Breakoutwatch Weekly Summary 05/14/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

Stocks climb back toward record highs on light volumes

The S&P 500 Index neared its all-time high and recorded its third consecutive week of gains. The other major indexes also advanced, with value stocks generally outperforming growth shares. T. Rowe Price traders noted that market volumes were especially low over much of the week, however, with Wednesday marking the lowest notional (in terms of the value of shares traded) session of the year and its third-lightest volume (in terms of number of shares traded) session. [more...]

Major Index Performance

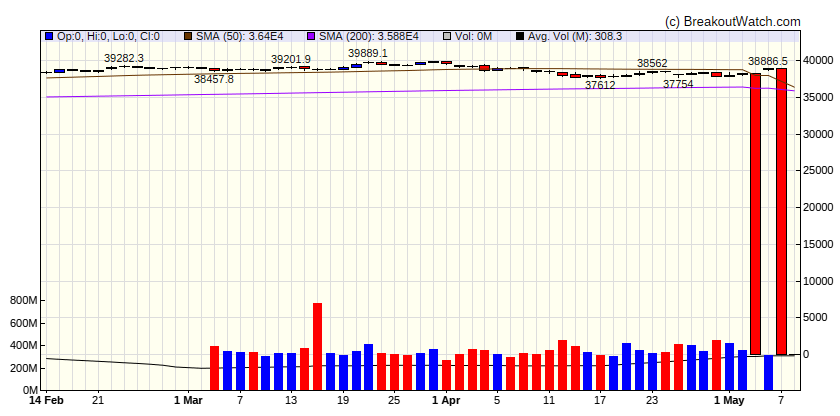

| Dow Jones | |

|---|---|

| Last Close | |

| Wk. Gain | NAN % |

| Yr. Gain | -100 % |

| Trend | Down |

|

|

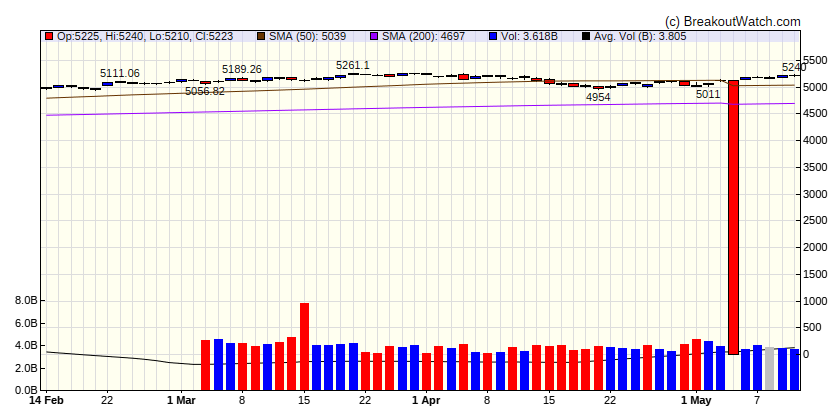

| S&P 500 | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Up |

|

|

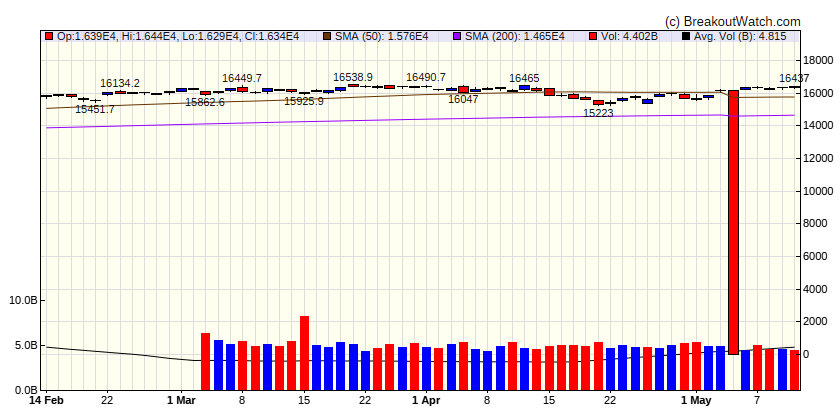

| NASDAQ Comp. | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Up |

|

|

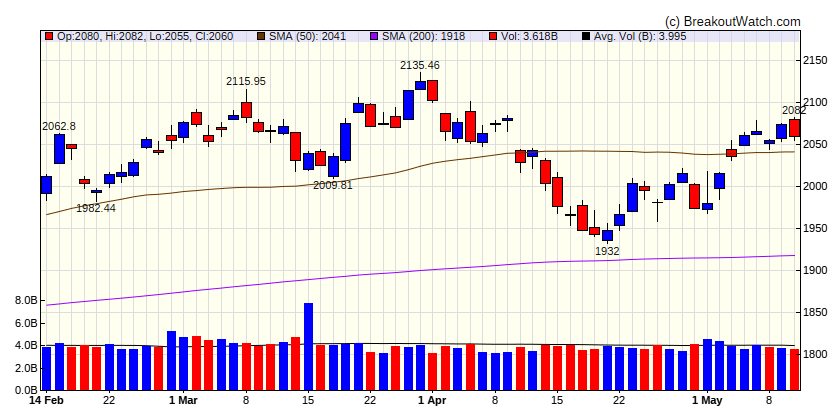

| Russell 2000 | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 0.97 | 1.9 | Up |

| Consumer Staples | 1.05 | 8.6 | Up |

| Energy | 0.77 | 10.69 | Down |

| Finance | 1.22 | 10.27 | Up |

| Health Care | 0.38 | 4.99 | Up |

| Industrials | 1.17 | 10.55 | Up |

| Technology | 1.2 | 8.53 | Up |

| Materials | 1.13 | 7.1 | Up |

| REIT | 1.8 | -5.55 | Up |

| Telecom | 0.86 | 13.13 | Up |

| Utilities | 2.75 | 13.48 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| CWH | BZ | N/A | Shell Companies | 82.2 % | 0.6 % |

| CWH | FN | N/A | Electronic Components | 72.7 % | 0.4 % |

| SQZ | PEGA | Pegasystems Inc. | Shell Companies | 71.2 % | 1.1 % |

| SQZ | DSP | Viant Technology Inc. | Credit Services | 69.9 % | 2 % |

| SQZ | NRP | Natural Resource Partners | Shell Companies | 66.9 % | 0.5 % |

| CWH | ATGE | Adtalem Global Education Inc. | Health Information Services | 63.9 % | 0.1 % |

| SQZ | VERX | Vertex, Inc. | Software - Application | 62.7 % | 3.8 % |

| SQZ | SSNT | SilverSun Technologies, Inc. | Shell Companies | 62 % | 2.3 % |

| SQZ | SYRE | Spyre Therapeutics, Inc. | Shell Companies | 61.9 % | 0.2 % |

| SQZ | SLG | SL Green Realty Corp | Shell Companies | 60.6 % | 1.4 % |

| SQZ | AU | N/A | Gold | 59.4 % | 1 % |

| SQZ | M | N/A | Shell Companies | 59.1 % | 0.9 % |

| SQZ | ORN | Orion Group Holdings, Inc. | Shell Companies | 59.1 % | 1.8 % |

| SQZ | DDI | N/A | Computer Hardware | 59 % | 3.7 % |

| SQZ | NNOX | NAN | Shell Companies | 53.2 % | 1.4 % |

| SQZ | DYN | Dyne Therapeutics, Inc. | Credit Services | 51.9 % | 2.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | GE | N/A | Specialty Industrial Machinery | 75.1 % | -1.9 % |

| SS | FTK | N/A | Shell Companies | 65.5 % | -0.9 % |

| SS | YELP | Yelp Inc. | Software - Application | 63.7 % | -3.4 % |

| SS | MKSI | MKS Instruments, Inc. | Shell Companies | 63.4 % | -3.9 % |

| SS | MLKN | MillerKnoll, Inc. | Metal Fabrication | 59.8 % | -0.6 % |

| SS | SPRY | ARS Pharmaceuticals, Inc. | Biotechnology | 58.7 % | -1.1 % |

| SS | SNOW | Snowflake Inc. | Software - Application | 47 % | -1.3 % |

| SS | PEPG | PepGen Inc. | Shell Companies | 44.1 % | -1.8 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| NVDA | 922.20 | NVIDIA Corporation | Shell Companies | 95.00 | 98.03 | 81.9 |

| BGC | 8.89 | BGC Group, Inc. | Personal Services | 90.00 | 96.96 | 70.5 |

| QCOM | 62.9 | |||||

| CSWI | 252.14 | CSW Industrials, Inc. | Credit Services | 85.00 | 95.95 | 71.2 |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.