Breakoutwatch Weekly Summary 04/19/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

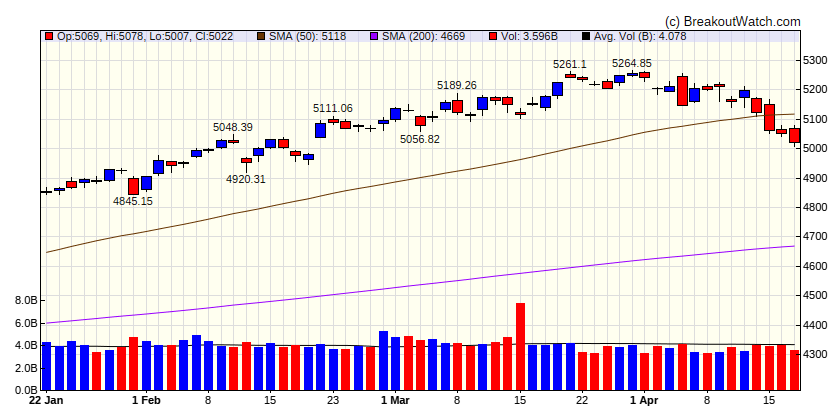

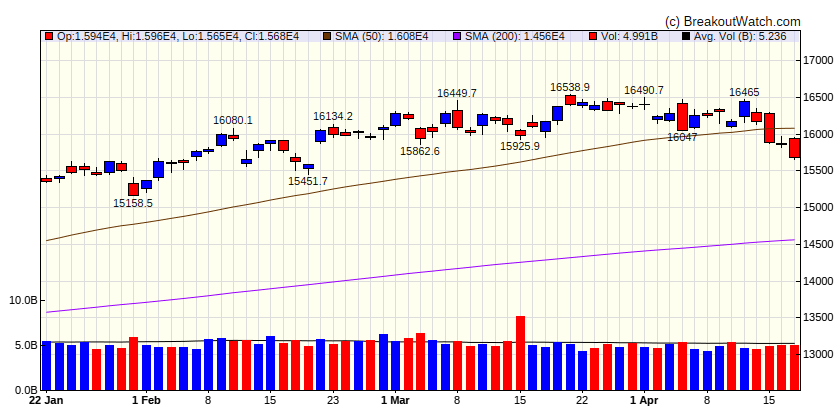

Market Summary

Inflation disappoints on the upside in U.S. and on the downside in China

The major equity benchmarks retreated for the week amid heightened fears of conflict in the Middle East and some signs of persistent inflation pressures that pushed long-term Treasury yields higher. Large-caps held up better than small-caps, with the Russell 2000 Index suffering its biggest daily decline in almost two months on Wednesday and falling back into negative territory for the year to date. Growth stocks also fared better than value shares, which were weighed down by interest rate-sensitive sectors, such as real estate investment trusts (REITs), regional banks, housing, and utilities. [more...]

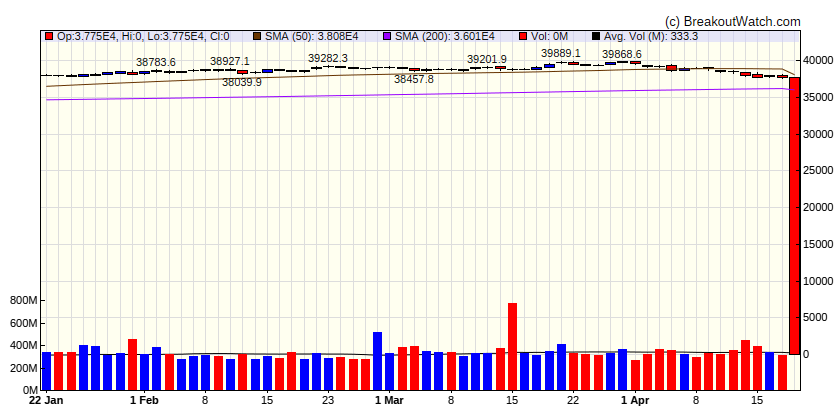

Major Index Performance

| Dow Jones

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

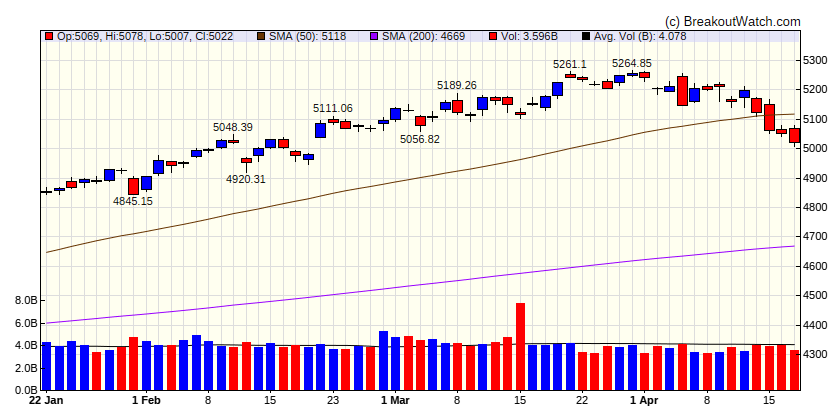

| S&P 500

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

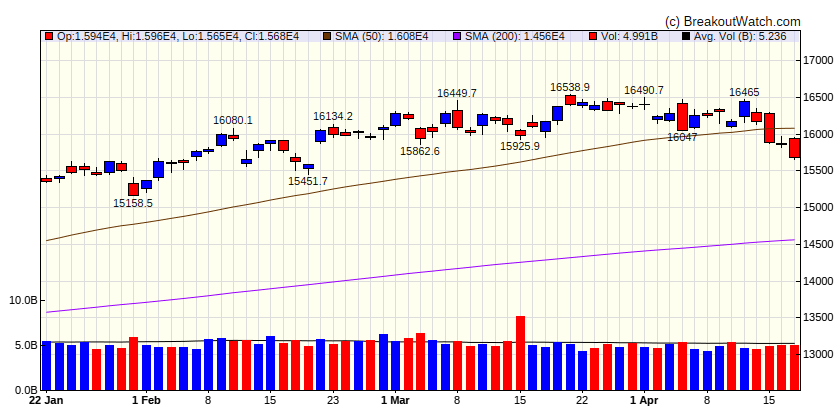

| NASDAQ Comp.

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

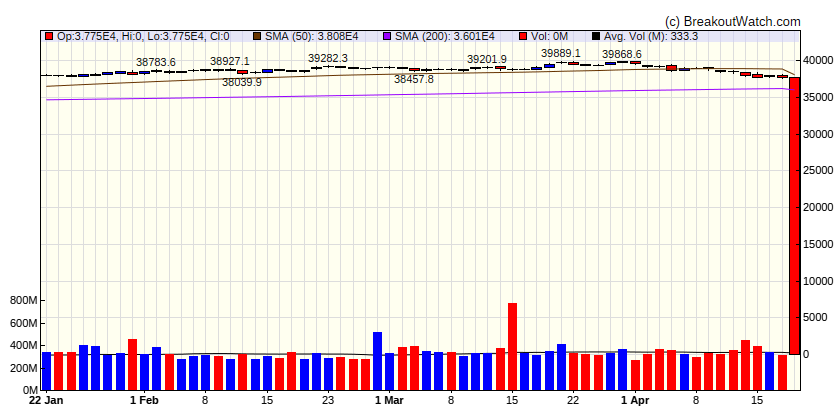

| Russell 2000

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

-4 |

-2.85 |

Down |

| Consumer Staples |

-0.21 |

3.12 |

Down |

| Energy |

-2.88 |

10.78 |

Up |

| Finance |

-1.9 |

5.07 |

Down |

| Health Care |

-1.53 |

1.25 |

Down |

| Industrials |

-3.21 |

6.13 |

Down |

| Technology |

-4.98 |

3.13 |

Down |

| Materials |

-2.03 |

3.49 |

Down |

| REIT |

-4.41 |

-10.71 |

Down |

| Telecom |

-2.03 |

10.37 |

Down |

| Utilities |

-0.44 |

2.32 |

Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| SQZ |

NPCE |

Neuropace, Inc. |

Medical Devices |

66.2 % |

4.4 % |

| SQZ |

ADSE |

AD |

Shell Companies |

52.4 % |

3.3 % |

| SQZ |

CGEM |

Cullinan Oncology, Inc. |

Biotechnology |

50.9 % |

4.2 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

GE |

GE Aerospace |

Information Technology Services |

77 % |

-1.9 % |

| SS |

UTI |

Universal Technical Institute Inc |

Biotechnology |

75 % |

-4.9 % |

| SS |

KRT |

Karat Packaging Inc. |

Biotechnology |

74.5 % |

-4.5 % |

| SS |

DUOL |

Duolingo, Inc. |

Software - Application |

73.8 % |

-0.5 % |

| SS |

NGVC |

Natural Grocers by Vitamin Cottage, Inc. |

Grocery Stores |

73.6 % |

-0.7 % |

| SS |

PEGA |

Pegasystems Inc. |

Software - Application |

70.2 % |

-3.6 % |

| SS |

COCO |

The Vita Coco Company, Inc. |

Beverages - Non-Alcoholic |

70 % |

-0.3 % |

| SS |

VNT |

Vontier Corporation |

REIT - Office |

69.8 % |

-3.1 % |

| SS |

LYTS |

LSI Industries Inc. |

Electronic Components |

69.3 % |

-2.9 % |

| SS |

WST |

West Pharmaceutical Services, Inc. |

REIT - Retail |

68.7 % |

-1 % |

| SS |

SEMR |

SEMrush Holdings, Inc. |

Software - Application |

67.4 % |

-4.2 % |

| SS |

AVPT |

AvePoint, Inc. |

Software - Infrastructure |

66.7 % |

-2.5 % |

| SS |

CEIX |

CONSOL Energy Inc. |

Thermal Coal |

66.3 % |

-0.8 % |

| SS |

PRDO |

Perdoceo Education Corporation |

Medical Devices |

66.2 % |

-3.6 % |

| SS |

YELP |

Yelp Inc. |

Software - Application |

61.6 % |

-1.5 % |

| SS |

ZEUS |

Olympic Steel, Inc. |

Steel |

60 % |

-0.9 % |

| SS |

SXC |

SunCoke Energy, Inc. |

Coking Coal |

58.6 % |

-2.8 % |

| SS |

UEC |

Uranium Energy Corp. |

Uranium |

58.5 % |

-2.8 % |

| SS |

VEON |

VEON Ltd. |

Telecom Services |

54.6 % |

-1 % |

| SS |

LPTH |

LightPath Technologies, Inc. |

Electronic Components |

53.3 % |

-4 % |

| SS |

SVRA |

Savara, Inc. |

Biotechnology |

50.9 % |

-3.4 % |

| SS |

NICK |

Nicholas Financial, Inc. |

Credit Services |

49.9 % |

-2.6 % |

| SS |

ROIV |

Roivant Sciences Ltd. |

Biotechnology |

49.5 % |

-4.6 % |

| SS |

PRPL |

Purple Innovation, Inc. |

Banks - Regional |

48.8 % |

-4.4 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

| There were no CWH stocks meeting our breakout model criteria |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.