Breakoutwatch Weekly Summary 09/18/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

Stocks rebound after sell-off

Stocks managed to post solid gains and largely recovered from the previous week’s steep losses, which saw the S&P 500 Index suffer its worst weekly decline since March 2023. Growth stocks outpaced value shares by a wide margin, helped by strong performance from technology stocks. NVIDIA was a particularly strong contributor after the chip giant offered a positive outlook on artificial intelligence at an investment conference. T. Rowe Price traders noted that it was a busy week for conferences in general, which seemed to drive sentiment. [more...]

Major Index Performance

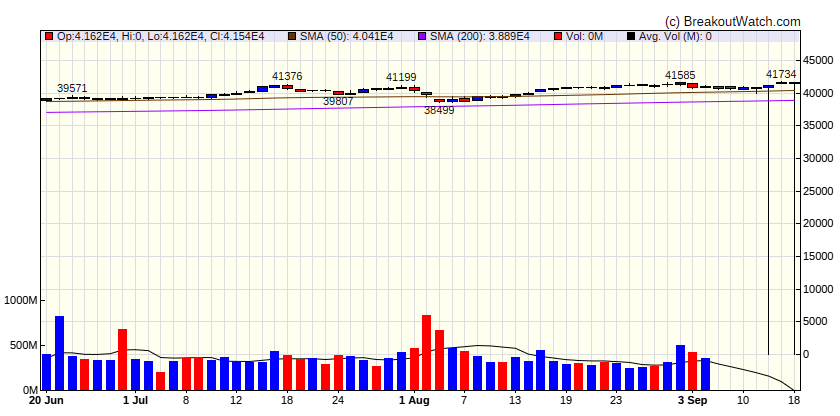

| Dow Jones | |

|---|---|

| Last Close | 41540.9 |

| Wk. Gain | INF % |

| Yr. Gain | 10.58 % |

| Trend | Up |

|

|

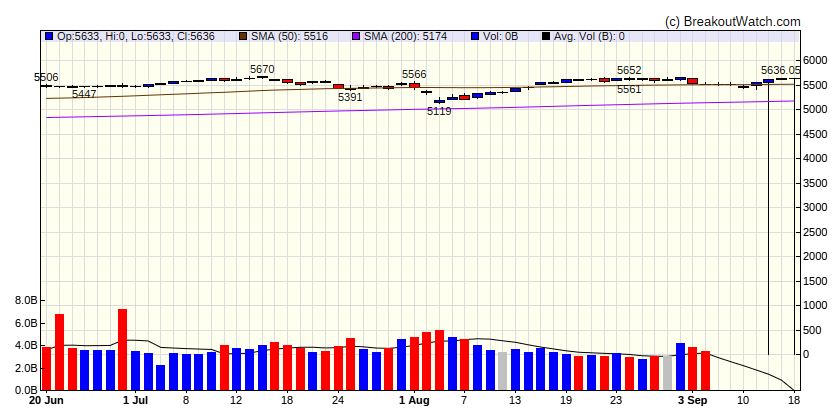

| S&P 500 | |

|---|---|

| Last Close | 5636.09 |

| Wk. Gain | INF % |

| Yr. Gain | 18.78 % |

| Trend | Up |

|

|

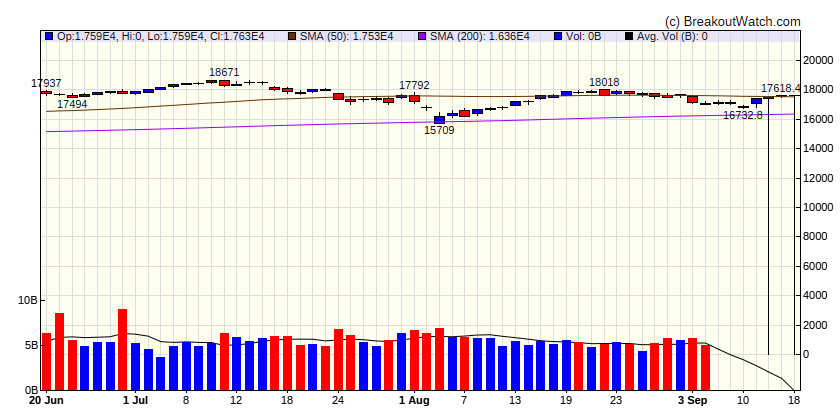

| NASDAQ Comp. | |

|---|---|

| Last Close | 17628.1 |

| Wk. Gain | INF % |

| Yr. Gain | 18.52 % |

| Trend | Up |

|

|

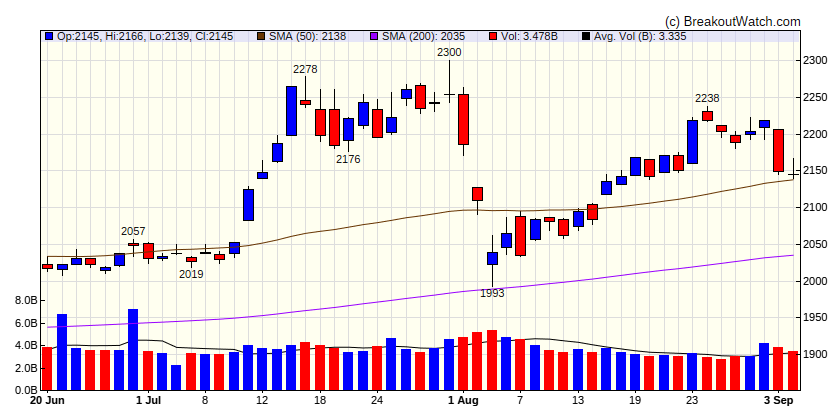

| Russell 2000 | |

|---|---|

| Last Close | 17628.1 |

| Wk. Gain | 18.52 % |

| Yr. Gain | 775.71 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 1.06 | 8.76 | Up |

| Consumer Staples | -0.25 | 15.02 | Up |

| Energy | 3.09 | 4.07 | Down |

| Finance | 1.91 | 19.64 | Up |

| Health Care | -0.21 | 14.07 | Up |

| Industrials | 1.79 | 15.69 | Up |

| Technology | -0.73 | 17.78 | Down |

| Materials | 1.65 | 8.37 | Up |

| REIT | -0.09 | 11.48 | Up |

| Telecom | 2.3 | 20.36 | Up |

| Utilities | 1.02 | 24.38 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | GSHD | Goosehead Insurance, Inc. | Confectioners | 79.1 % | 2.7 % |

| SQZ | PIPR | Piper Sandler Companies | Capital Markets | 78.7 % | 1.4 % |

| SQZ | RCL | Royal Caribbean Cruises Ltd. | Textile Manufacturing | 78.3 % | 1.8 % |

| SQZ | SPOT | Spotify Technology S.A. O | Medical Care Facilities | 78.3 % | 1.9 % |

| DB | PJT | PJT Partners Inc. | Beverages - Non-Alcoholic | 77.3 % | 1.8 % |

| SQZ | EVR | Evercore Inc. | Capital Markets | 75.3 % | 0.1 % |

| SQZ | LPX | Louisian | Biotechnology | 74.1 % | 3.7 % |

| SQZ | IBCP | Independent Bank Corporation | Banks - Regional | 72.9 % | 0.7 % |

| SQZ | KEX | Kirby Corporation | Marine Shipping | 72.2 % | 2.3 % |

| SQZ | LQDT | Liquidity Services, Inc. | Personal Services | 71.1 % | 2.6 % |

| SQZ | CBAN | Colony Bankcorp, Inc. | Household & Personal Products | 70.4 % | 0.8 % |

| SQZ | ESQ | Esquire Financial Holdings, Inc. | Banks - Regional | 69.9 % | 1.9 % |

| SQZ | PETQ | PetIQ, Inc. | Drug Manufacturers - Specialty & Generic | 69.2 % | 0.1 % |

| SQZ | LNTH | Lantheus Holdings, Inc. | Drug Manufacturers - Specialty & Generic | 68.7 % | 2.5 % |

| SQZ | LINC | Linco | Advertising Agencies | 68.2 % | 0.8 % |

| SQZ | PLNT | Planet Fitness, Inc. | Lodging | 67.6 % | 2.7 % |

| SQZ | LII | Lennox International, Inc. | Biotechnology | 67.4 % | 1.9 % |

| SQZ | SYBT | Stock Yards Bancorp, Inc. | Household & Personal Products | 67 % | 4.4 % |

| SQZ | TSLA | Tesla, Inc. | Auto Parts | 67 % | 0.5 % |

| SQZ | FFIN | First Financial Bankshares, Inc. | Household & Personal Products | 66.9 % | 2.9 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | NN | NextNav Inc. | Utilities - Regulated Gas | 59.5 % | -2.7 % |

| SS | CGEM | Cullinan Therapeutics, Inc. | Biotechnology | 50.6 % | -3.5 % |

| SS | WOW | WideOpenWest, Inc. | Specialty Chemicals | 49.2 % | -2.2 % |

| SS | BCAB | BioAtla, Inc. | Biotechnology | 33 % | -1.8 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.