Breakoutwatch Weekly Summary 08/16/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

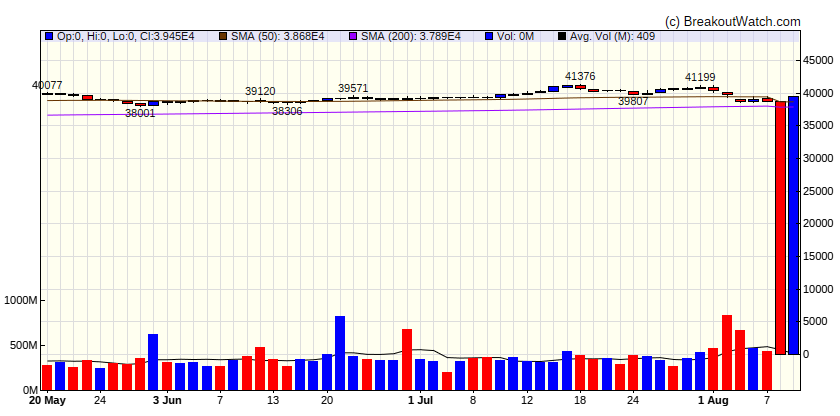

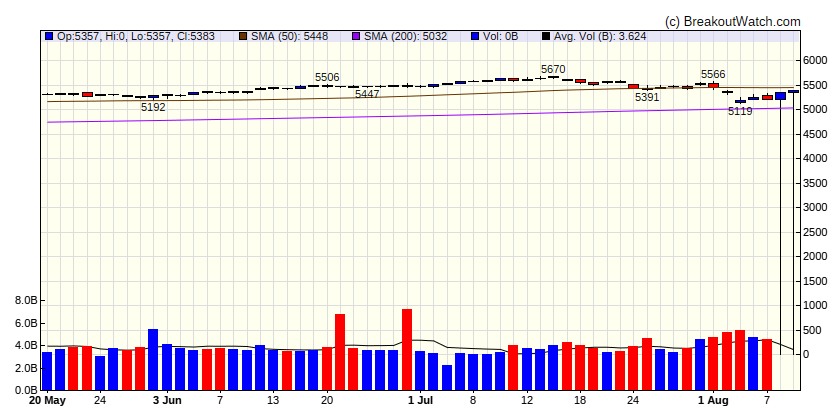

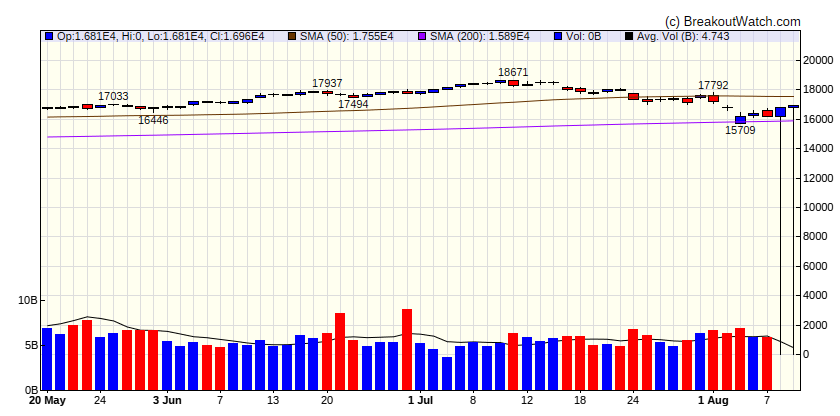

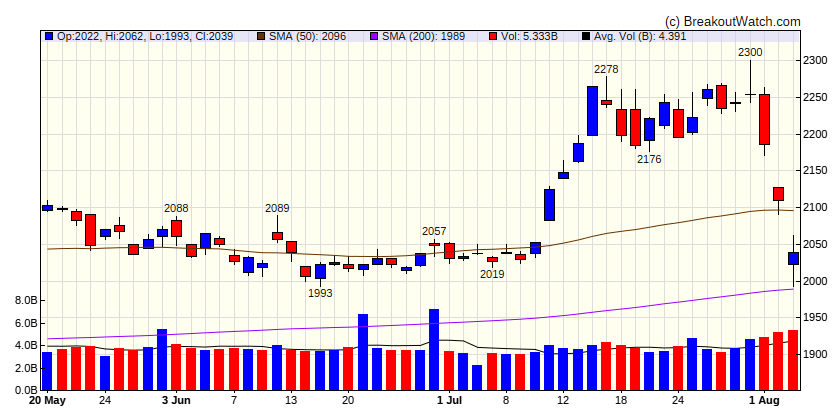

Stocks continue recovery from August 5 sell-off

Stocks recorded a solid week of gains, as investors appeared to celebrate positive news on both the inflation and growth fronts, which together bolstered hopes that the economy might achieve a “soft landing.” The technology-heavy Nasdaq Composite led the gains and ended the week up 12.24% off its intraday lows amid the sell-off on August 5. Artificial intelligence chip giant NVIDIA was especially strong, gaining 18.93% over the week. Relatedly, growth stocks handily outpaced value shares, according to various Russell indexes. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | |

| Wk. Gain | NAN % |

| Yr. Gain | -100 % |

| Trend | Up |

|

|

| S&P 500 | |

|---|---|

| Last Close | |

| Wk. Gain | NAN % |

| Yr. Gain | -100 % |

| Trend | Down |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | |

| Wk. Gain | NAN % |

| Yr. Gain | -100 % |

| Trend | Down |

|

|

| Russell 2000 | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Down |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 4.6 | 3.72 | Up |

| Consumer Staples | 1.82 | 11.92 | Up |

| Energy | 0.82 | 7.27 | Up |

| Finance | 3.04 | 15.75 | Up |

| Health Care | 1.71 | 12.11 | Up |

| Industrials | 2.26 | 11.57 | Up |

| Technology | 6.64 | 19.81 | Up |

| Materials | 2.21 | 5.14 | Down |

| REIT | 0.62 | 3.73 | Up |

| Telecom | 1.49 | 17.6 | Up |

| Utilities | 1.08 | 18.25 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | NFLX | Netflix, Inc. | Entertainment | 78.3 % | 4 % |

| SQZ | DVA | DaVita Inc. | Medical Care Facilities | 76.7 % | 3.1 % |

| SQZ | FIX | Comfort Systems USA, Inc. | Engineering & Construction | 76.2 % | 0.3 % |

| SQZ | EME | EMCOR Group, Inc. | Engineering & Construction | 73.8 % | 0.3 % |

| SQZ | DY | Dycom Industries, Inc. | Engineering & Construction | 73.6 % | 3.7 % |

| SQZ | AAON | AAON, Inc. | Building Products & Equipment | 72.6 % | 0.8 % |

| SQZ | TGS | Transportadora de Gas del Sur SA TGS | Oil & Gas Integrated | 71.6 % | 2.5 % |

| SQZ | PLNT | Planet Fitness, Inc. | Leisure | 69.6 % | 1.3 % |

| SQZ | ATMU | Atmus Filtration Technologies Inc. | Pollution & Treatment Controls | 69.1 % | 3.9 % |

| CWH | IOT | Samsara Inc. | Software - Infrastructure | 68.8 % | 0.3 % |

| SQZ | MTZ | MasTec, Inc. | Engineering & Construction | 65 % | 3.8 % |

| SQZ | EXR | Extra Space Storage Inc | REIT - Industrial | 64.9 % | 1.9 % |

| CWH | FTNT | Fortinet, Inc. | Software - Infrastructure | 64.6 % | 4 % |

| SQZ | ADSE | AD | Electrical Equipment & Parts | 64.2 % | 0.7 % |

| CWH | DASH | DoorDash, Inc. | Internet Content & Information | 60.6 % | 2.1 % |

| SQZ | HMST | HomeStreet, Inc. | Banks - Regional | 60.1 % | 3.2 % |

| SQZ | CROX | Crocs, Inc. | Footwear & Accessories | 60 % | 4.5 % |

| SQZ | RUN | Sunrun Inc. | Solar | 60 % | 4.8 % |

| SQZ | FULC | Fulcrum Therapeutics, Inc. | Biotechnology | 59.1 % | 2.4 % |

| SQZ | ZIM | ZIM Integrated Shipping S | Marine Shipping | 57.9 % | 2.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | OWL | Blue Owl Capital Inc. | Asset Management | 77.6 % | -0.1 % |

| SS | SEMR | SEMrush Holdings, Inc. | Software - Application | 73.8 % | -0.4 % |

| SS | PYXS | Pyxis Oncology, Inc. | Biotechnology | 57.6 % | -2.3 % |

| SS | ACHR | Archer Aviation Inc. | Aerospace & Defense | 42.2 % | -2.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| PRAX | 59.81 | Praxis Precision Medicines, Inc. | Biotechnology | 99.00 | 88.36 | 63.3 |

| GSUN | 8.94 | Golden Sun Health Technology Group Limited | Education & Training Services | 99.00 | 84.79 | 53.9 |

| VIRC | 18.05 | Virco Manufacturing Corporation | Furnishings, Fixtures & Appliances | 97.00 | 94.02 | 76.7 |

| REVG | 29.89 | REV Group, Inc. | Farm & Heavy Construction Machinery | 93.00 | 96.99 | 74.5 |

| DNTH | 31.61 | Dianthus Therapeutics, Inc. | Biotechnology | 92.00 | 90.95 | 67.4 |

| ARIS | 17.91 | Aris Water Solutions, Inc. | Utilities - Regulated Water | 91.00 | 90.62 | 72.1 |

| NVEI | 33.26 | Nuvei Corporation | Software - Infrastructure | 90.00 | 99.79 | 63.4 |

| LFVN | 8.75 | Lifevantage Corporation | Packaged Foods | 86.00 | 91.77 | 65.1 |

| FLXS | 38.95 | Flexsteel Industries, Inc. | Furnishings, Fixtures & Appliances | 89.00 | 93.45 | 75.2 |

| FFNW | 22.48 | First Financial Northwest, Inc. | Banks - Regional | 89.00 | 97.95 | 61 |

| TILE | 17.86 | Interface, Inc. | Building Products & Equipment | 90.00 | 97.82 | 72.2 |

| PRIM | 57.72 | Primoris Services Corporation | Engineering & Construction | 89.00 | 93.83 | 71.4 |

| ONON | 43.20 | On Holding AG Class A Ord | Footwear & Accessories | 87.00 | 98.47 | 69.8 |

| OSPN | 15.99 | OneSpan Inc. | Software - Infrastructure | 88.00 | 96.81 | 68.2 |

| SA | 59.4 | |||||

| RYTM | 53.92 | Rhythm Pharmaceuticals, Inc. | Biotechnology | 86.00 | 85.46 | 64.3 |

| SPR | 37.08 | Spirit Aerosystems Holdings, Inc. | Aerospace & Defense | 86.00 | 95.12 | 61.3 |

| INNV | 6.61 | InnovAge Holding Corp. | Medical Care Facilities | 88.00 | 93.34 | 65.4 |

| QNST | 20.50 | QuinStreet, Inc. | Advertising Agencies | 81.00 | 83.17 | 54.3 |

| PRG | 46.40 | PROG Holdings, Inc. | Rental & Leasing Services | 88.00 | 94.42 | 62.3 |

| BCRX | 8.09 | BioCryst Pharmaceuticals, Inc. | Biotechnology | 83.00 | 94.44 | 72.9 |

| MDGL | 298.00 | Madrigal Pharmaceuticals, Inc. | Biotechnology | 84.00 | 84.16 | 58.3 |

| ARGX | 540.49 | argenx SE | Biotechnology | 83.00 | 97.13 | 61.8 |

| EML | 31.00 | Eastern Company (The) | Tools & Accessories | 85.00 | 94.61 | 69.2 |

| PHG | 29.53 | Koninklijke Philips N.V. | Medical Devices | 84.00 | 98.51 | 56.7 |

| GSHD | 92.50 | Goosehead Insurance, Inc. | Insurance - Diversified | 83.00 | 92.74 | 75.5 |

| GE | 177.20 | GE Aerospace | Aerospace & Defense | 82.00 | 95.61 | 70.4 |

| BHRB | 70.00 | Burke & Herbert Financial Services Corp. | Banks - Regional | 82.00 | 90.14 | 61.7 |

| SMBC | 58.03 | Southern Missouri Bancorp, Inc. | Banks - Regional | 82.00 | 93.06 | 72 |

| COLL | 39.58 | Collegium Pharmaceutical, Inc. | Drug Manufacturers - Specialty & Generic | 80.00 | 89.09 | 67.1 |

| KTB | 73.31 | Kontoor Brands, Inc. | Apparel Manufacturing | 80.00 | 97.86 | 65.7 |

| ITOS | 48.2 | |||||

| TSEM | 44.18 | Tower Semiconductor Ltd. | Semiconductors | 82.00 | 90.56 | 59.2 |

| CRH | 54.7 | |||||

| CARE | 17.32 | Carter Bankshares, Inc. | Banks - Regional | 80.00 | 93.76 | 61.2 |

| ITGR | 62 | |||||

| IBM | 68.8 | |||||

| CPNG | 69.9 | |||||

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.