Breakoutwatch Weekly Summary 06/24/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Market Summary

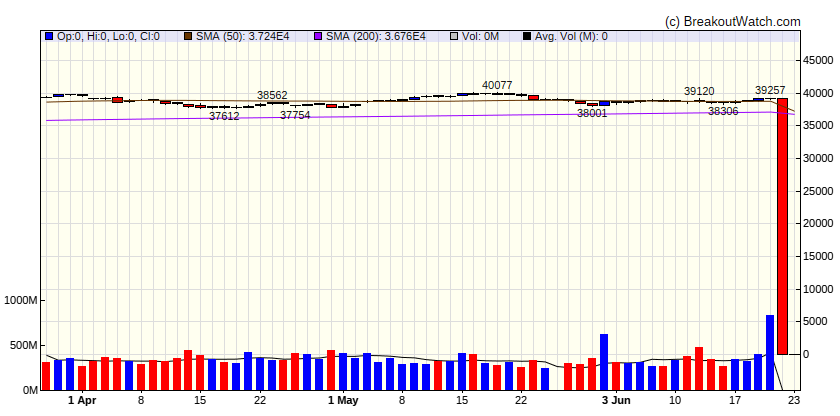

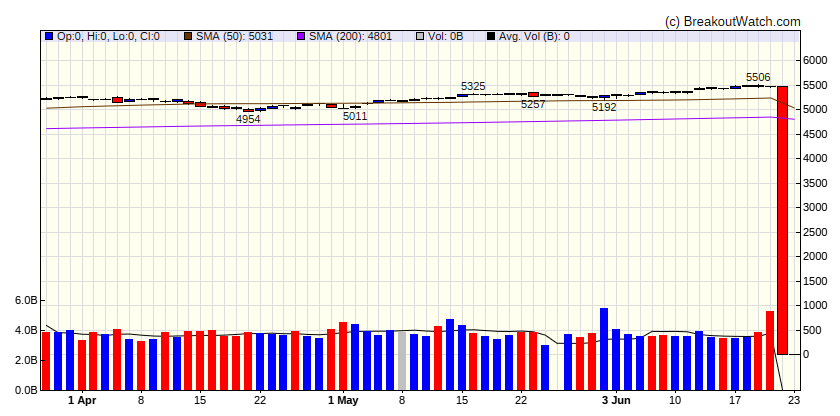

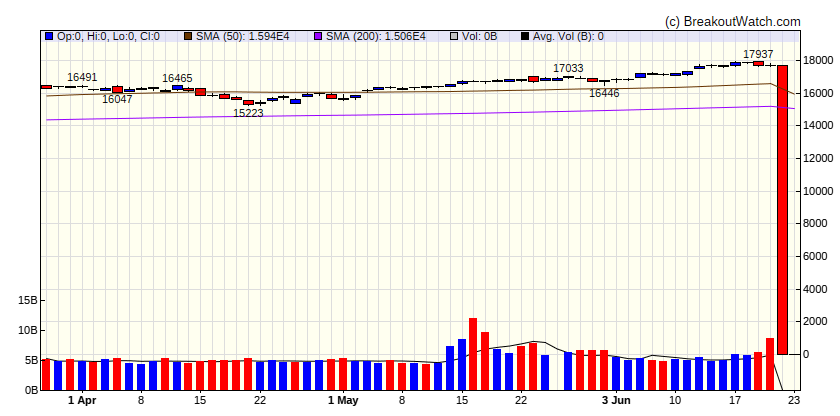

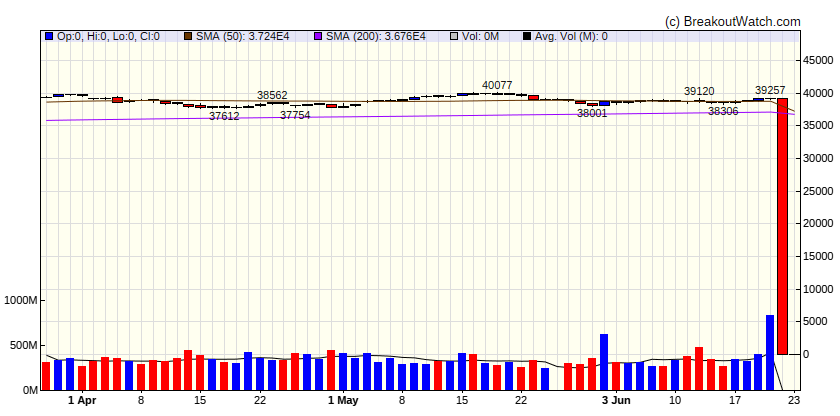

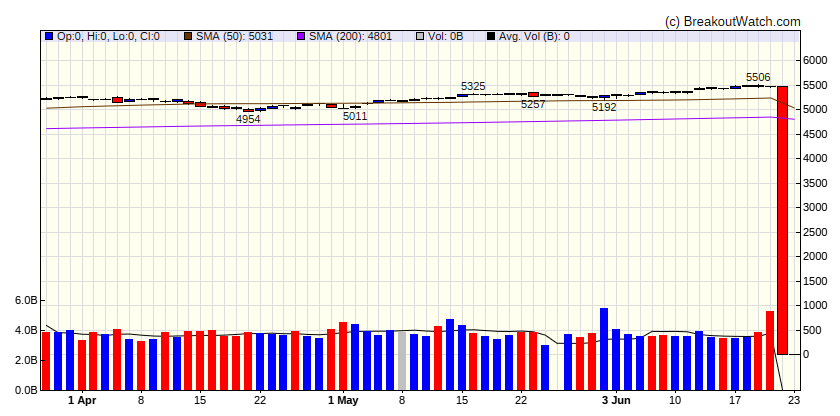

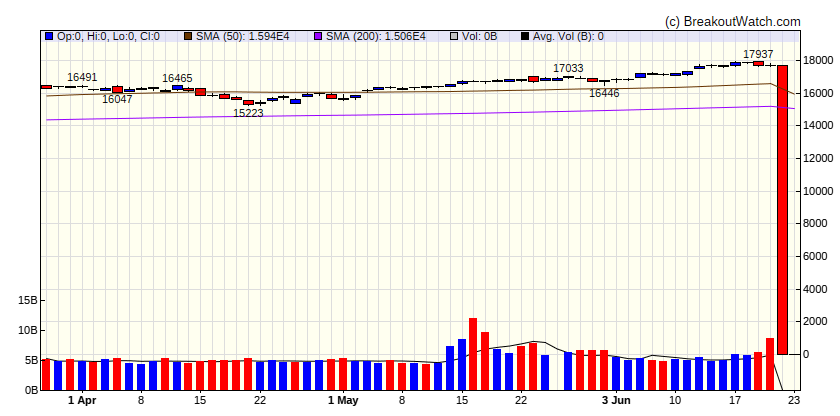

Stocks advance as gains appear to broaden

Stocks recorded modest gains over the shortened trading week (markets were closed Wednesday in observation of the Juneteenth holiday), helping push the S&P 500 Index to fresh all-time highs. The week also saw modest signs of a broadening and rotation in the market, with value stocks outperforming growth shares and most of the major benchmarks outperforming the technology-heavy Nasdaq Composite. Friday was a so-called triple-witching day, with roughly USD 5.5 trillion in options related to indexes, individual stocks, and exchange-traded funds set to expire, according to Bloomberg and options platform SpotGamma. [more...]

Major Index Performance

| Dow Jones

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Up |

|

| S&P 500

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Up |

|

| NASDAQ Comp.

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Up |

|

| Russell 2000

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

-100 |

-100 |

Up |

| Consumer Staples |

-100 |

-100 |

Up |

| Energy |

-100 |

-100 |

Down |

| Finance |

-100 |

-100 |

Down |

| Health Care |

-100 |

-100 |

Up |

| Industrials |

-100 |

-100 |

Down |

| Technology |

-100 |

-100 |

Up |

| Materials |

-100 |

-100 |

Down |

| REIT |

-100 |

-100 |

Up |

| Telecom |

-100 |

-100 |

Up |

| Utilities |

-100 |

-100 |

Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

There were no Breakdowns still within 5% of breakdown price this week |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

| There were no CWH stocks meeting our breakout model criteria |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.