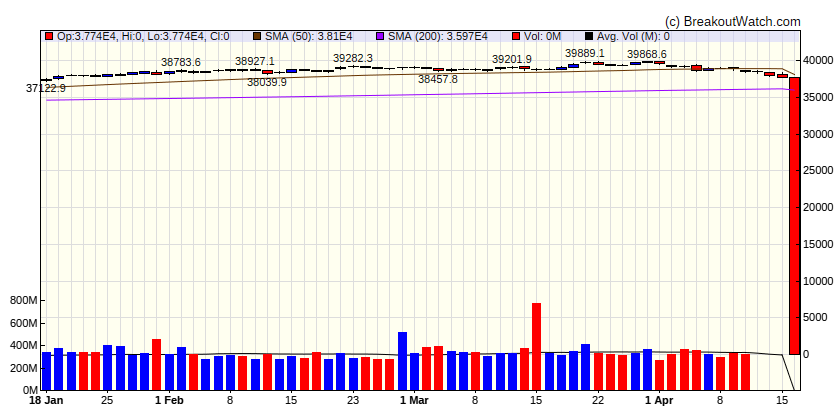

Major Index Performance

| Dow Jones

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

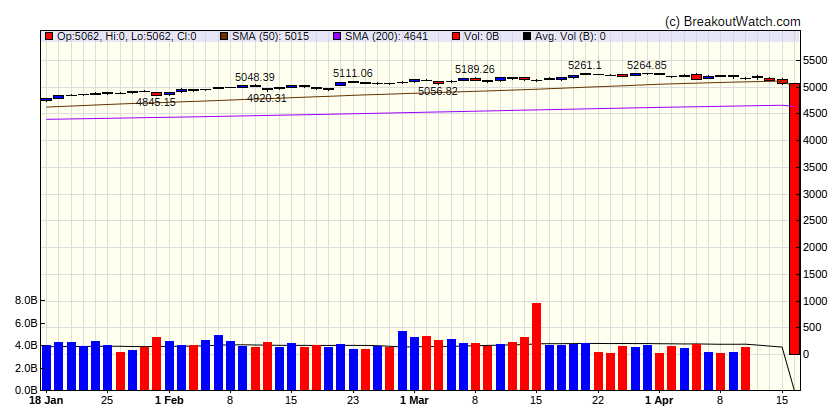

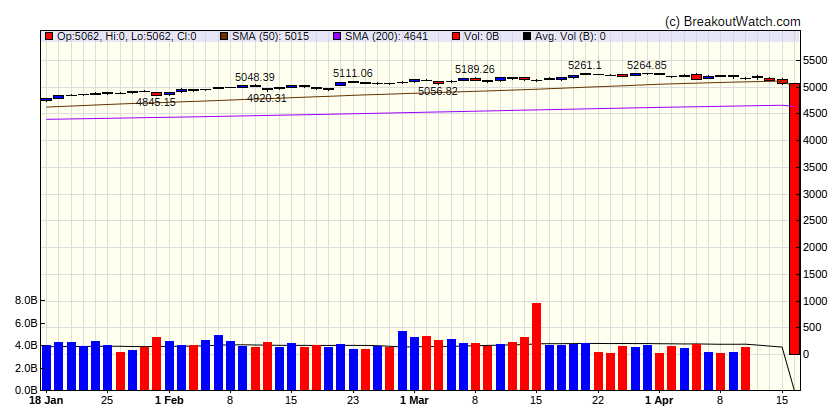

| S&P 500

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

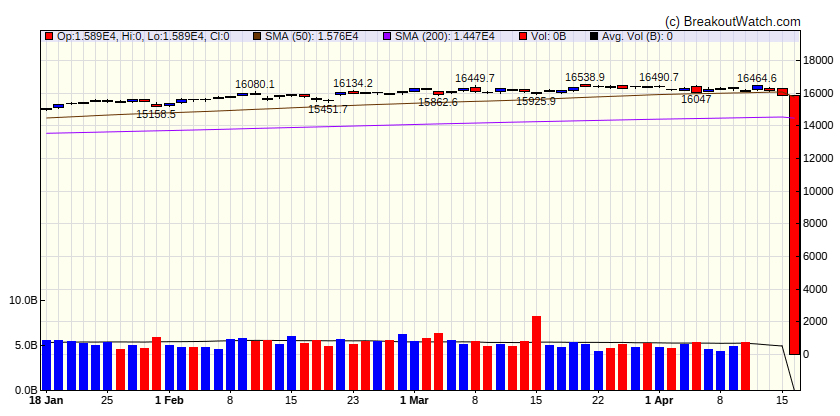

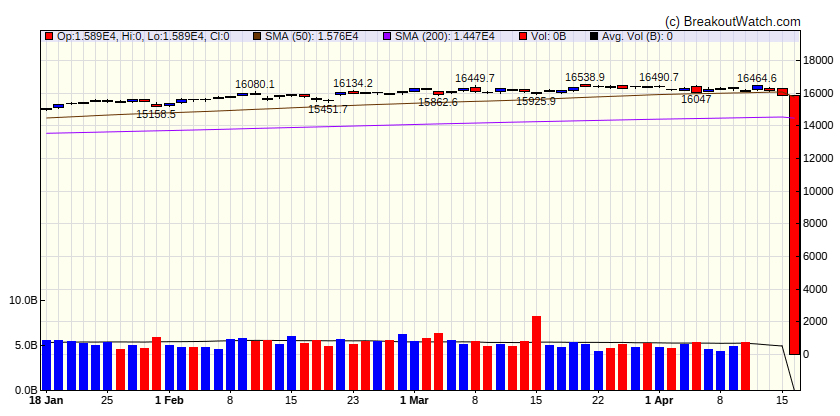

| NASDAQ Comp.

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

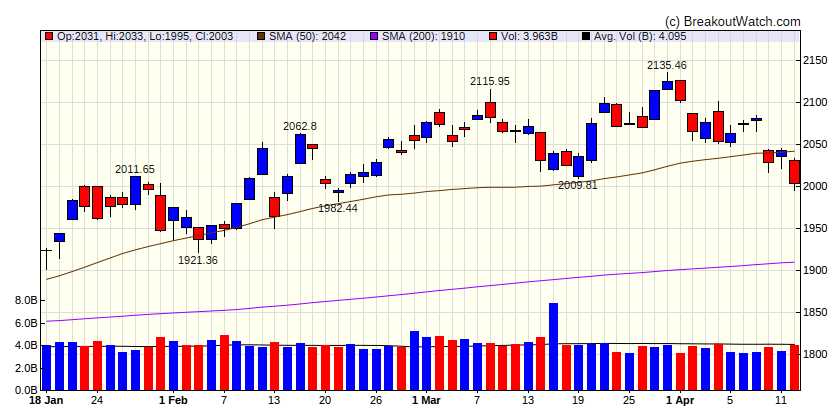

| Russell 2000

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

-3.02 |

-1.63 |

Down |

| Consumer Staples |

-1.03 |

2.43 |

Down |

| Energy |

-3.98 |

11.54 |

Up |

| Finance |

-1.97 |

4.52 |

Down |

| Health Care |

-1.41 |

1.65 |

Down |

| Industrials |

-1.58 |

7.25 |

Down |

| Technology |

-2.58 |

5.69 |

Down |

| Materials |

-2.81 |

3.45 |

Down |

| REIT |

-3.65 |

-10.06 |

Down |

| Telecom |

-2.92 |

9.79 |

Down |

| Utilities |

-3.22 |

-0.23 |

Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| SQZ |

ITGR |

Integer Holdings Corporation |

Medical Devices |

76.3 % |

0.5 % |

| SQZ |

FRO |

Frontline Plc Ordinary Sh |

Banks - Regional |

73 % |

0.7 % |

| SQZ |

ABEO |

Abeona Therapeutics Inc. |

Biotechnology |

66.9 % |

1.4 % |

| SQZ |

GOGL |

Golden Ocean Group Limited |

Marine Shipping |

66.7 % |

0.2 % |

| SQZ |

NPCE |

Neuropace, Inc. |

Medical Devices |

66.1 % |

4.7 % |

| SQZ |

ABL |

Abacus Life, Inc. |

Insurance - Life |

64.3 % |

1 % |

| SQZ |

EVER |

EverQuote, Inc. |

Shell Companies |

58.5 % |

2.5 % |

| SQZ |

ADSE |

AD |

Shell Companies |

52.2 % |

3.7 % |

| SQZ |

HSHP |

Himalaya Shipping Ltd. |

Marine Shipping |

36.7 % |

0.9 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

UTI |

Universal Technical Institute Inc |

Biotechnology |

75.9 % |

-3.3 % |

| SS |

NGVC |

Natural Grocers by Vitamin Cottage, Inc. |

Grocery Stores |

75.5 % |

-0.2 % |

| SS |

KRT |

Karat Packaging Inc. |

Biotechnology |

74.4 % |

-3.1 % |

| SS |

DUOL |

Duolingo, Inc. |

Software - Application |

72.9 % |

-3.8 % |

| SS |

SEMR |

SEMrush Holdings, Inc. |

Software - Application |

72.2 % |

-2.1 % |

| SS |

HOLI |

Hollysys Automation Technologies, Ltd. |

Recreational Vehicles |

71.9 % |

-3.6 % |

| SS |

VNT |

Vontier Corporation |

REIT - Office |

70.5 % |

-2.4 % |

| SS |

PEGA |

Pegasystems Inc. |

Software - Application |

69.4 % |

-3 % |

| SS |

YELP |

Yelp Inc. |

Software - Application |

68.5 % |

-1.1 % |

| SS |

LYTS |

LSI Industries Inc. |

Electronic Components |

67.7 % |

-1.6 % |

| SS |

AVPT |

AvePoint, Inc. |

Software - Infrastructure |

67.3 % |

-1.5 % |

| SS |

PRDO |

Perdoceo Education Corporation |

Medical Devices |

65.3 % |

-4.3 % |

| SS |

MKSI |

MKS Instruments, Inc. |

Computer Hardware |

64.4 % |

-2 % |

| SS |

WST |

West Pharmaceutical Services, Inc. |

REIT - Retail |

64.4 % |

-0.4 % |

| SS |

SXC |

SunCoke Energy, Inc. |

Coking Coal |

60.1 % |

-1.2 % |

| SS |

VEON |

VEON Ltd. |

Telecom Services |

54.7 % |

-2.5 % |

| SS |

ROIV |

Roivant Sciences Ltd. |

Biotechnology |

53.2 % |

-1.4 % |

| SS |

LPTH |

LightPath Technologies, Inc. |

Electronic Components |

52.5 % |

-0.3 % |

| SS |

POWW |

AMMO, Inc. |

Semiconductors |

52.2 % |

-0.4 % |

| SS |

NICK |

Nicholas Financial, Inc. |

Credit Services |

52 % |

-0 % |

| SS |

ALTO |

Alto Ingredients, Inc. |

Specialty Chemicals |

35.6 % |

-4.3 % |

| SS |

PRPL |

Purple Innovation, Inc. |

Banks - Regional |

33.8 % |

-2.2 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

| There were no CWH stocks meeting our breakout model criteria |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.