Breakoutwatch Weekly Summary 07/29/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

Stocks mixed again as rotation continues

Stocks recorded mixed returns for the second consecutive week, with small-cap and value shares continuing to outpace the large-cap growth stocks that have led the market over much of the year. Indeed, at the close of trading on Thursday, the technology-heavy Nasdaq Composite 100 Index was lagging the broader S&P 500 Index and barely outperforming the small-cap Russell 2000 Index for the year to date, before large-cap growth shares rebounded to close the week. The week was also notable for the S&P 500 Index selling off on Wednesday by more than 2% for the first time since February 2023, while the Nasdaq suffered its worst loss since October 2022. [more...]

Major Index Performance

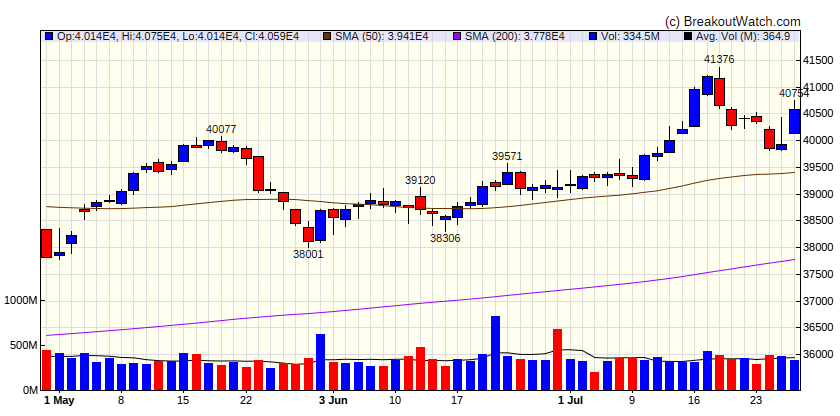

| Dow Jones | |

|---|---|

| Last Close | 40589 |

| Wk. Gain | 0.43 % |

| Yr. Gain | 8.05 % |

| Trend | Up |

|

|

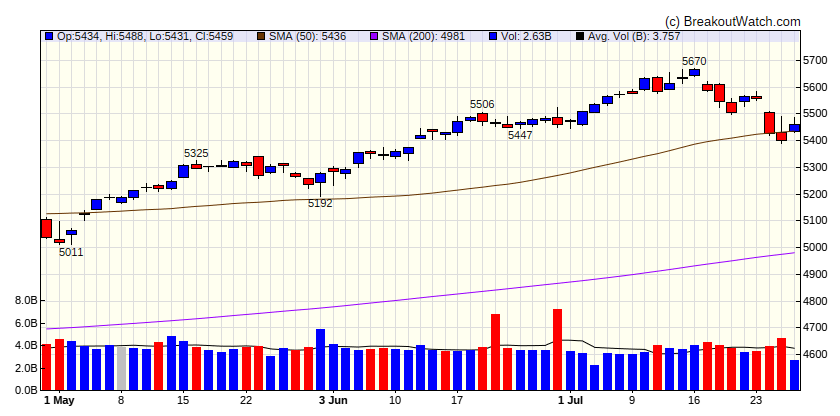

| S&P 500 | |

|---|---|

| Last Close | 5459 |

| Wk. Gain | -1.55 % |

| Yr. Gain | 15.05 % |

| Trend | Down |

|

|

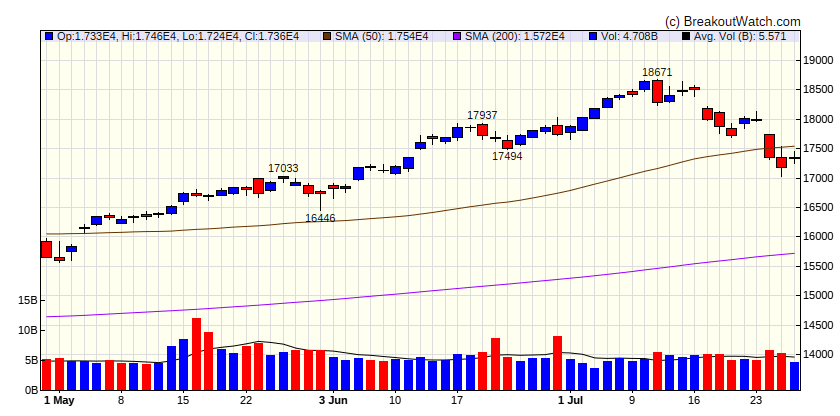

| NASDAQ Comp. | |

|---|---|

| Last Close | 17358 |

| Wk. Gain | -3.16 % |

| Yr. Gain | 16.7 % |

| Trend | Down |

|

|

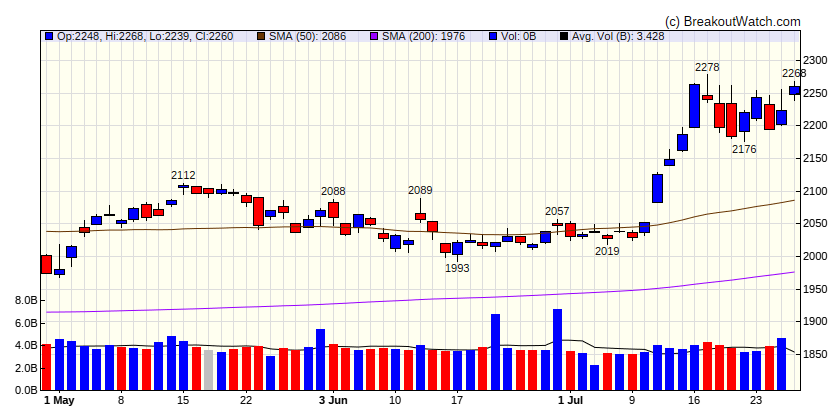

| Russell 2000 | |

|---|---|

| Last Close | 2260 |

| Wk. Gain | 3.15 % |

| Yr. Gain | 12.27 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | -2.25 | 3.72 | Down |

| Consumer Staples | 0.48 | 9.44 | Up |

| Energy | 0.07 | 9.53 | Up |

| Finance | 1.36 | 15.85 | Up |

| Health Care | 1.17 | 10.3 | Up |

| Industrials | 0.89 | 12.21 | Up |

| Technology | -3.13 | 17.48 | Down |

| Materials | 1.39 | 6.81 | Up |

| REIT | 0.58 | 1.73 | Up |

| Telecom | -2.78 | 14.4 | Down |

| Utilities | 1.05 | 13.62 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| CWH | BAND | Bandwidth Inc. | Utilities - Regulated Gas | 0 % | 0.2 % |

| CWH | GFF | Griffon Corporation | Computer Hardware | 0 % | 1.3 % |

| CWH | HOPE | Hope Bancorp, Inc. | Household & Personal Products | 0 % | 3.2 % |

| CWH | HY | Hyster-Yale, Inc. | Advertising Agencies | 0 % | 4.2 % |

| CWH | IBP | Installed Building Products, Inc. | Apparel Retail | 0 % | 3.9 % |

| CWH | JXN | Jackson Financial Inc. | Grocery Stores | 0 % | 2.8 % |

| CWH | MOFG | MidWestOne Financial Group, Inc. | Household & Personal Products | 0 % | 4 % |

| CWH | PRDO | Perdoceo Education Corporation | Drug Manufacturers - General | 0 % | 3.7 % |

| CWH | TILE | Interface, Inc. | Beverages - Non-Alcoholic | 0 % | 2.1 % |

| CWH | TRUP | Trupanion, Inc. | Discount Stores | 0 % | 0.5 % |

| CWH | VCTR | Victory Capital Holdings, Inc. | Packaged Foods | 0 % | 0.3 % |

| DB | COLL | Collegium Pharmaceutical, Inc. | Oil & Gas Drilling | 0 % | 3.5 % |

| DB | PEGA | Pegasystems Inc. | Utilities - Renewable | 0 % | 4.2 % |

| SQZ | AVAV | AeroVironment, Inc. | Household & Personal Products | 0 % | 2.3 % |

| SQZ | CGNT | Cognyte Software Ltd. | Utilities - Regulated Gas | 0 % | 1.2 % |

| SQZ | COGT | Cogent Biosciences, Inc. | Biotechnology | 0 % | 3.1 % |

| SQZ | ELYM | Eliem Therapeutics, Inc | Biotechnology | 0 % | 3.8 % |

| SQZ | ESOA | Energy Services of America Corporation | Discount Stores | 0 % | 1.5 % |

| SQZ | HWM | Howmet Aerospace Inc. | Advertising Agencies | 0 % | 0.4 % |

| SQZ | LOCO | El Pollo Loco Holdings, Inc. | Residential Construction | 0 % | 0.5 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | KLAC | KLA Corporation | Packaged Foods | 0 % | -2 % |

| SS | RAMP | LiveRamp Holdings, Inc. | Utilities - Regulated Gas | 0 % | -3.8 % |

| SS | RCMT | RCM Technologies, Inc. | Computer Hardware | 0 % | -0.7 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| AGIO | 50.35 | Agios Pharmaceuticals, Inc. | Biotechnology | 95.00 | 95.43 | 60.4 |

| ACLX | 67.37 | Arcellx, Inc. | Biotechnology | 89.00 | 95.61 | 65.6 |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.