Breakoutwatch Weekly Summary 09/04/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

Stocks end mixed in light pre-holiday trading

The major indexes ended mixed in a week of light trading ahead of the holiday weekend—T. Rowe Price traders observed that fewer shares traded hands Monday than on any other trading day so far this year, excluding early closes. The technology-heavy Nasdaq Composite fared the worst, dragged lower in part by chip giant NVIDIA, which lost nearly 10% of its value, or roughly USD 300 billion, at the stock’s low point on Thursday. Relatedly, value stocks outperformed growth shares by the largest margin since late July. Markets were scheduled to be closed the following Monday in observance of the Labor Day holiday. [more...]

Major Index Performance

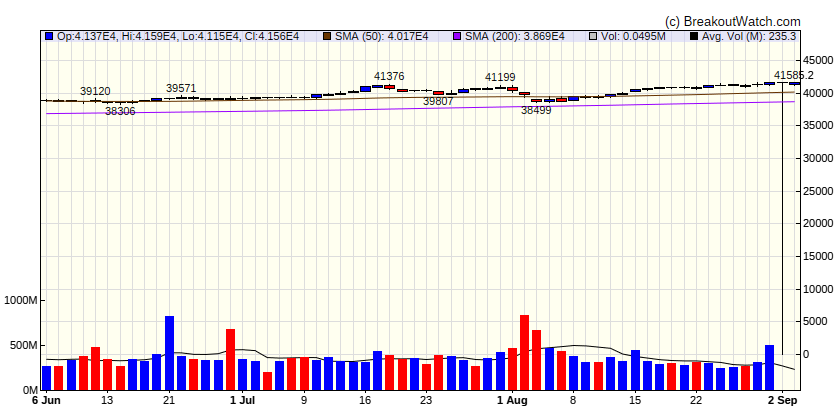

| Dow Jones | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Up |

|

|

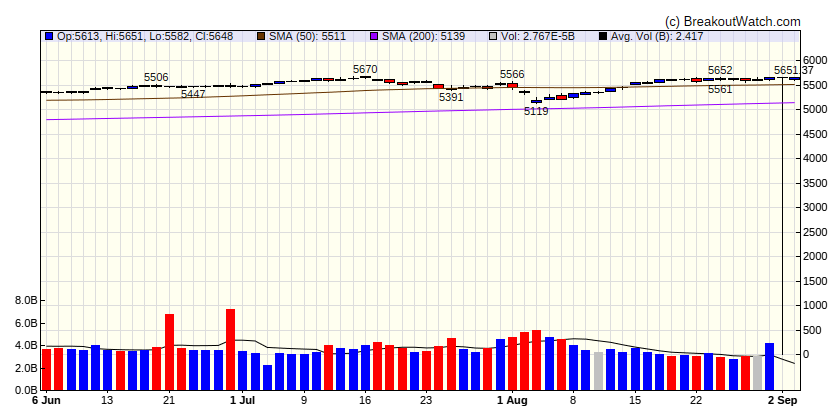

| S&P 500 | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Up |

|

|

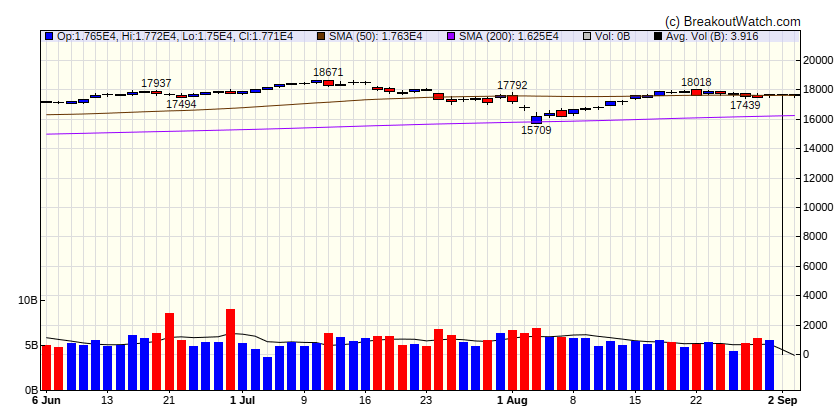

| NASDAQ Comp. | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Up |

|

|

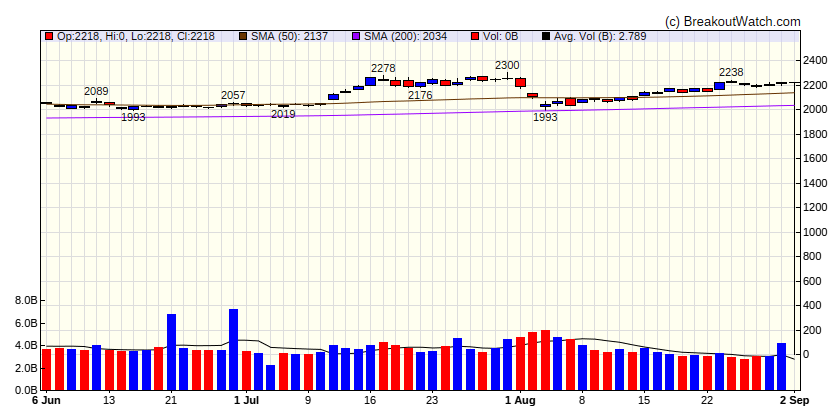

| Russell 2000 | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | -0.6 | 4.13 | Up |

| Consumer Staples | 1.4 | 15.37 | Up |

| Energy | -2.99 | 3.54 | Down |

| Finance | -0.37 | 19.47 | Up |

| Health Care | -0.07 | 14.73 | Up |

| Industrials | -1.93 | 12.41 | Up |

| Technology | -4.46 | 14.54 | Down |

| Materials | -2.53 | 5.81 | Up |

| REIT | 0.74 | 8.29 | Up |

| Telecom | -1.91 | 16.51 | Up |

| Utilities | 1.18 | 21.78 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | VEL | Velocity Financial, Inc. | Farm Products | 70.1 % | 0.5 % |

| SQZ | STOK | Stoke Therapeutics, Inc. | Biotechnology | 58.4 % | 3 % |

| SQZ | REPL | Replimune Group, Inc. | Biotechnology | 46.5 % | 1.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | TPC | Tutor Perini Corporation | Insurance - Diversified | 68.6 % | -0 % |

| SS | PRIM | Primoris Services Corporation | Grocery Stores | 61.2 % | -2.9 % |

| SS | GFF | Griffon Corporation | Computer Hardware | 59.8 % | -3.6 % |

| SS | CRM | Salesforce, Inc. | Utilities - Renewable | 52.8 % | -2 % |

| SS | RSVR | Reservoir Media, Inc. | Other Precious Metals & Mining | 50.7 % | -1.9 % |

| SS | GIII | N/A | Leisure | 46.6 % | -4.4 % |

| SS | SNX | TD SYNNEX Corporation | Household & Personal Products | 44.8 % | -0.3 % |

| SS | OPTN | OptiNose, Inc. | Biotechnology | 40.2 % | -4.7 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| PRAX | 0 | Select Water Solutions, Inc. | Advertising Agencies | 84.00 | 59 | |

| SLNO | 52.38 | Soleno Therapeutics, Inc. | Biotechnology | 98.00 | 95.07 | 54.7 |

| SG | 38.53 | Sweetgreen, Inc. | Residential Construction | 95.00 | 77.47 | 67.6 |

| SLDB | 10.37 | Solid Biosciences Inc. | Biotechnology | 94.00 | 81.97 | 52.3 |

| BDTX | 52.3 | |||||

| SUPV | 7.98 | Grupo Supervielle S.A. Am | Household & Personal Products | 96.00 | 97.74 | 75.9 |

| CRVO | 19.00 | CervoMed Inc. | Biotechnology | 94.00 | 89.16 | 52.5 |

| FLXS | 43.60 | Flexsteel Industries, Inc. | Footwear & Accessories | 92.00 | 91.72 | 75 |

| ACRV | 10.16 | Acrivon Therapeutics, Inc. | Biotechnology | 81.00 | 80.71 | 48.2 |

| DKS | 62 | |||||

| TILE | 19.15 | Interface, Inc. | Beverages - Non-Alcoholic | 90.00 | 95.2 | 70.8 |

| BBAR | 77.7 | |||||

| FRPT | 68.9 | |||||

| NGS | 22.83 | Natural Gas Services Group, Inc. | Luxury Goods | 85.00 | 89.05 | 71.7 |

| NVEI | 33.33 | Nuvei Corporation | Utilities - Regulated Gas | 88.00 | 99.7 | 59.3 |

| QNST | 62.7 | |||||

| RXST | 58.23 | RxSight, Inc. | Drug Manufacturers - General | 85.00 | 92.53 | 65.7 |

| SKYH | 12.54 | Sky Harbour Group Corporation Class A | Apparel Retail | 92.00 | 92.42 | 72.7 |

| STRW | 12.44 | Strawberry Fields REIT, Inc. | Oil & Gas Refining & Marketing | 89.00 | 93.65 | 74.7 |

| ITOS | 18.13 | iTeos Therapeutics, Inc. | Biotechnology | 85.00 | 89.63 | 56.4 |

| OSPN | 16.41 | OneSpan Inc. | Utilities - Regulated Gas | 89.00 | 93.48 | 67.6 |

| VCTR | 55.16 | Victory Capital Holdings, Inc. | Packaged Foods | 87.00 | 95.5 | 77.3 |

| WIX | 175.75 | Wix.com Ltd. | Utilities - Regulated Gas | 82.00 | 89.97 | 65.5 |

| FNKO | 10.73 | Funko, Inc. | Lodging | 88.00 | 95.34 | 60.2 |

| EML | 31.22 | Eastern Company (The) | Packaged Foods | 88.00 | 96.16 | 66.7 |

| MTZ | 57.4 | |||||

| NUVL | 87.70 | Nuvalent, Inc. | Biotechnology | 86.00 | 96.44 | 44.6 |

| ACLX | 74.10 | Arcellx, Inc. | Biotechnology | 86.00 | 88.34 | 57.9 |

| NFLX | 711.33 | Netflix, Inc. | Other Precious Metals & Mining | 84.00 | 95.55 | 76.4 |

| IOT | 65.2 | |||||

| COLL | 39.58 | Collegium Pharmaceutical, Inc. | Oil & Gas Drilling | 87.00 | 96.61 | 69 |

| SPR | 56.4 | |||||

| IP | 49.24 | International Paper Company | Biotechnology | 80.00 | 96.08 | 61.2 |

| FIHL | 19.02 | Fidelis Insurance Holdings Limited | Confectioners | 81.00 | 96.21 | 66.1 |

| ASA | 35 | |||||

| CVEO | 28.66 | Civeo Corporation (Canada) | Software - Infrastructure | 84.00 | 97.49 | 74.4 |

| TTD | 105.39 | The Trade Desk, Inc. | Utilities - Renewable | 81.00 | 96.17 | 75.1 |

| TNGX | 12.02 | Tango Therapeutics, Inc. | Biotechnology | 90.00 | 90.18 | 58.3 |

| STGW | 50 | |||||

| CRH | 91.02 | CRH PLC Ordinary Shares | Telecom Services | 80.00 | 93.58 | 54.5 |

| AAON | 69.9 | |||||

| BHRB | 70.00 | Burke & Herbert Financial Services Corp. | Household & Personal Products | 85.00 | 92.23 | 62.4 |

| NR | 62.3 | |||||

| PANW | 375.37 | Palo Alto Networks, Inc. | Utilities - Regulated Gas | 82.00 | 92.22 | 67.8 |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.