Breakoutwatch Weekly Summary 08/12/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Market Summary

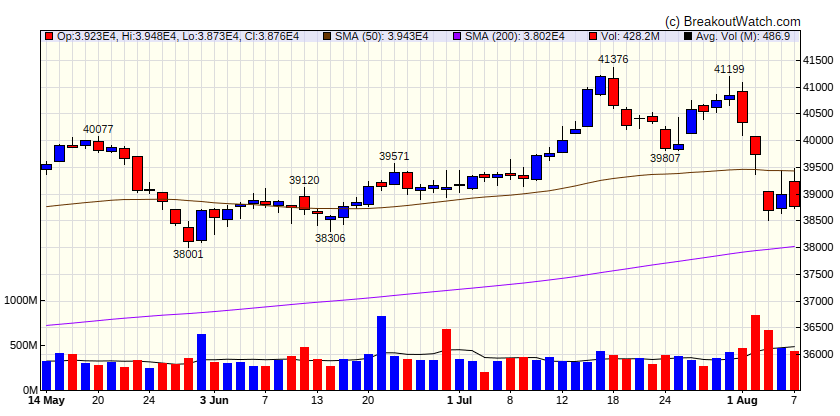

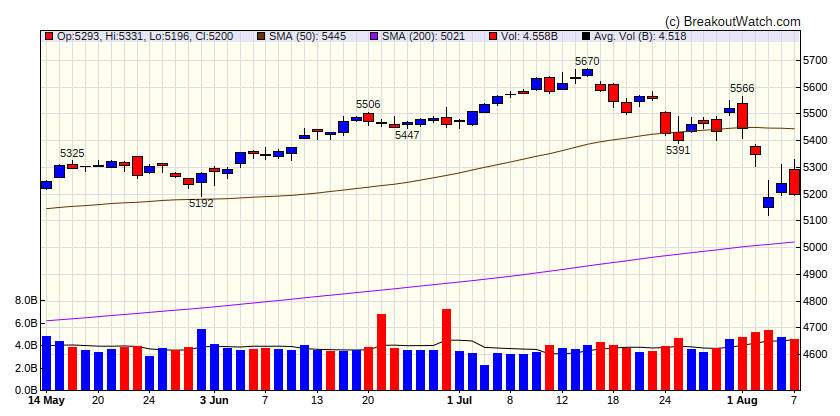

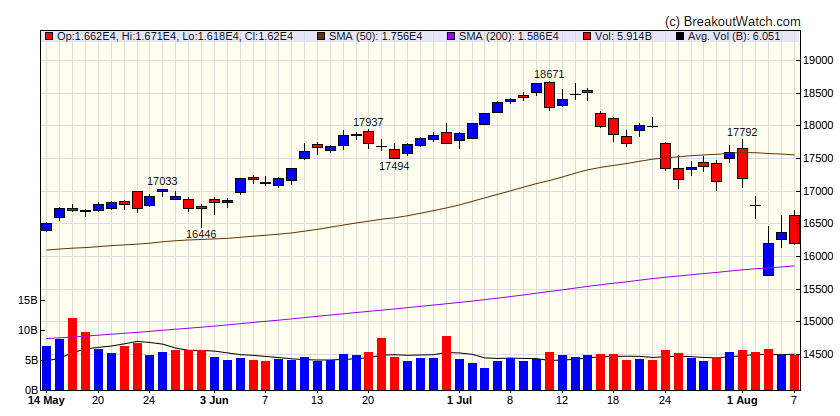

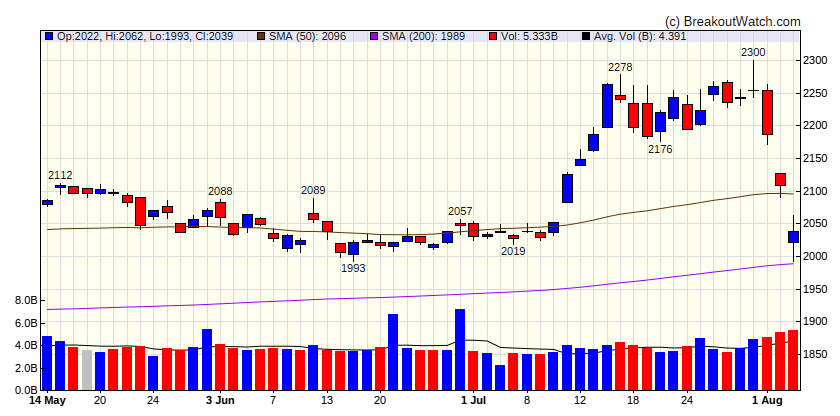

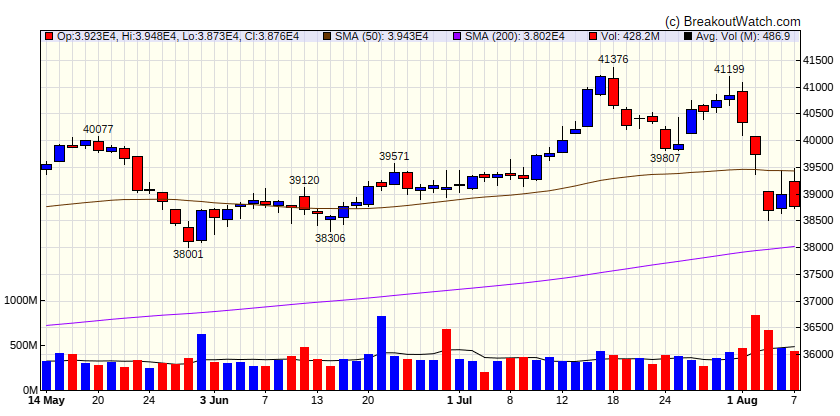

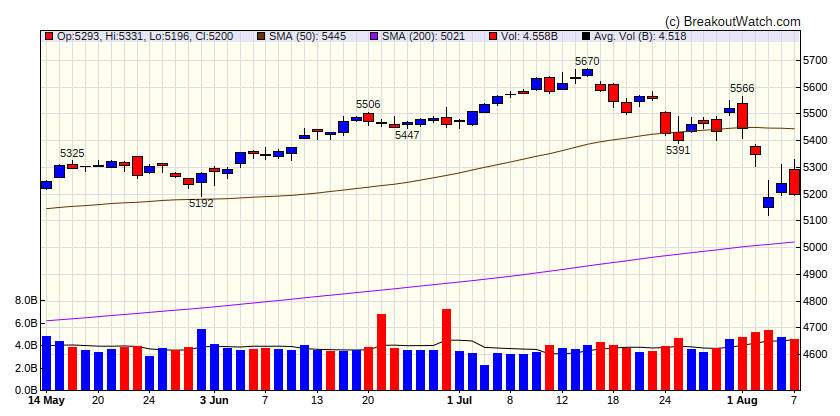

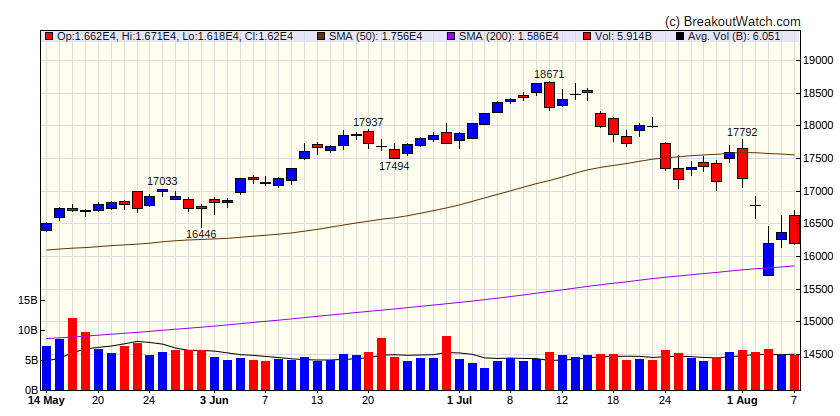

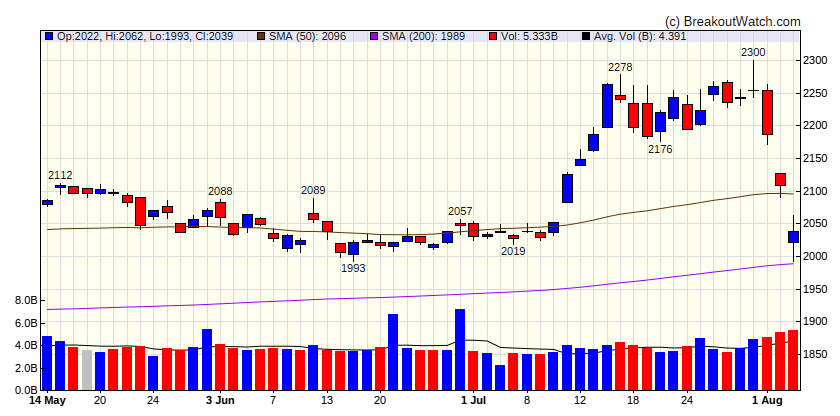

Markets volatile on growth worries and technical factors

The major indexes closed modestly lower for the week after recovering from the biggest sell-off in nearly two years. The S&P 500 Index neared correction territory (down over 10%) on Monday morning, when it fell as much as 9.71% from its intraday high in mid-January; around the same time, the Nasdaq Composite was down 15.81% from its peak, after entering a correction the previous Friday. Even more pronounced were the swings in the CBOE Volatility Index (VIX), Wall Street’s so-called fear gauge, which briefly spiked Monday to 65.73, its highest level since late March 2020, before falling back to end the week at 20.69. [more...]

Major Index Performance

| Dow Jones

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

| S&P 500

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

| NASDAQ Comp.

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

| Russell 2000

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

5.17 |

-1.03 |

Down |

| Consumer Staples |

0.24 |

9.87 |

Up |

| Energy |

3.81 |

5.68 |

Down |

| Finance |

3.56 |

12 |

Down |

| Health Care |

1.65 |

9.92 |

Down |

| Industrials |

3.63 |

8.95 |

Down |

| Technology |

8.21 |

12.06 |

Down |

| Materials |

1.49 |

2.81 |

Down |

| REIT |

1.8 |

3.45 |

Up |

| Telecom |

6.14 |

15.67 |

Down |

| Utilities |

-1.15 |

16.95 |

Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| SQZ |

DECK |

Deckers Outdoor Corporation |

Footwear & Accessories |

69 % |

0.7 % |

| SQZ |

PLNT |

Planet Fitness, Inc. |

Leisure |

68.9 % |

1 % |

| SQZ |

LOCO |

El Pollo Loco Holdings, Inc. |

Restaurants |

68.8 % |

0.5 % |

| CWH |

TRUP |

Trupanion, Inc. |

Insurance - Specialty |

67.4 % |

0.4 % |

| SQZ |

ATMU |

Atmus Filtration Technologies Inc. |

Pollution & Treatment Controls |

66.5 % |

0.4 % |

| CWH |

TGLS |

Tecnoglass Inc. |

Building Materials |

66 % |

0.4 % |

| SQZ |

RXST |

RxSight, Inc. |

Medical Devices |

65.2 % |

2.8 % |

| SQZ |

SNCR |

Synchronoss Technologies, Inc. |

Software - Infrastructure |

63.9 % |

2.6 % |

| SQZ |

SHIP |

Seanergy Maritime Holdings Corp. |

Marine Shipping |

61.6 % |

0.3 % |

| SQZ |

T |

AT&T Inc. |

Telecom Services |

60 % |

1.2 % |

| SQZ |

ENV |

Envestnet, Inc |

Software - Application |

45.8 % |

0.1 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

IP |

International Paper Company |

Packaging & Containers |

65 % |

-1.5 % |

| SS |

MAX |

MediaAlpha, Inc. |

Internet Content & Information |

63.9 % |

-1.3 % |

| SS |

SWBI |

Smith & Wesson Brands, Inc. |

Aerospace & Defense |

56.5 % |

-3.6 % |

| SS |

PYXS |

Pyxis Oncology, Inc. |

Biotechnology |

56.1 % |

-4.4 % |

| SS |

VERA |

Vera Therapeutics, Inc. |

Biotechnology |

54.2 % |

-1.2 % |

| SS |

GIC |

Global Industrial Company |

Industrial Distribution |

46.1 % |

-4.5 % |

| SS |

TNGX |

Tango Therapeutics, Inc. |

Biotechnology |

33.2 % |

-3.7 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

| There were no CWH stocks meeting our breakout model criteria |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.