Breakoutwatch Weekly Summary 05/10/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Market Summary

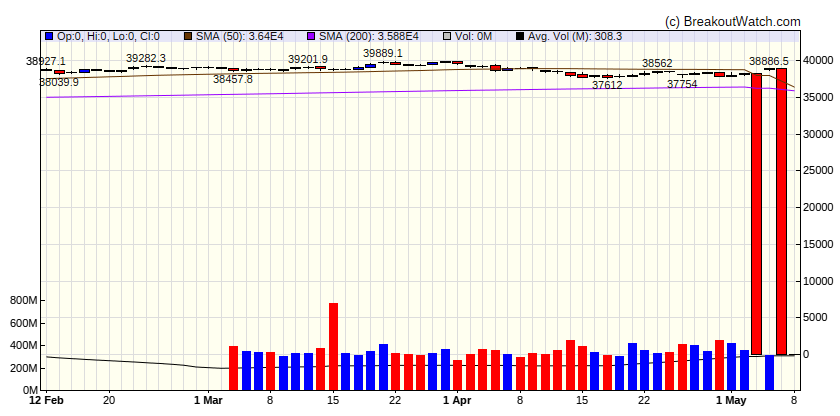

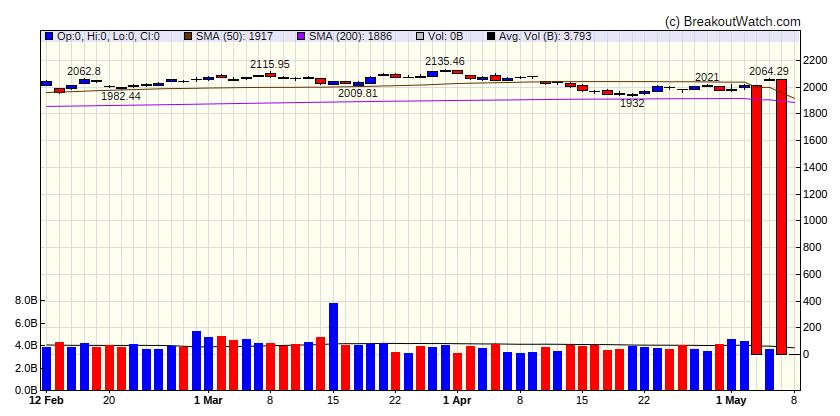

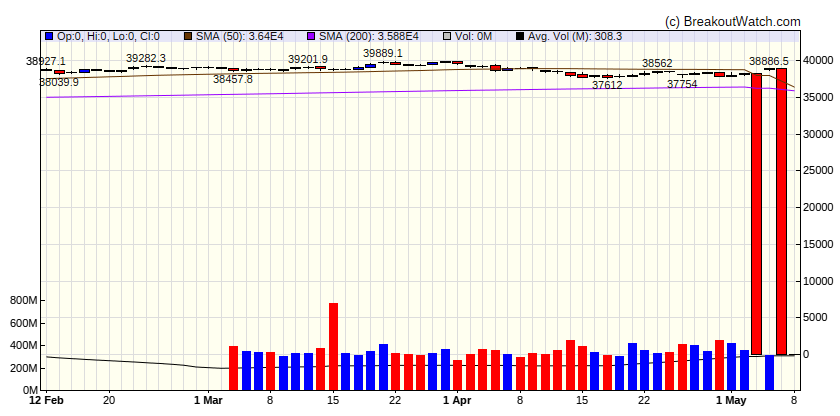

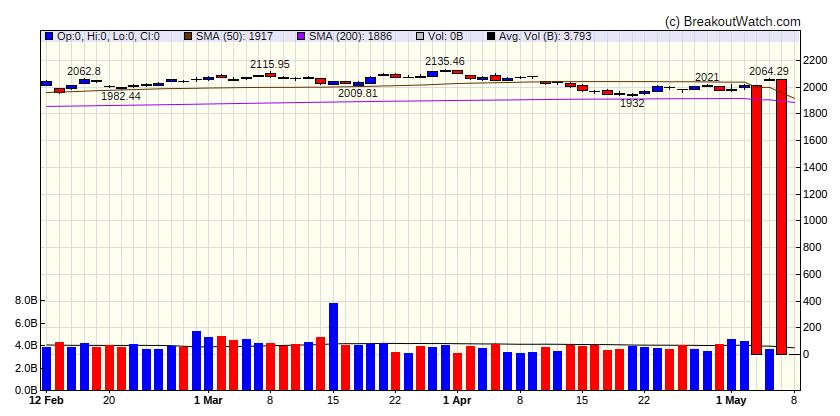

Late rally lifts small-caps back into positive territory for 2024

Stocks ended higher following a volatile week featuring a raft of economic and earnings data. Growth stocks outperformed value shares, which were flat overall for the week. Small-caps outpaced large-caps, helping lift the small-cap Russell 2000 Index back into slightly positive territory for the year-to-date period. [more...]

Major Index Performance

| Dow Jones

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

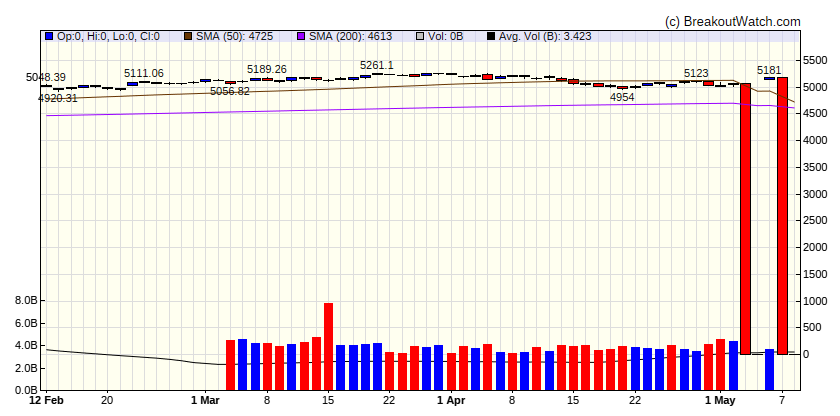

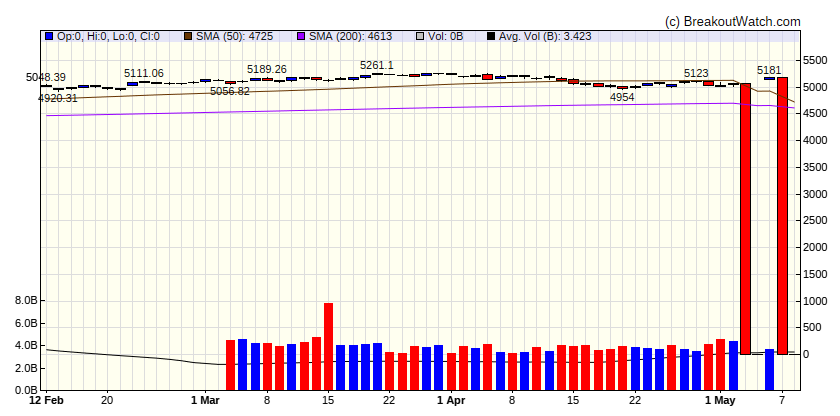

| S&P 500

|

| Last Close

| |

| Wk. Gain

| NAN % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

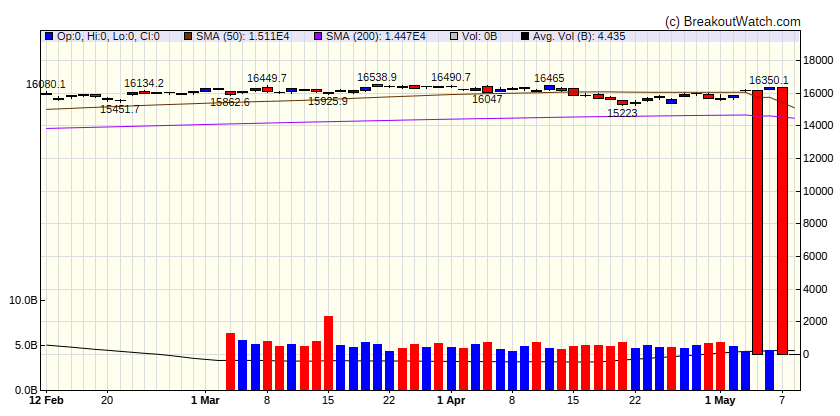

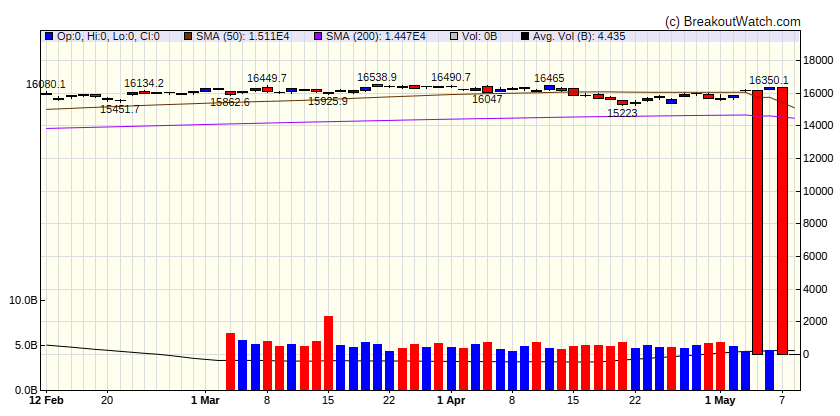

| NASDAQ Comp.

|

| Last Close

| |

| Wk. Gain

| NAN % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

| Russell 2000

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

0.51 |

2.31 |

Up |

| Consumer Staples |

1.53 |

8.17 |

Up |

| Energy |

1.62 |

11.76 |

Down |

| Finance |

2.06 |

10.39 |

Up |

| Health Care |

1.19 |

4.95 |

Up |

| Industrials |

1.69 |

11 |

Up |

| Technology |

0.68 |

7.72 |

Up |

| Materials |

1.95 |

7.14 |

Up |

| REIT |

1.5 |

-5.6 |

Up |

| Telecom |

1.13 |

13.26 |

Up |

| Utilities |

3.81 |

13.6 |

Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| SQZ |

COST |

N/A |

Discount Stores |

75 % |

4.7 % |

| SQZ |

CSWI |

N/A |

Specialty Industrial Machinery |

71.3 % |

1.6 % |

| DB |

CM |

N/A |

Banks - Diversified |

67.3 % |

2.1 % |

| SQZ |

BBSI |

N/A |

Asset Management |

65.8 % |

2.1 % |

| CWH |

HIBB |

N/A |

Apparel Retail |

62.2 % |

0.1 % |

| SQZ |

ADSE |

N/A |

Shell Companies |

50.8 % |

0.2 % |

| SQZ |

SWAV |

Shockwave Medical, Inc. |

Medical Devices |

41.7 % |

0 % |

| SQZ |

KGS |

Kodiak Gas Services, Inc. |

Gold |

38.7 % |

3.5 % |

| SQZ |

SLN |

Silence Therapeutics Plc |

Biotechnology |

38.5 % |

4.3 % |

| SQZ |

INBK |

N/A |

Banks - Regional |

38.4 % |

2.2 % |

| SQZ |

KYMR |

Kymera Therapeutics, Inc. |

Biotechnology |

38 % |

3.2 % |

| SQZ |

MATV |

Mativ Holdings, Inc. |

Specialty Chemicals |

38 % |

1.3 % |

| SQZ |

UEC |

Uranium Energy Corp. |

Uranium |

37.6 % |

0.7 % |

| SQZ |

VRM |

Vroom, Inc. |

Medical Devices |

37.2 % |

3.7 % |

| SQZ |

NGVC |

Natural Grocers by Vitamin Cottage, Inc. |

Grocery Stores |

36.6 % |

2.5 % |

| SQZ |

MEDP |

Medpace Holdings, Inc. |

Personal Services |

36.1 % |

1.7 % |

| SQZ |

IDT |

N/A |

Telecom Services |

35.3 % |

0.3 % |

| SQZ |

PEGA |

Pegasystems Inc. |

Software - Application |

35.2 % |

2.5 % |

| SQZ |

UVE |

UNIVERSAL INSURANCE HOLDINGS INC |

Uranium |

33.7 % |

2.1 % |

| SQZ |

PLUS |

ePlus inc. |

Software - Application |

33.1 % |

2.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

SPRY |

ARS Pharmaceuticals, Inc. |

Biotechnology |

37.8 % |

-2.1 % |

| SS |

PEPG |

PepGen Inc. |

Biotechnology |

37 % |

-1.8 % |

| SS |

MLKN |

MillerKnoll, Inc. |

Metal Fabrication |

35.4 % |

-1.2 % |

| SS |

SRRK |

Scholar Rock Holding Corporation |

Biotechnology |

34.5 % |

-4.7 % |

| SS |

MDXG |

MiMedx Group, Inc |

Biotechnology |

28.3 % |

-2.3 % |

| SS |

VYGR |

Voyager Therapeutics, Inc. |

Biotechnology |

26.4 % |

-3.9 % |

| SS |

SNOW |

Snowflake Inc. |

Software - Application |

18 % |

-3.7 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

| There were no CWH stocks meeting our breakout model criteria |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.