Breakoutwatch Weekly Summary 07/11/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

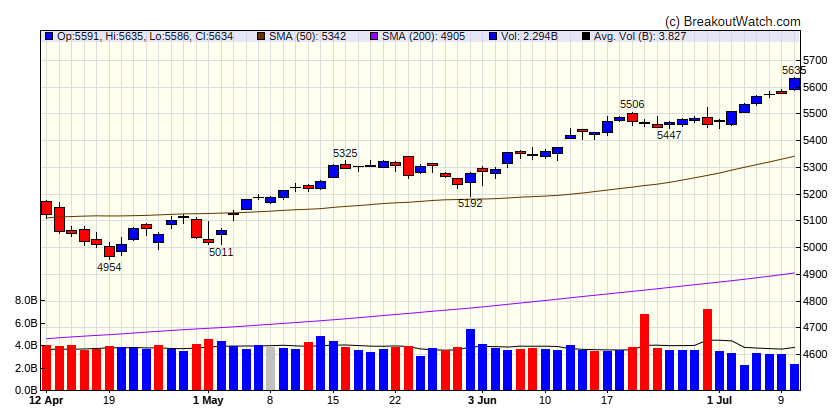

Exceptionally narrow advance continues on falling interest rates

The S&P 500 Index continued to climb to record highs, although the market’s gains remained notably narrow. As measured by Russell 1000 indexes, growth shares outperformed value stocks by 415 basis points (4.15 percentage points), while the small- and mid-cap benchmarks recorded losses. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 39721 |

| Wk. Gain | 1.04 % |

| Yr. Gain | 5.74 % |

| Trend | Up |

|

|

| S&P 500 | |

|---|---|

| Last Close | 5634 |

| Wk. Gain | 1.73 % |

| Yr. Gain | 18.74 % |

| Trend | Up |

|

|

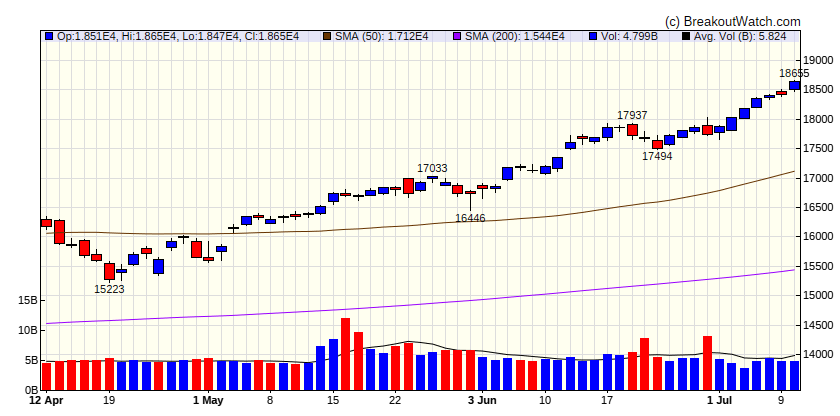

| NASDAQ Comp. | |

|---|---|

| Last Close | 18647 |

| Wk. Gain | 2.45 % |

| Yr. Gain | 25.37 % |

| Trend | Up |

|

|

| Russell 2000 | |

|---|---|

| Last Close | 2052 |

| Wk. Gain | 0.98 % |

| Yr. Gain | 1.94 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 1.07 | 6.48 | Up |

| Consumer Staples | 0.75 | 7.27 | Down |

| Energy | -2.15 | 6.26 | Down |

| Finance | 0.75 | 10.66 | Up |

| Health Care | 2.04 | 7.15 | Down |

| Industrials | 0.16 | 7.37 | Down |

| Technology | 2.26 | 26.96 | Up |

| Materials | 0.69 | 2.35 | Down |

| REIT | 1.13 | -4.17 | Down |

| Telecom | 1.8 | 21.14 | Up |

| Utilities | 1.25 | 10.25 | Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| CWH | MMYT | MakeMyTrip Limited | Textile Manufacturing | 84.2 % | 0.3 % |

| SQZ | GCT | GigaCloud Technology Inc | Utilities - Regulated Gas | 80 % | 1 % |

| SQZ | MELI | MercadoLibre, Inc. | Personal Services | 79.5 % | 2.7 % |

| SQZ | MEDP | Medpace Holdings, Inc. | Apparel Manufacturing | 79.1 % | 2 % |

| SQZ | NVO | Novo Nordisk A/S | Biotechnology | 78.4 % | 0.3 % |

| CWH | IBN | ICICI Bank Limited | Household & Personal Products | 76.7 % | 1 % |

| SQZ | ESTC | Elastic N.V. Ordinary Sha | Utilities - Renewable | 76 % | 0.4 % |

| SQZ | ICLR | ICON plc | Gold | 72.9 % | 1.4 % |

| CWH | AX | Axos Financial, Inc. | Household & Personal Products | 72.8 % | 0.9 % |

| SQZ | IDCC | InterDigital, Inc. | Specialty Chemicals | 72.5 % | 1.5 % |

| SQZ | ONTO | Onto Innovation Inc. | Utilities - Renewable | 72.2 % | 0.9 % |

| SQZ | MCY | Mercury General Corporation | Apparel Manufacturing | 72.1 % | 0.2 % |

| SQZ | MBIN | Merchants Bancorp | Household & Personal Products | 71.7 % | 2.5 % |

| SQZ | KTOS | Kratos Defense & Security Solutions, Inc. | Packaged Foods | 71.6 % | 0.7 % |

| SQZ | VIST | Vista Energy S.A.B. de C. | Utilities - Regulated Water | 71.3 % | 2.6 % |

| CWH | MIRM | Mirum Pharmaceuticals, Inc. | Biotechnology | 70.7 % | 1.4 % |

| SQZ | DOC | Healthpeak Properties, Inc. | Oil & Gas Refining & Marketing | 69.2 % | 0.9 % |

| HTF | ENVX | Enovix Corporation | Biotechnology | 68.8 % | 2.2 % |

| DB | RGA | Reinsurance Group of America, Inco | Tobacco | 67.7 % | 0.2 % |

| SQZ | DNTH | Dianthus Therapeutics, Inc. | Biotechnology | 67.7 % | 1.4 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | AXON | Axon Enterprise, Inc. | Drug Manufacturers - General | 76.7 % | -0.9 % |

| SS | GPS | Gap, Inc. | Resorts & Casinos | 71.1 % | -2.5 % |

| SS | RAMP | LiveRamp Holdings, Inc. | Utilities - Regulated Gas | 63.3 % | -1.9 % |

| SS | CRM | Salesforce, Inc. | Utilities - Renewable | 60.4 % | -2.7 % |

| SS | INSW | International Seaways, Inc. | Utilities - Renewable | 53.9 % | -4.2 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.