Breakoutwatch Weekly Summary 08/28/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

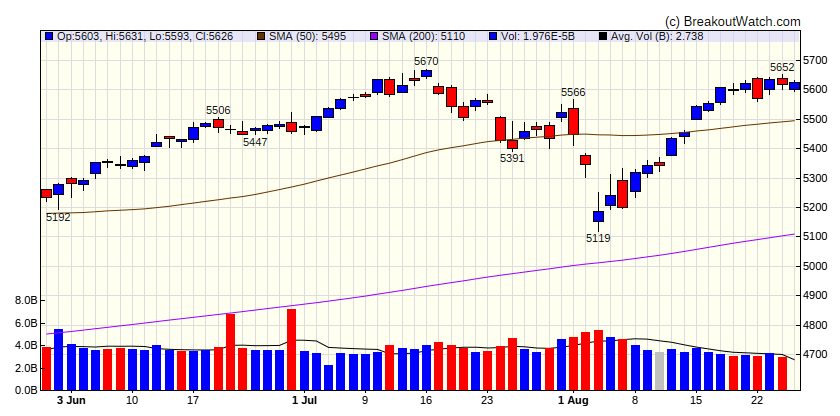

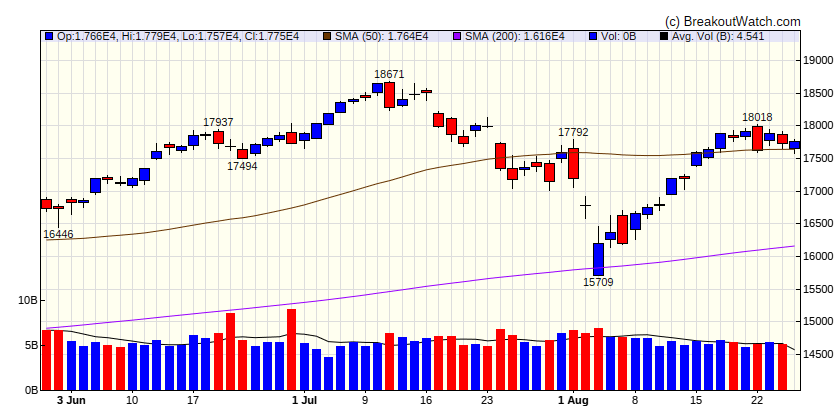

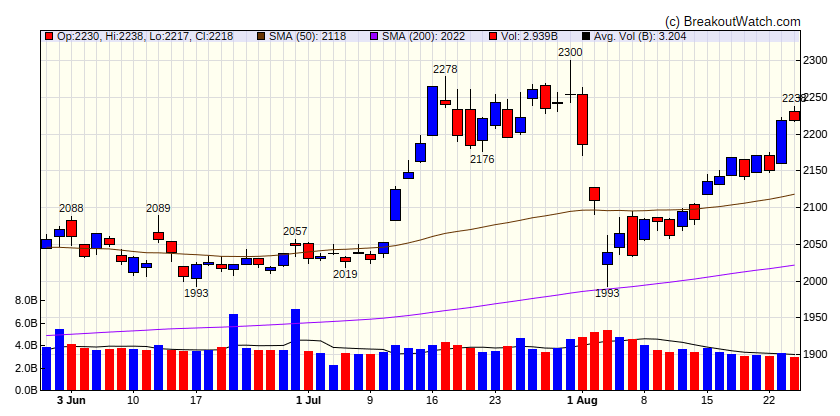

Investors celebrate notice of coming rate cuts

The Dow Jones Industrial Average and S&P 500 Index moved back toward record highs, as investors appeared to celebrate Federal Reserve Chair Jerome Powell’s announcement that interest rate cuts would soon be coming. The gains were also broad-based, with small-caps outperforming large-caps and an equal-weighted version of the S&P 500 Index outpacing its more familiar, capitalization-weighted counterpart. T. Rowe Price traders noted that trading activity was exceptionally light through most of week, which featured some of the lowest daily trading volumes of the summer. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 41250.5 |

| Wk. Gain | 0.78 % |

| Yr. Gain | 9.81 % |

| Trend | Up |

|

|

| S&P 500 | |

|---|---|

| Last Close | 5625.8 |

| Wk. Gain | -0.22 % |

| Yr. Gain | 18.56 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 17754.8 |

| Wk. Gain | -1.33 % |

| Yr. Gain | 19.37 % |

| Trend | Up |

|

|

| Russell 2000 | |

|---|---|

| Last Close | 17754.8 |

| Wk. Gain | 721.98 % |

| Yr. Gain | 782.01 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | -0.76 | 5.27 | Up |

| Consumer Staples | 0.81 | 14.6 | Up |

| Energy | 1.68 | 7.1 | Up |

| Finance | 2.11 | 18.41 | Up |

| Health Care | 0.29 | 14.34 | Up |

| Industrials | 0.62 | 13.59 | Up |

| Technology | -1.34 | 20.75 | Up |

| Materials | 1.6 | 8.15 | Up |

| REIT | 2.55 | 7.76 | Up |

| Telecom | -0.78 | 19.17 | Up |

| Utilities | -0.06 | 19.59 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| DB | WING | Wingstop Inc. | Restaurants | 75 % | 2.4 % |

| SQZ | EME | EMCOR Group, Inc. | Engineering & Construction | 74.8 % | 3.7 % |

| SQZ | TILE | Interface, Inc. | Building Products & Equipment | 72.5 % | 3.4 % |

| DB | LNTH | Lantheus Holdings, Inc. | Drug Manufacturers - Specialty & Generic | 72.1 % | 3.2 % |

| SQZ | NXRT | NexPoint Residential Trust, Inc. | REIT - Residential | 70.8 % | 1.7 % |

| CWH | TGLS | Tecnoglass Inc. | Building Materials | 70.1 % | 2.5 % |

| DB | ARQT | Arcutis Biotherapeutics, Inc. | Biotechnology | 66.8 % | 3.3 % |

| CWH | DKS | Dick's Sporting Goods Inc | Specialty Retail | 66.7 % | 2.8 % |

| SQZ | PRMW | Primo Water Corporation | Shell Companies | 65.8 % | 0.5 % |

| SQZ | NSA | National Storage Affiliates Trust | REIT - Industrial | 64.9 % | 2.8 % |

| SQZ | BNTC | Benitec Biopharma Inc. | Biotechnology | 63.9 % | 3.3 % |

| CWH | CAL | Caleres, Inc. | Apparel Retail | 63.5 % | 1.9 % |

| DB | TDS | Telephone and Data Systems, Inc. | Specialty Chemicals | 61.5 % | 1.6 % |

| SQZ | T | AT&T Inc. | Telecom Services | 59.1 % | 0.8 % |

| SQZ | IFF | International Flavors & Fragrances, Inc. | Specialty Chemicals | 56.6 % | 3 % |

| CWH | PHG | Koninklijke Philips N.V. | Medical Devices | 56.5 % | 2.5 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | OWL | Blue Owl Capital Inc. | Asset Management | 73.5 % | -1.5 % |

| SS | KEX | Kirby Corporation | Marine Shipping | 69.9 % | -0.7 % |

| SS | MTSI | MACOM Technology Solutions Holdings, Inc. | Semiconductors | 67.9 % | -1.4 % |

| SS | GFF | Griffon Corporation | Conglomerates | 60.6 % | -0.2 % |

| SS | AMD | Advanced Micro Devices, Inc. | Semiconductors | 57 % | -2.6 % |

| SS | DKNG | DraftKings Inc. | Gambling | 55.1 % | -3.2 % |

| SS | WMS | Advanced Drainage Systems, Inc. | Building Products & Equipment | 54 % | -1.5 % |

| SS | ARVN | Arvinas, Inc. | Biotechnology | 41.7 % | -2.6 % |

| SS | OPAD | Offerpad Solutions Inc. | Oil & Gas Midstream | 40.8 % | -2.2 % |

| SS | RXRX | Recursion Pharmaceuticals, Inc. | Biotechnology | 37.4 % | -1.8 % |

| SS | FBYD | Falcon's Beyond Global, Inc. | Conglomerates | 36.8 % | -4.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| PRAX | 59.81 | Praxis Precision Medicines, Inc. | Biotechnology | 99.00 | 89.48 | 61 |

| SLNO | 52.38 | Soleno Therapeutics, Inc. | Biotechnology | 98.00 | 93.62 | 58.5 |

| SG | 38.53 | Sweetgreen, Inc. | Residential Construction | 97.00 | 89.77 | 70 |

| SLDB | 10.37 | Solid Biosciences Inc. | Biotechnology | 95.00 | 88.24 | 54.3 |

| APP | 92.50 | Applovin Corporation | Utilities - Renewable | 94.00 | 97.62 | 77.9 |

| SUPV | 7.56 | Grupo Supervielle S.A. Am | Household & Personal Products | 94.00 | 92.59 | 75.6 |

| BDTX | 6.75 | Black Diamond Therapeutics, Inc. | Biotechnology | 94.00 | 92.89 | 57.1 |

| DKS | 239.30 | Dick's Sporting Goods Inc | Footwear & Accessories | 93.00 | 98.75 | 66.7 |

| GGAL | 36.63 | Grupo Financiero Galicia S.A. | Household & Personal Products | 93.00 | 95.39 | 60.9 |

| ARIS | 17.91 | Aris Water Solutions, Inc. | Electrical Equipment & Parts | 92.00 | 93.63 | 73.6 |

| CRVO | 19.00 | CervoMed Inc. | Biotechnology | 92.00 | 87.74 | 54.6 |

| DNTH | 31.61 | Dianthus Therapeutics, Inc. | Biotechnology | 92.00 | 90.57 | 68.3 |

| INFN | 6.19 | Infinera Corporation | Utilities - Regulated Water | 91.00 | 98.38 | 56.7 |

| QNST | 20.50 | QuinStreet, Inc. | Gold | 90.00 | 95.8 | 64.7 |

| NVEI | 33.33 | Nuvei Corporation | Utilities - Regulated Gas | 89.00 | 99.79 | 62.9 |

| BBAR | 10.68 | Banco BBVA Argentina S.A. | Household & Personal Products | 88.00 | 88.58 | 73.1 |

| OSPN | 16.41 | OneSpan Inc. | Utilities - Regulated Gas | 88.00 | 95.06 | 67.7 |

| SPHR | 50.88 | Sphere Entertainment Co. Class A | Other Precious Metals & Mining | 87.00 | 96.38 | 62.2 |

| ITOS | 18.13 | iTeos Therapeutics, Inc. | Biotechnology | 87.00 | 95.75 | 61.1 |

| NGS | 22.83 | Natural Gas Services Group, Inc. | Luxury Goods | 87.00 | 95.62 | 76.4 |

| FIX | 347.73 | Comfort Systems USA, Inc. | Utilities - Regulated Gas | 86.00 | 96.49 | 74.8 |

| BHRB | 70.00 | Burke & Herbert Financial Services Corp. | Household & Personal Products | 86.00 | 95.13 | 65.1 |

| NUVL | 87.70 | Nuvalent, Inc. | Biotechnology | 86.00 | 96.1 | 46.3 |

| SPR | 37.08 | Spirit Aerosystems Holdings, Inc. | Utilities - Renewable | 84.00 | 94.39 | 61.1 |

| AAON | 95.88 | AAON, Inc. | Utilities - Regulated Water | 84.00 | 97.19 | 70.5 |

| NFLX | 711.33 | Netflix, Inc. | Other Precious Metals & Mining | 83.00 | 97.81 | 77.5 |

| DASH | 131.21 | DoorDash, Inc. | Insurance - Specialty | 82.00 | 97.92 | 59.1 |

| TTD | 105.39 | The Trade Desk, Inc. | Utilities - Renewable | 81.00 | 98.61 | 76.1 |

| COLL | 39.58 | Collegium Pharmaceutical, Inc. | Oil & Gas Drilling | 81.00 | 95.48 | 67.9 |

| FIHL | 19.02 | Fidelis Insurance Holdings Limited | Confectioners | 81.00 | 97 | 69.7 |

| FTNT | 76.31 | Fortinet, Inc. | Utilities - Regulated Gas | 81.00 | 99.55 | 65.1 |

| NFBK | 12.94 | Northfield Bancorp, Inc. | Household & Personal Products | 80.00 | 92.35 | 68.8 |

| INNV | 6.61 | InnovAge Holding Corp. | Health Information Services | 80.00 | 94.4 | 63.3 |

| GSHD | 92.50 | Goosehead Insurance, Inc. | Confectioners | 80.00 | 90.17 | 76.3 |

| FRBA | 15.70 | First Bank | Household & Personal Products | 80.00 | 97.64 | 67 |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.