Breakoutwatch Weekly Summary 05/18/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

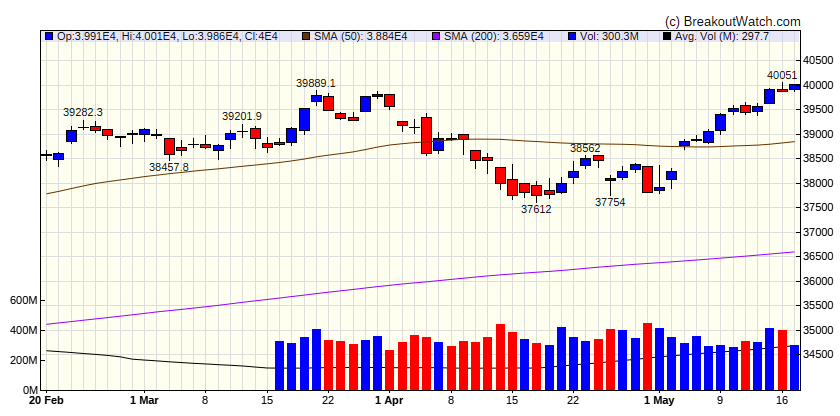

Large-cap indexes move back to record highs

The Dow Jones Industrial Average, S&P 500 Index, and Nasdaq Composite climbed to record highs during the week, with the Dow crossing the 40,000 threshold for the first time. As inflation and interest rate worries appeared to dissipate, growth stocks outperformed, perhaps due in part to the lower implied discount placed on future earnings. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 40004 |

| Wk. Gain | 1.04 % |

| Yr. Gain | 6.49 % |

| Trend | Up |

|

|

| S&P 500 | |

|---|---|

| Last Close | 40004 |

| Wk. Gain | 664.46 % |

| Yr. Gain | 743.04 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 16686 |

| Wk. Gain | 1.74 % |

| Yr. Gain | 12.18 % |

| Trend | Up |

|

|

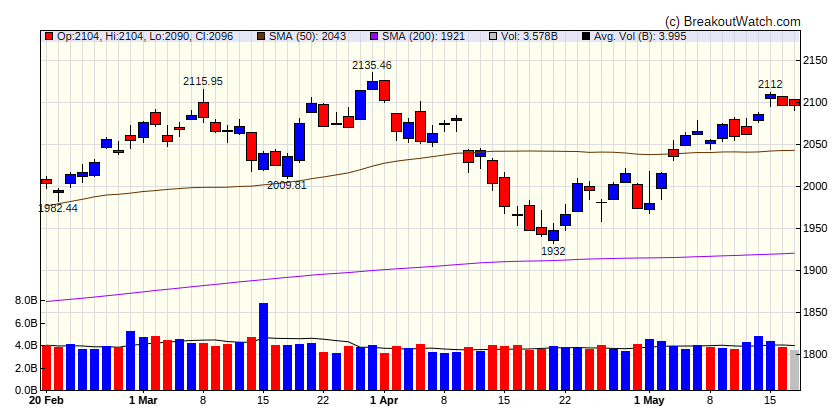

| Russell 2000 | |

|---|---|

| Last Close | 2096 |

| Wk. Gain | 1.16 % |

| Yr. Gain | 4.14 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | -0.24 | 2.06 | Up |

| Consumer Staples | 0.44 | 9.55 | Up |

| Energy | 1.12 | 12.53 | Down |

| Finance | 1.19 | 12.26 | Up |

| Health Care | 1.61 | 6.97 | Up |

| Industrials | -0.68 | 10.7 | Up |

| Technology | 2.41 | 11.41 | Up |

| Materials | 0.29 | 7.76 | Up |

| REIT | 2.03 | -3.59 | Up |

| Telecom | 2 | 14.71 | Up |

| Utilities | 1.1 | 15.06 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| CWH | PDD | PDD Holdings Inc. | Personal Services | 92.5 % | 2.2 % |

| SQZ | AROC | Archrock, Inc. | Biotechnology | 82.6 % | 1.1 % |

| CWH | EQBK | Equity Bancshares, Inc. | Household & Personal Products | 75.7 % | 0.9 % |

| SQZ | DXPE | DXP Enterprises, Inc. | Electronics & Computer Distribution | 75.3 % | 0.3 % |

| CWH | IOT | Samsara Inc. | Utilities - Regulated Gas | 75 % | 0.5 % |

| SQZ | KEY | KeyCorp | Shell Companies | 73.9 % | 3.4 % |

| SQZ | CYBR | CyberArk Software Ltd. | Utilities - Regulated Gas | 72.2 % | 0.6 % |

| CWH | HCP | HashiCorp, Inc. | Utilities - Regulated Gas | 71.8 % | 0.1 % |

| SQZ | CUBI | Customers Bancorp, Inc | Household & Personal Products | 71.6 % | 1.2 % |

| SQZ | REX | REX American Resources Co | Entertainment | 71.6 % | 0.4 % |

| CWH | BGC | BGC Group, Inc. | Beverages - Non-Alcoholic | 71.5 % | 0.3 % |

| CWH | WMS | Advanced Drainage Systems, Inc. | Household & Personal Products | 71.3 % | 0.2 % |

| SQZ | FFNW | First Financial Northwest, Inc. | Household & Personal Products | 71.3 % | 2.9 % |

| CWH | TTD | The Trade Desk, Inc. | Utilities - Renewable | 70.3 % | 2.8 % |

| SQZ | PEGA | Pegasystems Inc. | Shell Companies | 69.7 % | 2.3 % |

| SQZ | NRP | Natural Resource Partners | Shell Companies | 68.1 % | 0.5 % |

| CWH | RBB | RBB Bancorp | Household & Personal Products | 67.7 % | 0.7 % |

| SQZ | STC | Stewart Information Services Corporation | Beverages - Wineries & Distilleries | 66.8 % | 0.4 % |

| CWH | ATGE | Adtalem Global Education Inc. | Health Information Services | 66.5 % | 0.4 % |

| SQZ | ARQT | Arcutis Biotherapeutics, Inc. | Biotechnology | 64.7 % | 0.8 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | GE | GE Aerospace | Shell Companies | 75 % | -1.7 % |

| SS | LRCX | Lam Research Corporation | Personal Services | 66.3 % | -2.4 % |

| SS | MRUS | Merus N.V. | Shell Companies | 60.4 % | -2.7 % |

| SS | VERA | Vera Therapeutics, Inc. | Biotechnology | 60.1 % | -2.3 % |

| SS | GIII | N/A | Leisure | 55.8 % | -1.7 % |

| SS | NEO | NeoGenomics, Inc. | Shell Companies | 54.2 % | -0.9 % |

| SS | PEPG | PepGen Inc. | Shell Companies | 44.3 % | -2.8 % |

| SS | TERN | Terns Pharmaceuticals, Inc. | Biotechnology | 39.3 % | -0.2 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| NCTY | 0 | United Rentals, Inc. | Biotechnology | 88.00 | 59.4 | |

| DOMA | 65.5 | |||||

| SLNO | 53.80 | Soleno Therapeutics, Inc. | Biotechnology | 99.00 | 85.8 | 57.8 |

| GCT | 41.31 | GigaCloud Technology Inc | Utilities - Regulated Gas | 98.00 | 86.56 | 88.2 |

| STTK | 42.2 | |||||

| LBPH | 23.96 | Longboard Pharmaceuticals, Inc. | Biotechnology | 97.00 | 86.35 | 58.5 |

| JMIA | 56.9 | |||||

| NVDA | 83 | |||||

| ALXO | 17.83 | ALX Oncology Holdings Inc. | Biotechnology | 94.00 | 79.7 | 53 |

| ADSE | 49.9 | |||||

| POWL | 84.8 | |||||

| PEPG | 15.22 | PepGen Inc. | Biotechnology | 92.00 | 86.47 | 44.3 |

| MRUS | 49.50 | Merus N.V. | Biotechnology | 92.00 | 88.71 | 60.4 |

| TILE | 18.18 | Interface, Inc. | Beverages - Non-Alcoholic | 91.00 | 85.48 | 58.4 |

| KURA | 53.1 | |||||

| ELMD | 18.60 | Electromed, Inc. | Drug Manufacturers - General | 87.00 | 88.06 | 71.2 |

| TRTX | 71.8 | |||||

| SNAP | 17.29 | Snap Inc. | Software - Infrastructure | 91.00 | 92.83 | 66.4 |

| UTI | 17.09 | Universal Technical Institute Inc | Biotechnology | 90.00 | 87.65 | 76 |

| ARDX | 9.33 | Ardelyx, Inc. | Biotechnology | 91.00 | 83.71 | 70.6 |

| BGC | 71.5 | |||||

| EDN | 21.02 | Empresa Distribuidora Y C | Specialty Business Services | 89.00 | 90.25 | 72.5 |

| SHAK | 111.29 | Shake Shack, Inc. | Residential Construction | 83.00 | 89.1 | 74.9 |

| TOST | 71.9 | |||||

| ELAN | 17.43 | Elanco Animal Health Inco | Recreational Vehicles | 88.00 | 98.62 | 56.7 |

| EVBG | 35.70 | Everbridge, Inc. | Utilities - Renewable | 88.00 | 97.68 | 64.1 |

| AG | 38.8 | |||||

| ENV | 68.83 | Envestnet, Inc | Utilities - Renewable | 86.00 | 98.52 | 74.8 |

| QRTEP | 51.20 | Qurate Retail, Inc. | Personal Services | 84.00 | 96.76 | 36.3 |

| MEG | 71.5 | |||||

| RPAY | 11.04 | Repay Holdings Corporation | Utilities - Regulated Gas | 84.00 | 92.21 | 58 |

| AGIO | 35.48 | Agios Pharmaceuticals, Inc. | Biotechnology | 86.00 | 96.79 | 57.5 |

| PESI | 69.5 | |||||

| ALKT | 27.94 | Alkami Technology, Inc. | Utilities - Renewable | 89.00 | 99.18 | 72.8 |

| HCC | 78.3 | |||||

| RBB | 67.7 | |||||

| CSWI | 71.8 | |||||

| NR | 64.9 | |||||

| CAL | 63 | |||||

| HCP | 71.8 | |||||

| LFVN | 61.3 | |||||

| DVA | 145.04 | DaVita Inc. | Health Information Services | 83.00 | 96.4 | 76.5 |

| ZBRA | 66.1 | |||||

| MPWR | 69.1 | |||||

| LMNR | 22.00 | Limoneira Co | Credit Services | 83.00 | 97.91 | 61.6 |

| BRP | 63.5 | |||||

| JFIN | 77.7 | |||||

| WCC | 67.3 | |||||

| VEON | 53 | |||||

| TGTX | 57.2 | |||||

| MTH | 72.5 | |||||

| NWPX | 62.9 | |||||

| GLDD | 58.3 | |||||

| BFH | 72.5 | |||||

| ANAB | 27.02 | AnaptysBio, Inc. | Biotechnology | 81.00 | 92.78 | 57.6 |

| AMRK | 42.48 | A-Mark Precious Metals, Inc. | Beverages - Non-Alcoholic | 84.00 | 91.27 | 73.6 |

| AESI | 24.03 | Atlas Energy Solutions Inc. | Marine Shipping | 82.00 | 97.92 | 70.1 |

| AMKR | 67.4 | |||||

| TTD | 70.3 | |||||

| CHEF | 67.3 | |||||

| CXW | 68.8 | |||||

| SAP | 73.8 | |||||

| HIW | 54.6 | |||||

| IBCP | 72.1 | |||||

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.