Breakoutwatch Weekly Summary 05/04/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

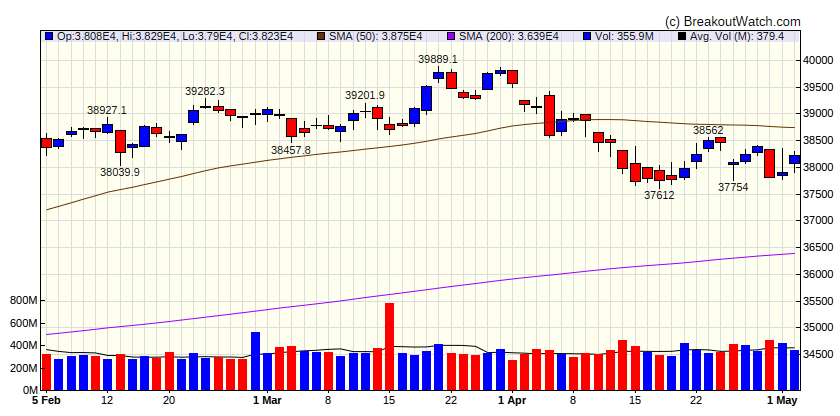

Late rally lifts small-caps back into positive territory for 2024

Stocks ended higher following a volatile week featuring a raft of economic and earnings data. Growth stocks outperformed value shares, which were flat overall for the week. Small-caps outpaced large-caps, helping lift the small-cap Russell 2000 Index back into slightly positive territory for the year-to-date period. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Down |

|

|

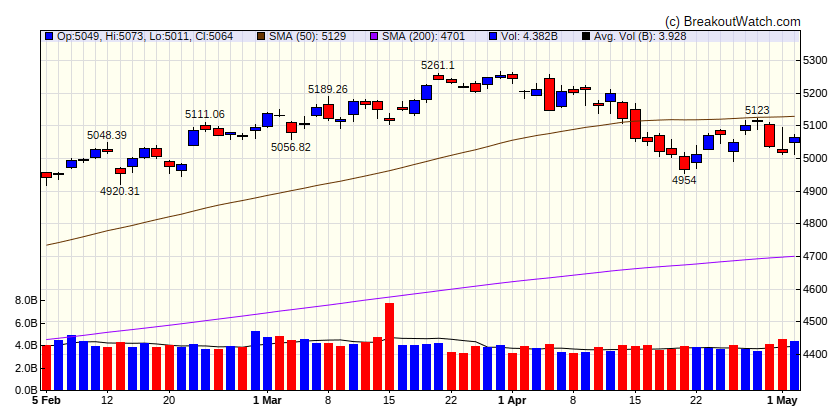

| S&P 500 | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Down |

|

|

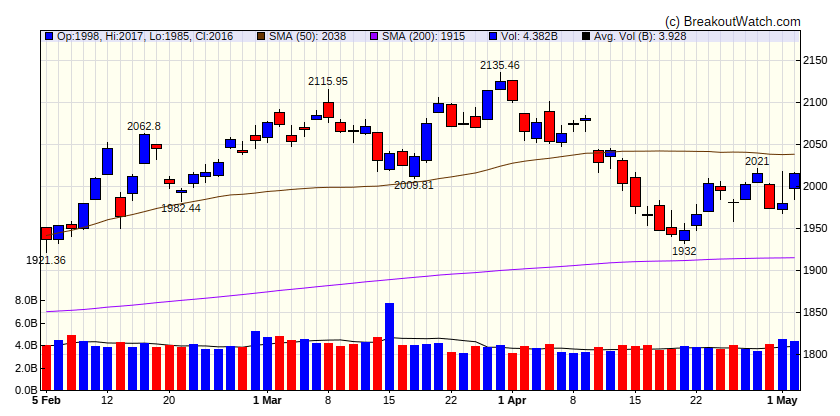

| NASDAQ Comp. | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Down |

|

|

| Russell 2000 | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Down |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | -0.29 | 1.2 | Up |

| Consumer Staples | 0.45 | 6.3 | Up |

| Energy | -3.13 | 9.5 | Down |

| Finance | -0.3 | 7.57 | Down |

| Health Care | 0.88 | 3.33 | Up |

| Industrials | 0.19 | 8.49 | Down |

| Technology | 0.67 | 6.58 | Down |

| Materials | -0.02 | 4.39 | Down |

| REIT | 0.98 | -7.66 | Down |

| Telecom | 1.11 | 11.42 | Down |

| Utilities | 2.93 | 9.04 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | GLP | Global Partners LP | Information Technology Services | 68.1 % | 1.8 % |

| SQZ | UVE | UNIVERSAL INSURANCE HOLDINGS INC | Uranium | 65.5 % | 1.4 % |

| CWH | GNK | Genco Shipping & Trading | Marine Shipping | 62.9 % | 3 % |

| SQZ | GIII | N/A | Apparel Manufacturing | 59 % | 1.5 % |

| SQZ | NEXA | Nexa Resources S.A. | Banks - Regional | 58.9 % | 0.4 % |

| SQZ | SILK | Silk Road Medical, Inc. | Medical Devices | 52.2 % | 4.3 % |

| SQZ | RACE | Ferrari N.V. | Auto Manufacturers | 36.7 % | 3.5 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | URI | United Rentals, Inc. | Biotechnology | 75.4 % | -1.9 % |

| SS | SKT | Tanger Inc. | REIT - Retail | 74.2 % | -3.5 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| SLNO | 0 | N/A | 99.00 | 56.9 | ||

| DOMA | 0 | N/A | 99.00 | 65.7 | ||

| STTK | 59.7 | |||||

| PESI | 0 | N/A | 86.00 | 70 | ||

| DUOL | 76.7 | |||||

| EVBG | 0 | N/A | 89.00 | 66.5 | ||

| NSSC | 0 | N/A | 90.00 | 78.7 | ||

| SYF | 74.9 | |||||

| HCC | 0 | N/A | 89.00 | 75.5 | ||

| KLAC | 0 | N/A | 87.00 | 61.2 | ||

| AAON | 73.8 | |||||

| TXRH | 76.6 | |||||

| AMRK | 0 | N/A | 86.00 | 76.9 | ||

| FWRG | 0 | N/A | 84.00 | 79.4 | ||

| MATV | 64.8 | |||||

| ZBRA | 0 | N/A | 82.00 | 65.2 | ||

| NR | 0 | N/A | 83.00 | 63.7 | ||

| SE | 71.8 | |||||

| SEMR | 73.6 | |||||

| TOST | 69.2 | |||||

| STER | 0 | N/A | 82.00 | 61.1 | ||

| CCJ | 0 | N/A | 82.00 | 71.9 | ||

| AG | 0 | N/A | 81.00 | 38.7 | ||

| AVPT | 0 | N/A | 81.00 | 67.3 | ||

| ENV | 70.6 | |||||

| TSQ | 58.4 | |||||

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.