Breakoutwatch Weekly Summary 07/24/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

Investors continue turn to value and small-caps

The major indexes ended mixed in a week that saw a continued rotation in market leadership to small-cap and value shares. The narrowly focused Dow Jones Industrial Average outperformed, and value stocks outpaced growth stocks by 477 basis points (4.77 percentage points), as measured by Russell indexes—the largest divergence since March 2023, when growth shares outperformed by 654 basis points. The week was also notable for a widespread global disruption to computer systems early Friday due to an error in a vendor’s security update to some users of the Microsoft operating system. The problems seemed to have little impact on U.S. trading, however. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 40358 |

| Wk. Gain | -1.94 % |

| Yr. Gain | 7.43 % |

| Trend | Up |

|

|

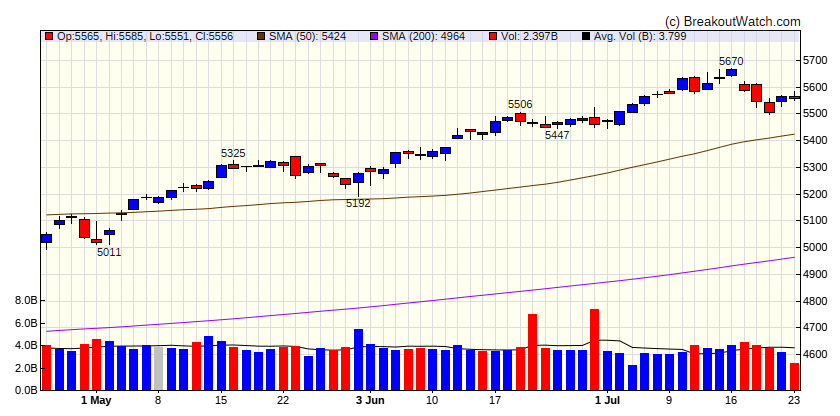

| S&P 500 | |

|---|---|

| Last Close | 5556 |

| Wk. Gain | -0.94 % |

| Yr. Gain | 17.09 % |

| Trend | Up |

|

|

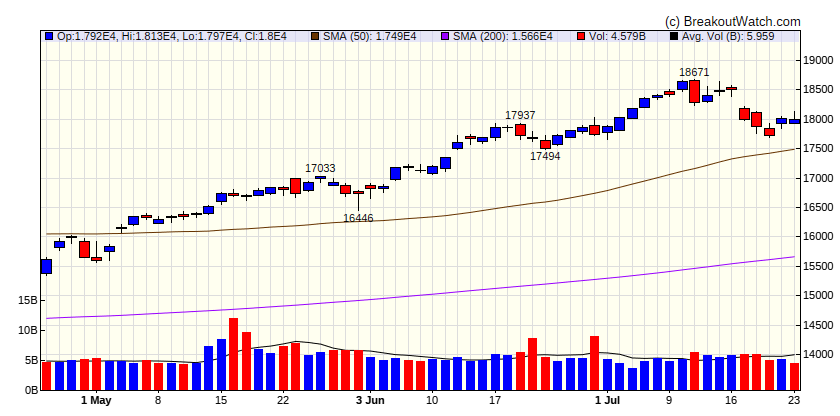

| NASDAQ Comp. | |

|---|---|

| Last Close | 17997 |

| Wk. Gain | -0.67 % |

| Yr. Gain | 21 % |

| Trend | Down |

|

|

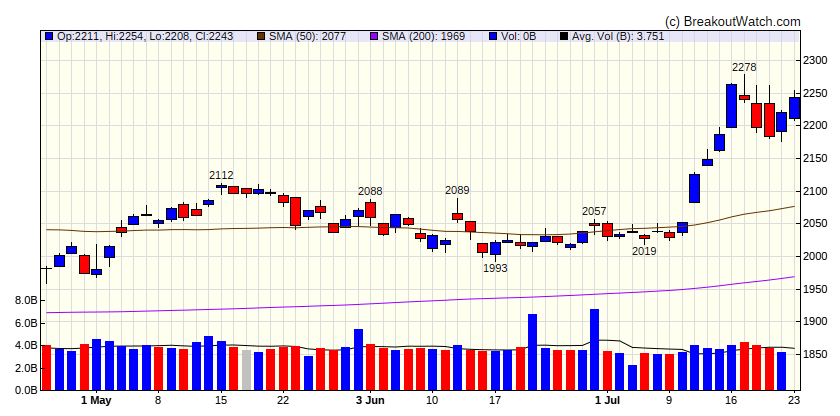

| Russell 2000 | |

|---|---|

| Last Close | 2243 |

| Wk. Gain | 0.4 % |

| Yr. Gain | 11.43 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | -1.39 | 6.37 | Up |

| Consumer Staples | -0.85 | 8.32 | Up |

| Energy | -2.98 | 7.7 | Up |

| Finance | -0.8 | 15.06 | Up |

| Health Care | -0.66 | 9.29 | Up |

| Industrials | 0.02 | 11.97 | Up |

| Technology | -0.71 | 22 | Down |

| Materials | -0.54 | 6.08 | Up |

| REIT | 0.45 | 1.81 | Up |

| Telecom | -0.71 | 17.64 | Down |

| Utilities | 0.36 | 12.2 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| CWH | MMYT | MakeMyTrip Limited | Textile Manufacturing | 84.5 % | 3.9 % |

| CWH | SRTS | Sensus Healthcare, Inc. | Drug Manufacturers - General | 75.8 % | 1.6 % |

| CWH | VCTR | Victory Capital Holdings, Inc. | Packaged Foods | 75.7 % | 0.9 % |

| CWH | AROW | Arrow Financial Corporation | Household & Personal Products | 75.2 % | 1.1 % |

| CWH | ROAD | Construction Partners, Inc. | Specialty Industrial Machinery | 74.7 % | 3.7 % |

| CWH | IGIC | International General Insurance Holdings Ltd. | Confectioners | 74.4 % | 4.3 % |

| SQZ | HWM | Howmet Aerospace Inc. | Advertising Agencies | 73.6 % | 2.7 % |

| CWH | MLR | Miller Industries, Inc. | Specialty Retail | 73.1 % | 2.1 % |

| CWH | GENC | Gencor Industries, Inc. | Utilities - Regulated Gas | 72.7 % | 4.7 % |

| CWH | TILE | Interface, Inc. | Beverages - Non-Alcoholic | 72.4 % | 0.1 % |

| SQZ | THC | Tenet Healthcare Corporation | Health Information Services | 71.5 % | 2.8 % |

| CWH | JXN | Jackson Financial Inc. | Grocery Stores | 71.1 % | 0.1 % |

| SQZ | REVG | REV Group, Inc. | Telecom Services | 70.9 % | 2.4 % |

| CWH | HY | Hyster-Yale, Inc. | Advertising Agencies | 69.9 % | 0.9 % |

| SQZ | LOCO | El Pollo Loco Holdings, Inc. | Residential Construction | 69 % | 0.3 % |

| SQZ | SGC | Superior Group of Companies, Inc. | Leisure | 68.8 % | 1.5 % |

| SQZ | ONON | On Holding AG Class A Ord | Uranium | 68.6 % | 1.1 % |

| SQZ | DVA | DaVita Inc. | Health Information Services | 67.5 % | 1.4 % |

| SQZ | SQSP | Squarespace, Inc. | Utilities - Regulated Gas | 67.2 % | 0 % |

| CWH | MOFG | MidWestOne Financial Group, Inc. | Household & Personal Products | 66.4 % | 0.9 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | RAMP | LiveRamp Holdings, Inc. | Utilities - Regulated Gas | 61.6 % | -3.6 % |

| SS | IDN | Intellicheck, Inc. | Utilities - Renewable | 53.1 % | -4.5 % |

| SS | FOSL | Fossil Group, Inc. | Recreational Vehicles | 38.8 % | -0.8 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.