Breakoutwatch Weekly Summary 05/02/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Market Summary

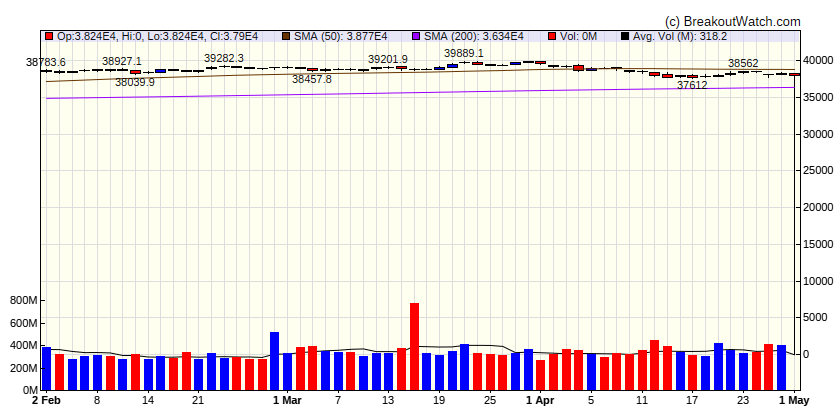

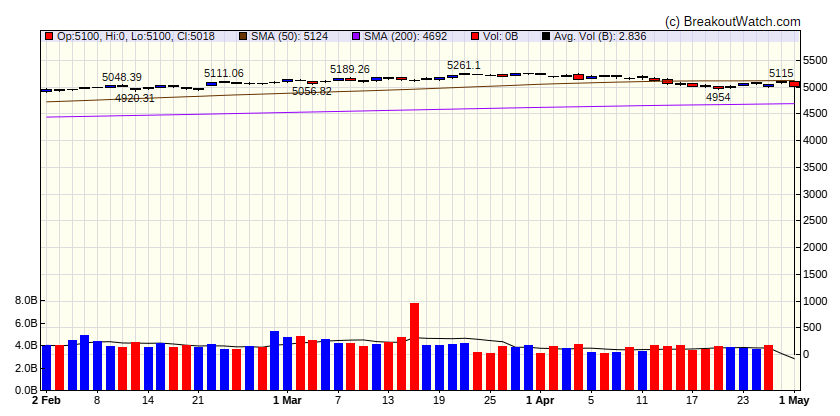

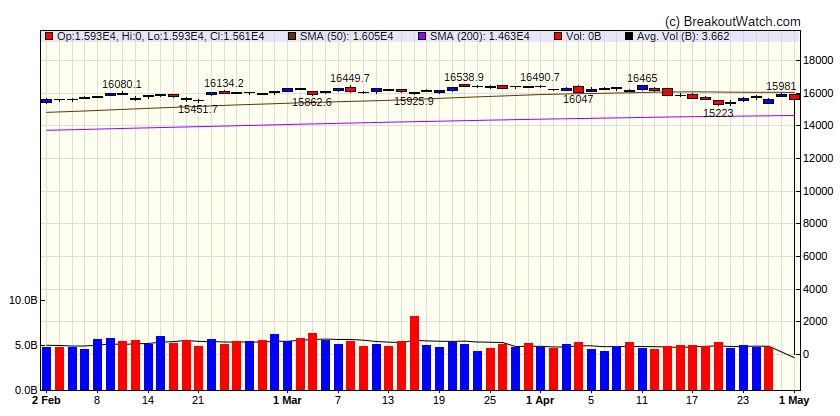

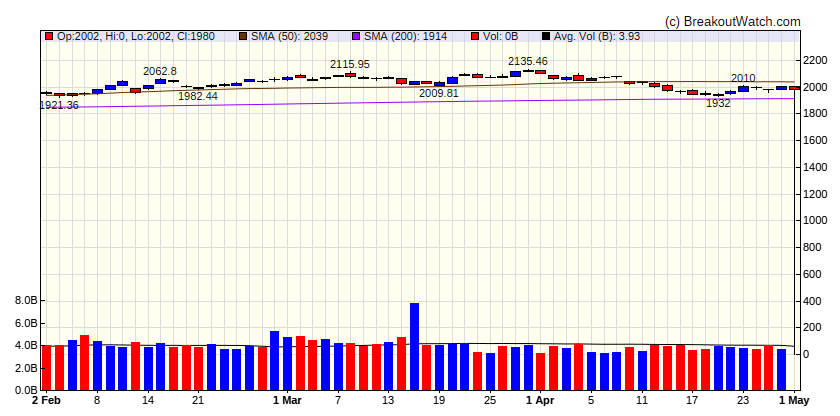

Stocks break losing streak

The S&P 500 Index and most other major benchmarks managed to snap a string of three weekly losses as investors responded to the busiest week of the first-quarter earnings reporting season. As of the end of the week, analysts polled by FactSet were expecting overall earnings for the S&P 500 to have increased 3.7% in the first quarter relative to the year before, with “both the percentage of S&P 500 companies reporting positive earnings surprises and the magnitude of earnings surprises... above their 10-year averages.” [more...]

Major Index Performance

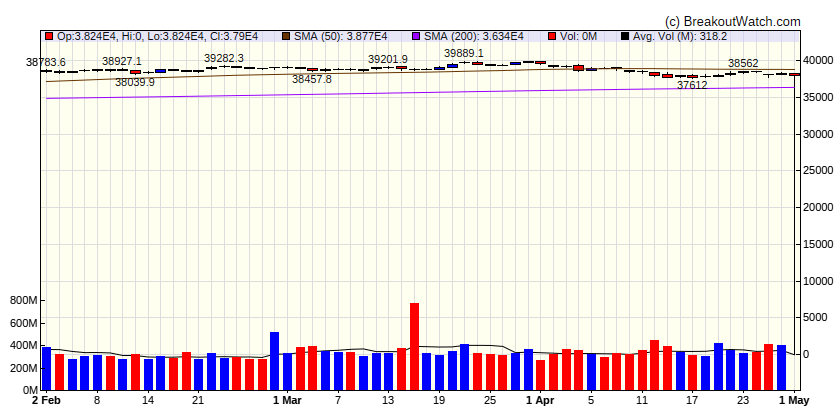

| Dow Jones

|

| Last Close

| |

| Wk. Gain

| NAN % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

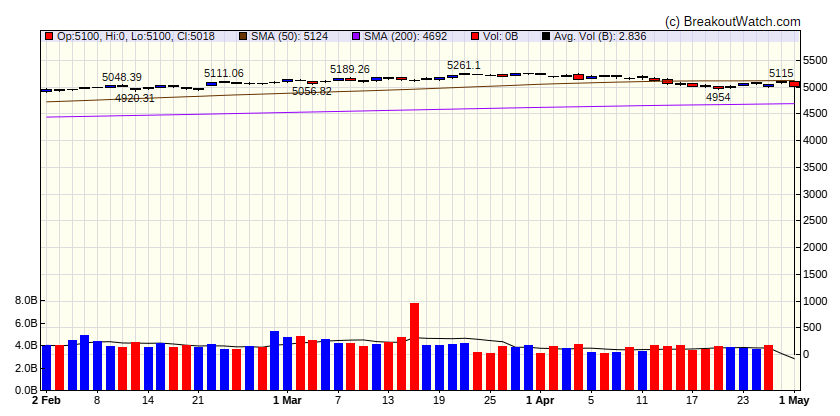

| S&P 500

|

| Last Close

| |

| Wk. Gain

| NAN % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

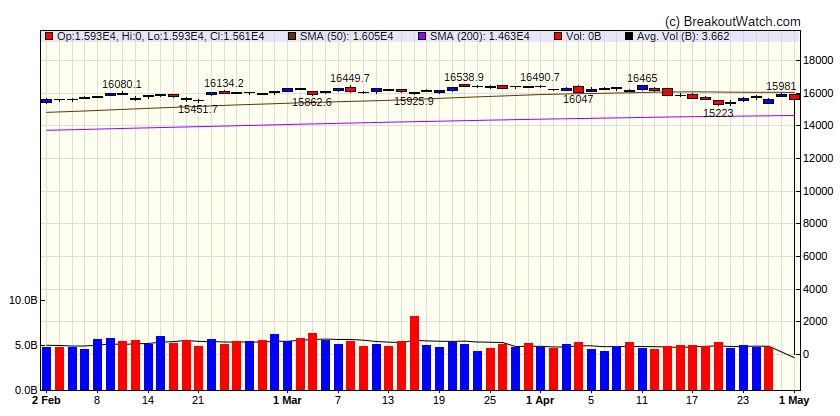

| NASDAQ Comp.

|

| Last Close

| |

| Wk. Gain

| NAN % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

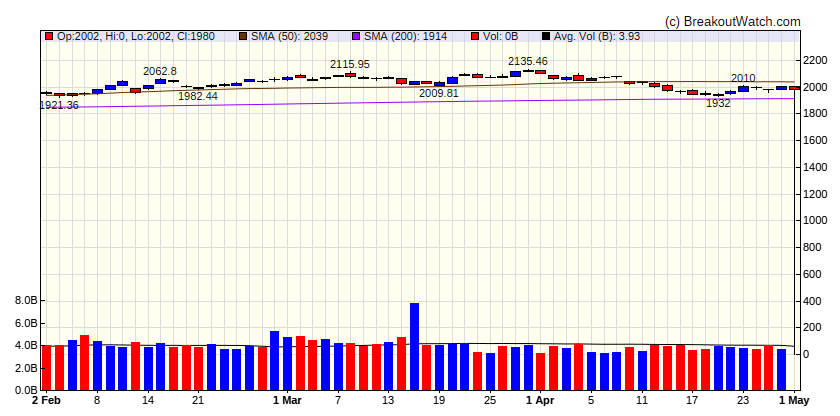

| Russell 2000

|

| Last Close

| |

| Wk. Gain

| NAN % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

-1.07 |

0.4 |

Up |

| Consumer Staples |

0.12 |

5.96 |

Up |

| Energy |

-3.2 |

9.42 |

Down |

| Finance |

-0.64 |

7.22 |

Down |

| Health Care |

0.53 |

2.98 |

Down |

| Industrials |

-0.52 |

7.73 |

Down |

| Technology |

-1.98 |

3.78 |

Down |

| Materials |

-0.82 |

3.55 |

Down |

| REIT |

0.31 |

-8.28 |

Down |

| Telecom |

0.33 |

10.55 |

Down |

| Utilities |

2.15 |

8.22 |

Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| SQZ |

BMA |

Banco Macro S.A. ADR (representing Ten Class B |

Banks - Regional |

75.3 % |

3.6 % |

| SQZ |

GLP |

Global Partners LP |

Information Technology Services |

68 % |

1.6 % |

| SQZ |

UVE |

UNIVERSAL INSURANCE HOLDINGS INC |

Uranium |

65.5 % |

1 % |

| CWH |

GNK |

Genco Shipping & Trading |

Marine Shipping |

63.3 % |

2.5 % |

| SQZ |

NAMS |

NewAmsterdam Pharma Company N.V. |

Biotechnology |

59.6 % |

3.4 % |

| SQZ |

GIII |

N/A |

Apparel Manufacturing |

59 % |

1.2 % |

| SQZ |

RACE |

Ferrari N.V. |

Auto Manufacturers |

36.7 % |

2.1 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

SKT |

Tanger Inc. |

REIT - Retail |

75.3 % |

-1.7 % |

| SS |

URI |

United Rentals, Inc. |

Biotechnology |

75.2 % |

-2.2 % |

| SS |

CEIX |

CONSOL Energy Inc. |

Thermal Coal |

62 % |

-2 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

| There were no CWH stocks meeting our breakout model criteria |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.