Breakoutwatch Weekly Summary 09/26/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Market Summary

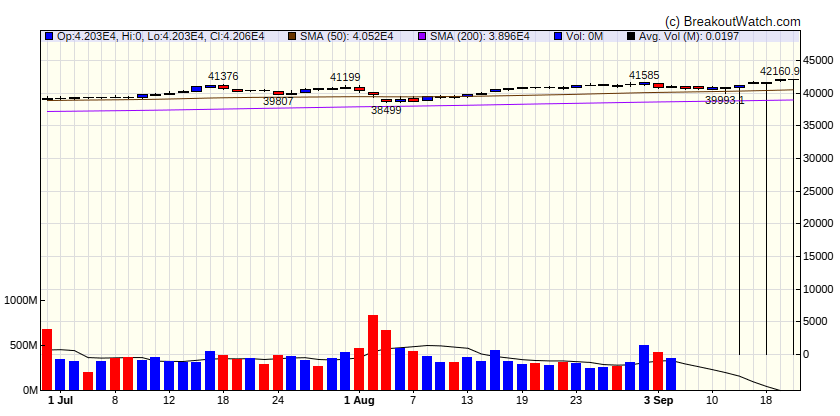

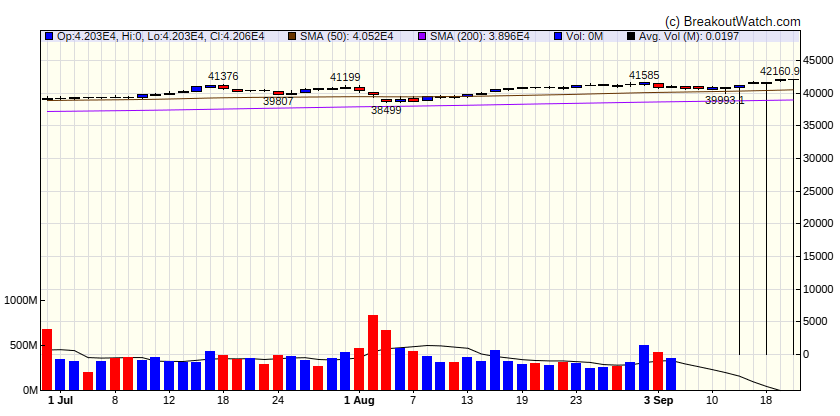

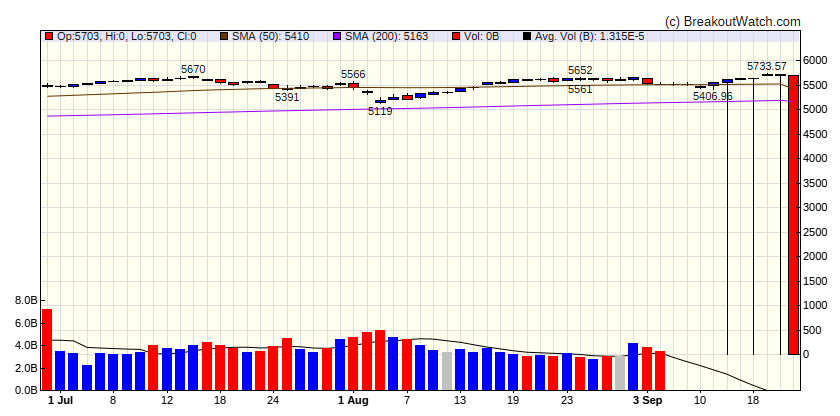

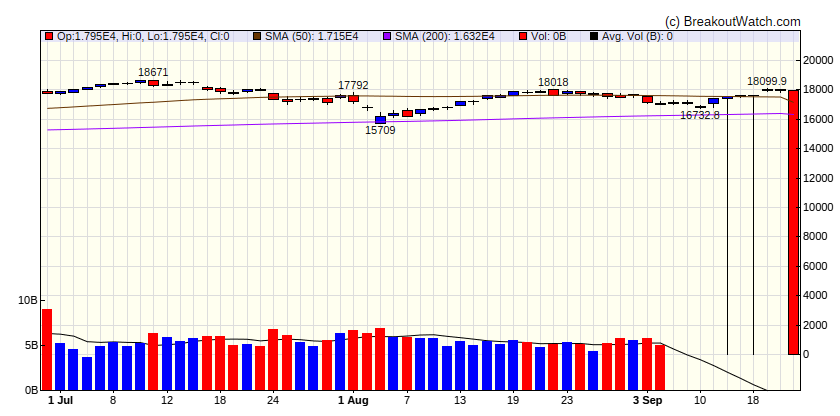

Stocks move to new highs as investors celebrate Fed rate cut

The large-cap indexes moved to record highs as investors celebrated the kickoff to what many expect to be a prolonged Federal Reserve rate-cutting cycle. The rally was also relatively broad, with the smaller-cap indexes outperforming, although they remained below previous peaks—the small-cap Russell 2000 Index, in particular, ended the week roughly 9% below the all-time high it established in November 2021. [more...]

Major Index Performance

| Dow Jones

|

| Last Close

| |

| Wk. Gain

| NAN % |

| Yr. Gain

| -100 % |

| Trend

| Up |

|

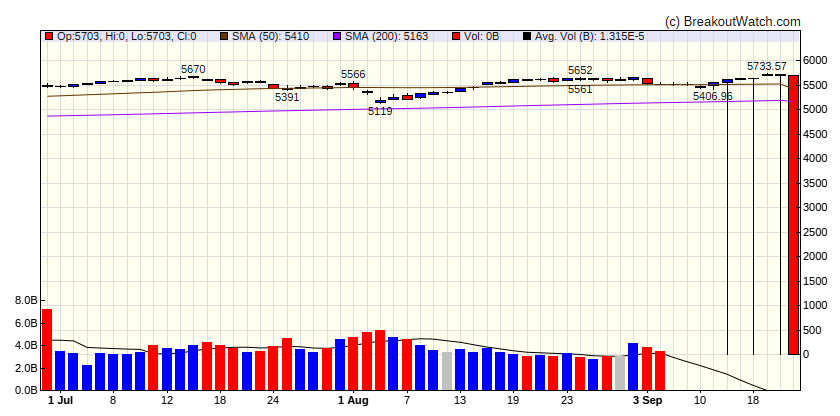

| S&P 500

|

| Last Close

| |

| Wk. Gain

| NAN % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

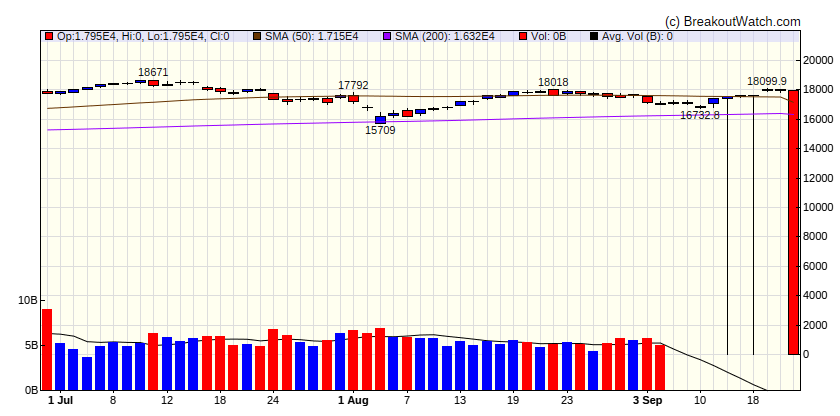

| NASDAQ Comp.

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

| Russell 2000

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Up |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

1.2 |

12.21 |

Up |

| Consumer Staples |

0.63 |

15.12 |

Up |

| Energy |

-0.86 |

4.09 |

Up |

| Finance |

-1.56 |

18.94 |

Up |

| Health Care |

-1.79 |

12.37 |

Down |

| Industrials |

0.63 |

17.82 |

Up |

| Technology |

0.81 |

21.97 |

Up |

| Materials |

0.76 |

11.03 |

Up |

| REIT |

0.64 |

11.58 |

Up |

| Telecom |

0.47 |

23.11 |

Up |

| Utilities |

2.01 |

27.63 |

Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| SQZ |

GSHD |

Goosehead Insurance, Inc. |

Confectioners |

78.3 % |

1.8 % |

| CWH |

IBKR |

Interactive Brokers Group, Inc. |

Capital Markets |

74.1 % |

2.1 % |

| SQZ |

ESQ |

Esquire Financial Holdings, Inc. |

Banks - Regional |

70.8 % |

0.3 % |

| SQZ |

EXLS |

ExlService Holdings, Inc. |

Utilities - Regulated Electric |

67.1 % |

0.5 % |

| SQZ |

CINT |

CI&T Inc |

Utilities - Regulated Gas |

66.9 % |

2.6 % |

| CWH |

PRTH |

Priority Technology Holdings, Inc. |

Utilities - Regulated Gas |

66.4 % |

0.7 % |

| SQZ |

TNDM |

Tandem Diabetes Care, Inc. |

Medical Devices |

64.5 % |

0.4 % |

| SQZ |

RNA |

Avidity Biosciences, Inc. |

Biotechnology |

54.2 % |

2.9 % |

| SQZ |

ELVN |

Enliven Therapeutics, Inc. |

Biotechnology |

49.2 % |

5 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

NGS |

Natural Gas Services Group, Inc. |

Oil & Gas Equipment & Services |

66.2 % |

-3.9 % |

| SS |

PRK |

Park National Corporation |

Banks - Regional |

66.1 % |

-2.2 % |

| SS |

RXST |

RxSight, Inc. |

Medical Devices |

64.2 % |

-3.7 % |

| SS |

ALKT |

Alkami Technology, Inc. |

Software - Application |

64 % |

-4 % |

| SS |

GERN |

Geron Corporation |

Biotechnology |

61.2 % |

-1.1 % |

| SS |

MBWM |

Mercantile Bank Corporation |

Banks - Regional |

58.9 % |

-5 % |

| SS |

BARK |

BARK, Inc. |

Footwear & Accessories |

58.2 % |

-0.6 % |

| SS |

QCOM |

QUALCOMM Inco |

Semiconductors |

58.2 % |

-2.8 % |

| SS |

TRTX |

TPG RE Finance Trust, Inc. |

REIT - Mortgage |

51.6 % |

-2.2 % |

| SS |

FSTR |

L.B. Foster Company |

Railroads |

43.1 % |

-4.1 % |

| SS |

DIBS |

1stdibs.com, Inc. |

Internet Retail |

42.7 % |

-0.7 % |

| SS |

VSTM |

Verastem, Inc. |

Biotechnology |

41.2 % |

-2.6 % |

| SS |

OLMA |

Olema Pharmaceuticals, Inc. |

Biotechnology |

38.2 % |

-4.9 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

| There were no CWH stocks meeting our breakout model criteria |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.