Breakoutwatch Weekly Summary 09/11/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

Slowdown worries weigh on stocks

The S&P 500 Index suffered its worst weekly drop in 18 months, as worries over an economic slowdown appeared to weigh on sentiment. Information technology shares led the declines, driven in part by a drop in NVIDIA following rumors that it may be the subject of a Justice Department antitrust investigation, which led to a roughly USD 300 billion drop in the chip giant’s market capitalization. Energy shares were also especially weak on the back of a decline in oil prices. Conversely, the typically defensive utilities, consumer staples, and real estate sectors held up better. [more...]

Major Index Performance

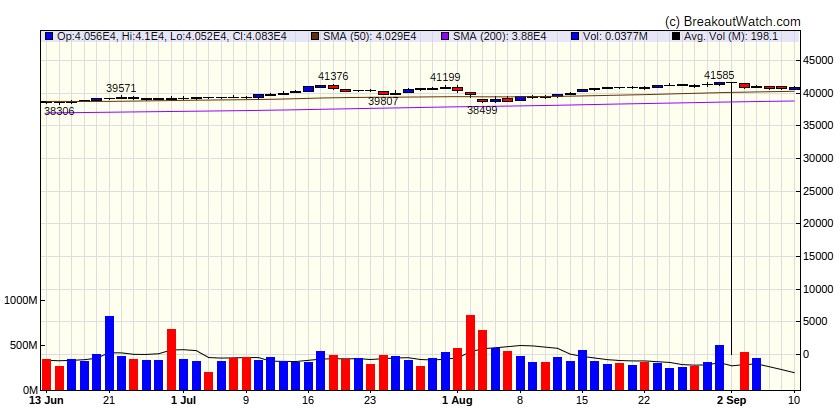

| Dow Jones | |

|---|---|

| Last Close | 40829.6 |

| Wk. Gain | -0.55 % |

| Yr. Gain | 8.69 % |

| Trend | Down |

|

|

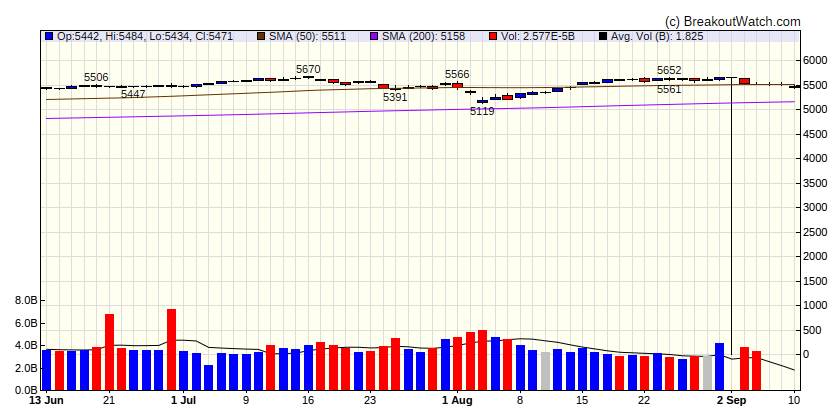

| S&P 500 | |

|---|---|

| Last Close | 5471.05 |

| Wk. Gain | -0.89 % |

| Yr. Gain | 15.3 % |

| Trend | Down |

|

|

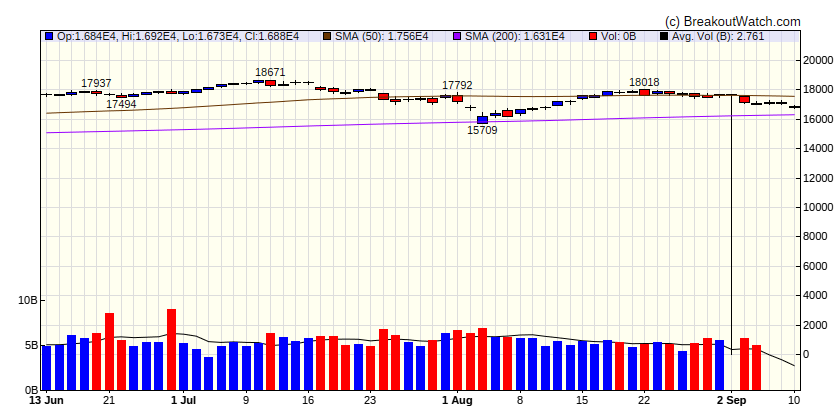

| NASDAQ Comp. | |

|---|---|

| Last Close | 16884.6 |

| Wk. Gain | -1.05 % |

| Yr. Gain | 13.52 % |

| Trend | Down |

|

|

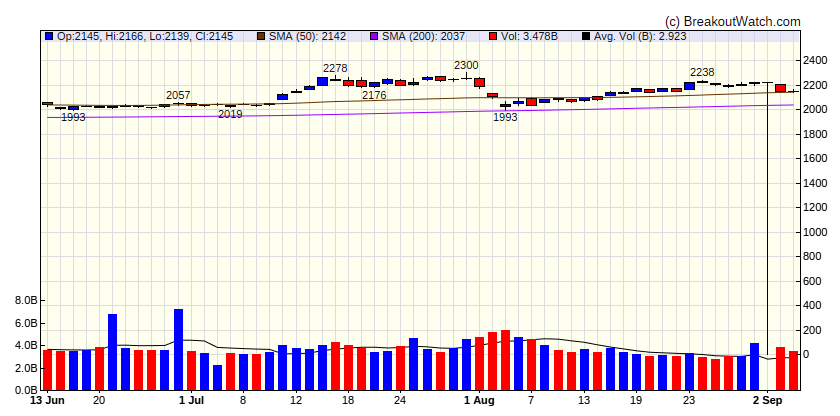

| Russell 2000 | |

|---|---|

| Last Close | 16884.6 |

| Wk. Gain | 13.52 % |

| Yr. Gain | 738.78 % |

| Trend | Down |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 0.15 | 4.91 | Up |

| Consumer Staples | -0.26 | 15.21 | Up |

| Energy | -3.92 | 0.24 | Down |

| Finance | -2.67 | 16.92 | Up |

| Health Care | -0.67 | 13.94 | Up |

| Industrials | -0.61 | 11.57 | Down |

| Technology | 0.33 | 14.19 | Down |

| Materials | -1.23 | 4.7 | Down |

| REIT | 1.48 | 10.62 | Up |

| Telecom | -1.47 | 14.84 | Down |

| Utilities | -0.53 | 22.07 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | VEL | Velocity Financial, Inc. | Farm Products | 71.5 % | 1.3 % |

| SQZ | PI | Impinj, Inc. | Utilities - Regulated Water | 70.8 % | 4 % |

| SQZ | NOW | ServiceNow, Inc. | Utilities - Renewable | 70.7 % | 0.5 % |

| SQZ | TYL | Tyler Technologies, Inc. | Utilities - Renewable | 67.4 % | 2.5 % |

| SQZ | FFIN | First Financial Bankshares, Inc. | Household & Personal Products | 63.7 % | 1 % |

| CWH | TAC | TransAlta Corporation Ord | Aerospace & Defense | 61.3 % | 0.6 % |

| SQZ | GDYN | Grid Dynamics Holdings, Inc. | Utilities - Regulated Electric | 59.3 % | 2.5 % |

| CWH | ACLX | Arcellx, Inc. | Biotechnology | 58.7 % | 0.1 % |

| SQZ | WKME | WalkMe Ltd. | Utilities - Renewable | 56.1 % | 0.1 % |

| SQZ | ANNX | Annexon, Inc. | Biotechnology | 54.9 % | 0.3 % |

| SQZ | LMB | Limbach Holdings, Inc. | Other Precious Metals & Mining | 54.6 % | 3.3 % |

| DB | DHR | Danaher Corporation | Packaged Foods | 51.5 % | 0.4 % |

| CWH | DNLI | Denali Therapeutics Inc. | Biotechnology | 49.1 % | 1.7 % |

| SQZ | LRMR | Larimar Therapeutics, Inc. | Biotechnology | 39.9 % | 1.4 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | AX | Axos Financial, Inc. | Household & Personal Products | 69.8 % | -4.5 % |

| SS | TPC | Tutor Perini Corporation | Insurance - Diversified | 69.1 % | -0.9 % |

| SS | FCNCA | First Citizens BancShares, Inc. | Household & Personal Products | 64 % | -4.4 % |

| SS | RSVR | Reservoir Media, Inc. | Other Precious Metals & Mining | 49.6 % | -1.6 % |

| SS | SNX | TD SYNNEX Corporation | Household & Personal Products | 41 % | -4.8 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| PRAX | 0 | Veritone, Inc. | Utilities - Regulated Gas | 86.00 | 60.9 | |

| ACLX | 58.7 | |||||

| APGE | 51.67 | Apogee Therapeutics, Inc. | Biotechnology | 90.00 | 95.82 | 44.4 |

| SG | 38.53 | Sweetgreen, Inc. | Residential Construction | 95.00 | 78.74 | 69.2 |

| APP | 93.70 | Applovin Corporation | Utilities - Renewable | 94.00 | 92.03 | 78.6 |

| REPL | 11.32 | Replimune Group, Inc. | Biotechnology | 84.00 | 91.34 | 50.6 |

| OSPN | 16.41 | OneSpan Inc. | Utilities - Regulated Gas | 86.00 | 89.64 | 66.5 |

| FLXS | 73.5 | |||||

| SLDB | 47.1 | |||||

| TNGX | 36 | |||||

| AFRM | 60 | |||||

| CLDX | 51 | |||||

| BHRB | 70.00 | Burke & Herbert Financial Services Corp. | Household & Personal Products | 88.00 | 92.14 | 60.2 |

| TILE | 19.15 | Interface, Inc. | Beverages - Non-Alcoholic | 88.00 | 92.9 | 70.1 |

| FIHL | 19.02 | Fidelis Insurance Holdings Limited | Confectioners | 81.00 | 95.01 | 64.5 |

| FNKO | 10.73 | Funko, Inc. | Lodging | 89.00 | 95.71 | 58.7 |

| FTNT | 78.08 | Fortinet, Inc. | Utilities - Regulated Gas | 88.00 | 97.43 | 66.1 |

| AAON | 96.55 | AAON, Inc. | Utilities - Regulated Water | 85.00 | 91.41 | 69.7 |

| NVEI | 33.33 | Nuvei Corporation | Utilities - Regulated Gas | 85.00 | 99.73 | 58.7 |

| NSA | 60.4 | |||||

| STRW | 66.3 | |||||

| VCTR | 55.16 | Victory Capital Holdings, Inc. | Packaged Foods | 86.00 | 93.11 | 75.4 |

| CCOI | 76.42 | Cogent Communications Holdings, Inc. | Specialty Chemicals | 84.00 | 94.01 | 69.3 |

| SUPN | 35.41 | Supernus Pharmaceuticals, Inc. | Drug Manufacturers - Specialty & Generic | 84.00 | 94.58 | 62.2 |

| INTA | 46.58 | Intapp, Inc. | Utilities - Renewable | 86.00 | 94.95 | 69.6 |

| FIX | 359.34 | Comfort Systems USA, Inc. | Utilities - Regulated Gas | 80.00 | 88.28 | 71.9 |

| DSGR | 59.2 | |||||

| WNEB | 8.99 | Western New England Bancorp, Inc. | Household & Personal Products | 81.00 | 95.66 | 49.3 |

| TTD | 76 | |||||

| ZYME | 59.9 | |||||

| FRBA | 15.70 | First Bank | Household & Personal Products | 81.00 | 94.78 | 65.2 |

| DNB | 12.75 | Dun & Bradstreet Holdings, Inc. | Biotechnology | 82.00 | 92.71 | 55.2 |

| CRH | 52.9 | |||||

| AAPL | 65.9 | |||||

| IP | 62.4 | |||||

| EME | 393.35 | EMCOR Group, Inc. | Packaged Foods | 83.00 | 94.38 | 73.2 |

| MSGE | 63.8 | |||||

| LIND | 54.1 | |||||

| TMP | 58.3 | |||||

| VFC | 19.03 | V.F. Corporation | Leisure | 81.00 | 92.59 | 52.9 |

| BIPC | 41.58 | Brookfield Infrastructure | Engineering & Construction | 83.00 | 96.9 | 65.9 |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.