Breakoutwatch Weekly Summary 10/01/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

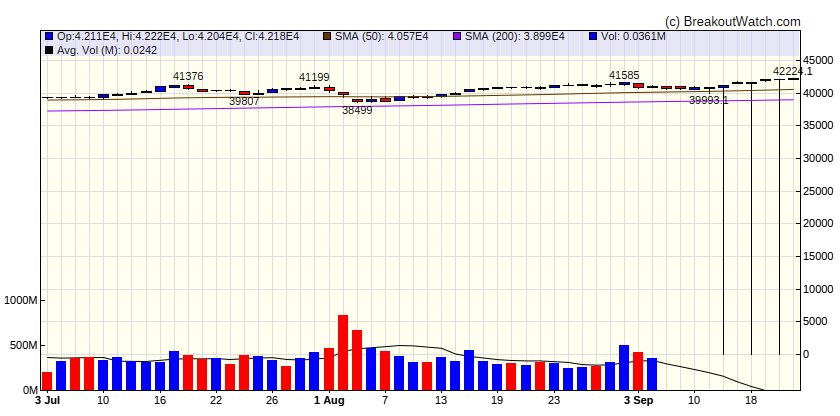

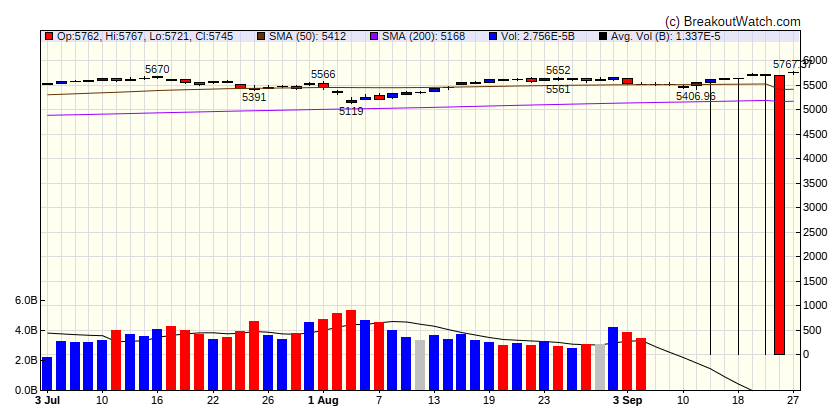

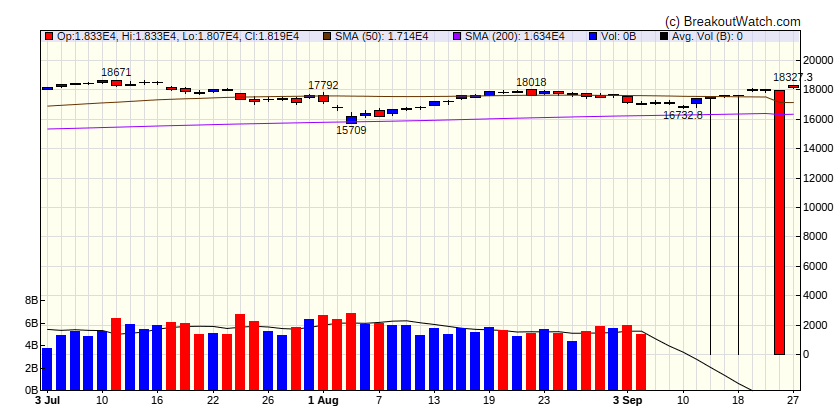

Stocks reach record highs on China and AI hopes

The Dow Jones Industrial Average and the S&P 500 Index moved to record highs, as investors appeared to celebrate new stimulus measures in China (see below). Chemicals and materials stocks were particularly strong on hopes for a rebound in Chinese demand. Copper prices also increased, raising hopes that “Doctor Copper” was again reflecting a healthier global industrial economy. Technology stocks outperformed as well, helped by reports of a possible takeover of Intel and news that NVIDIA’s CEO had ceased sales of his own shares in the company. In addition, chipmaker Micron Technology surged and seemed to provide a general tailwind for the sector following its upbeat outlook for artificial intelligence demand. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Up |

|

|

| S&P 500 | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Down |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Down |

|

|

| Russell 2000 | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | -0.19 | 12.33 | Up |

| Consumer Staples | -0.71 | 14.8 | Down |

| Energy | -2.09 | 3.82 | Up |

| Finance | 0.01 | 19.79 | Up |

| Health Care | -0.69 | 13.02 | Down |

| Industrials | 0.16 | 18.82 | Up |

| Technology | 1 | 22.7 | Up |

| Materials | 0.1 | 12.03 | Up |

| REIT | -1.6 | 10.64 | Up |

| Telecom | 0.81 | 24.33 | Up |

| Utilities | 0.01 | 27.65 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | GSHD | Goosehead Insurance, Inc. | Confectioners | 78.3 % | 1.4 % |

| CWH | ESQ | Esquire Financial Holdings, Inc. | Household & Personal Products | 71.3 % | 0.4 % |

| SQZ | OFG | OFG Bancorp | Household & Personal Products | 70.9 % | 1.1 % |

| SQZ | MTG | MGIC Investment Corporation | Discount Stores | 69.6 % | 0.9 % |

| SQZ | EXLS | ExlService Holdings, Inc. | Utilities - Regulated Electric | 67.7 % | 3.2 % |

| SQZ | QNST | QuinStreet, Inc. | Gold | 65.5 % | 2.6 % |

| CWH | ZBRA | Zebra Technologies Corporation | Utilities - Regulated Water | 64.6 % | 0.7 % |

| SQZ | OPBK | OP Bancorp | Household & Personal Products | 64.5 % | 0.8 % |

| SQZ | ORRF | Orrstown Financial Services Inc | Household & Personal Products | 63.7 % | 0.6 % |

| SQZ | MGNI | Magnite, Inc. | Gold | 62.9 % | 0.9 % |

| SQZ | STBA | S&T Bancorp, Inc. | Household & Personal Products | 62.9 % | 2 % |

| SQZ | RCKY | Rocky Brands, Inc. | Biotechnology | 61.4 % | 0.2 % |

| SQZ | HRB | H&R Block, Inc. | Apparel Manufacturing | 61 % | 0.2 % |

| SQZ | EFSC | Enterprise Financial Services Corporation | Household & Personal Products | 58.9 % | 1.6 % |

| SQZ | BLFS | BioLife Solutions, Inc. | Packaged Foods | 57.8 % | 2.8 % |

| SQZ | SERA | Sera Prognostics, Inc. | Drug Manufacturers - General | 54.5 % | 1.4 % |

| SQZ | CRNX | Crinetics Pharmaceuticals, Inc. | Biotechnology | 47.2 % | 1 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | PRK | Park National Corporation | Household & Personal Products | 65.9 % | -0.8 % |

| SS | RXST | RxSight, Inc. | Drug Manufacturers - General | 62.5 % | -2.8 % |

| SS | ABL | Abacus Life, Inc. | Grocery Stores | 58.1 % | -0.1 % |

| SS | EUDA | Euda Health Holdings Limited | Medical Care Facilities | 53.9 % | -3.7 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| LUMN | 7.58 | Lumen Technologies, Inc. | Specialty Chemicals | 99.00 | 93.67 | 59.5 |

| NYCB | 12.42 | New York Community Bancorp, Inc. | Household & Personal Products | 97.00 | 90.42 | 60.2 |

| VKTX | 72.36 | Viking Therapeutics, Inc. | Biotechnology | 97.00 | 87.49 | 51.4 |

| TPC | 74.3 | |||||

| VERA | 47.30 | Vera Therapeutics, Inc. | Biotechnology | 95.00 | 93.45 | 54.9 |

| APGE | 60.82 | Apogee Therapeutics, Inc. | Biotechnology | 94.00 | 96.58 | 48.1 |

| BBAR | 12.40 | Banco BBVA Argentina S.A. | Household & Personal Products | 92.00 | 83.63 | 77.5 |

| MHO | 173.69 | M/I Homes, Inc. | Apparel Retail | 90.00 | 98.66 | 71.8 |

| MHK | 65.2 | |||||

| MAX | 18.51 | MediaAlpha, Inc. | Packaged Foods | 91.00 | 97.84 | 72.1 |

| KKR | 134.85 | KKR & Co. Inc. | Packaged Foods | 91.00 | 96.83 | 76.6 |

| ZYME | 13.27 | Zymeworks Inc. | Biotechnology | 90.00 | 94.57 | 60.1 |

| HMST | 16.10 | HomeStreet, Inc. | Household & Personal Products | 91.00 | 97.89 | 57.3 |

| EVR | 259.70 | Evercore Inc. | Beverages - Non-Alcoholic | 89.00 | 97.55 | 76.2 |

| TBBK | 54.97 | The Bancorp, Inc. | Household & Personal Products | 91.00 | 97.33 | 72.9 |

| TARS | 34.99 | Tarsus Pharmaceuticals, Inc. | Biotechnology | 87.00 | 94 | 67.6 |

| PRIM | 60.27 | Primoris Services Corporation | Grocery Stores | 90.00 | 96.37 | 67.5 |

| SLNO | 55.56 | Soleno Therapeutics, Inc. | Biotechnology | 85.00 | 90.87 | 55.1 |

| SKYH | 13.25 | Sky Harbour Group Corporation Class A | Apparel Retail | 87.00 | 83.32 | 54.2 |

| BLBD | 55.60 | Blue Bird Corporation | Auto Parts | 89.00 | 86.26 | 71 |

| QNST | 20.91 | QuinStreet, Inc. | Gold | 89.00 | 91.49 | 65.5 |

| WING | 433.86 | Wingstop Inc. | Residential Construction | 89.00 | 95.9 | 74.9 |

| BSRR | 31.83 | Sierra Bancorp | Household & Personal Products | 87.00 | 90.73 | 59.6 |

| CHWY | 33.18 | Chewy, Inc. | Personal Services | 87.00 | 88.28 | 67.3 |

| RYTM | 55.64 | Rhythm Pharmaceuticals, Inc. | Biotechnology | 90.00 | 94.16 | 64.1 |

| FISI | 27.00 | Financial Institutions, Inc. | Household & Personal Products | 86.00 | 94.33 | 62.3 |

| OSPN | 67.7 | |||||

| EXP | 293.00 | Eagle Materials Inc | Telecom Services | 87.00 | 98.17 | 70.4 |

| ESQ | 71.3 | |||||

| DASH | 146.36 | DoorDash, Inc. | Insurance - Specialty | 88.00 | 97.52 | 59.9 |

| RBB | 24.00 | RBB Bancorp | Household & Personal Products | 86.00 | 95.92 | 58 |

| PEGA | 74.40 | Pegasystems Inc. | Utilities - Renewable | 86.00 | 98.24 | 74.9 |

| ATGE | 77.83 | Adtalem Global Education Inc. | Specialty Chemicals | 86.00 | 96.98 | 68.8 |

| AFRM | 47.98 | Affirm Holdings, Inc. | Utilities - Regulated Gas | 84.00 | 85.08 | 65.3 |

| PRK | 181.42 | Park National Corporation | Household & Personal Products | 85.00 | 92.59 | 65.9 |

| TMHC | 71.95 | Taylor Morrison Home Corporation | Apparel Retail | 85.00 | 97.65 | 60.8 |

| NVEI | 33.48 | Nuvei Corporation | Utilities - Regulated Gas | 85.00 | 99.61 | 61.9 |

| CALM | 75.64 | Cal-Maine Foods, Inc. | Credit Services | 84.00 | 98.94 | 62.7 |

| CBAN | 15.96 | Colony Bankcorp, Inc. | Household & Personal Products | 85.00 | 97.24 | 65.6 |

| MTH | 213.98 | Meritage Homes Corporation | Apparel Retail | 84.00 | 95.84 | 67.7 |

| ABCB | 65.40 | Ameris Bancorp | Household & Personal Products | 85.00 | 95.4 | 62.3 |

| FITB | 43.85 | Fifth Third Bancorp | Household & Personal Products | 82.00 | 97.7 | 60.2 |

| ITRI | 108.51 | Itron, Inc. | Biotechnology | 83.00 | 98.43 | 70.3 |

| COOP | 96.00 | Mr. Cooper Group Inc. | Farm Products | 84.00 | 96.02 | 75.2 |

| WEAV | 61.8 | |||||

| MC | 71.34 | Moelis & Company Class A | Beverages - Non-Alcoholic | 81.00 | 96.03 | 70.6 |

| CVCO | 444.90 | Cavco Industries, Inc. | Apparel Retail | 82.00 | 96.26 | 63.9 |

| EQBK | 42.64 | Equity Bancshares, Inc. | Household & Personal Products | 82.00 | 95.87 | 60.4 |

| RH | 60.7 | |||||

| DFH | 39.15 | Dream Finders Homes, Inc. | Apparel Retail | 80.00 | 92.49 | 69.4 |

| FTNT | 78.18 | Fortinet, Inc. | Utilities - Regulated Gas | 81.00 | 99.19 | 65.8 |

| CNO | 35.63 | CNO Financial Group, Inc. | Grocery Stores | 84.00 | 98.51 | 68 |

| FFIN | 39.21 | First Financial Bankshares, Inc. | Household & Personal Products | 81.00 | 94.39 | 64.4 |

| RYAN | 68.47 | Ryan Specialty Holdings, Inc. | Discount Stores | 82.00 | 96.96 | 67.1 |

| MCB | 54.86 | Metropolitan Bank Holding Corp. | Household & Personal Products | 80.00 | 95.84 | 72.1 |

| VFC | 53.9 | |||||

| BWB | 61.3 | |||||

| SSB | 102.82 | SouthState Corporation | Household & Personal Products | 80.00 | 94.51 | 61.3 |

| VBTX | 26.72 | Veritex Holdings, Inc. | Household & Personal Products | 81.00 | 98.5 | 57.9 |

| ARGX | 554.74 | argenx SE | Biotechnology | 82.00 | 97.72 | 56.8 |

| MTB | 180.64 | M&T Bank Corporation | Household & Personal Products | 80.00 | 98.6 | 58.1 |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.