Breakoutwatch Weekly Summary 10/14/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

Stocks reach new highs as earnings season kicks off

The S&P 500 Index, Dow Jones Industrial Average, and S&P MidCap 400 Index all moved to record highs over the week, helped by some upside surprises to kick off earnings season. Shares in JPMorgan Chase and Wells Fargo rose on Friday after the banking giants reported smaller-than-feared declines in third-quarter profits, while the former managed a small increase in revenues. [more...]

Major Index Performance

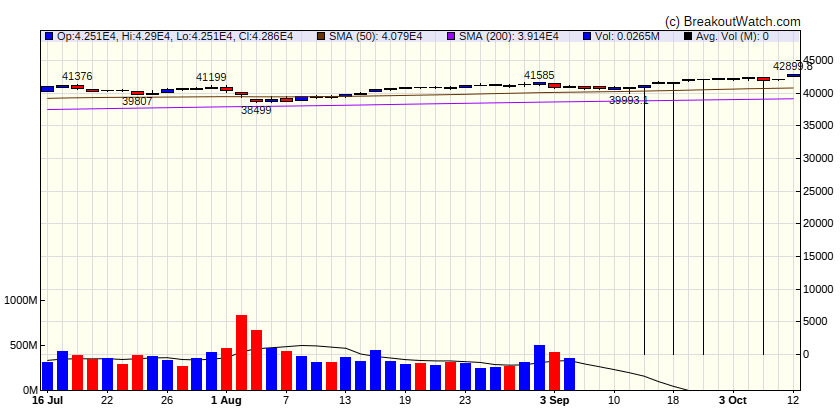

| Dow Jones | |

|---|---|

| Last Close | 42863.9 |

| Wk. Gain | INF % |

| Yr. Gain | 14.1 % |

| Trend | Up |

|

|

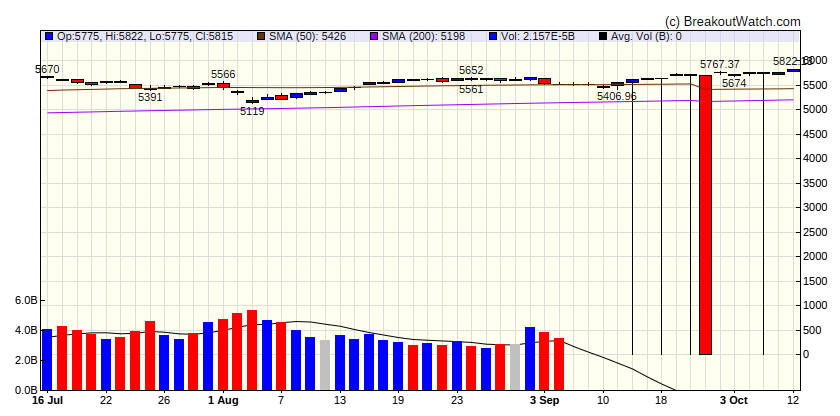

| S&P 500 | |

|---|---|

| Last Close | 5815.03 |

| Wk. Gain | INF % |

| Yr. Gain | 22.55 % |

| Trend | Up |

|

|

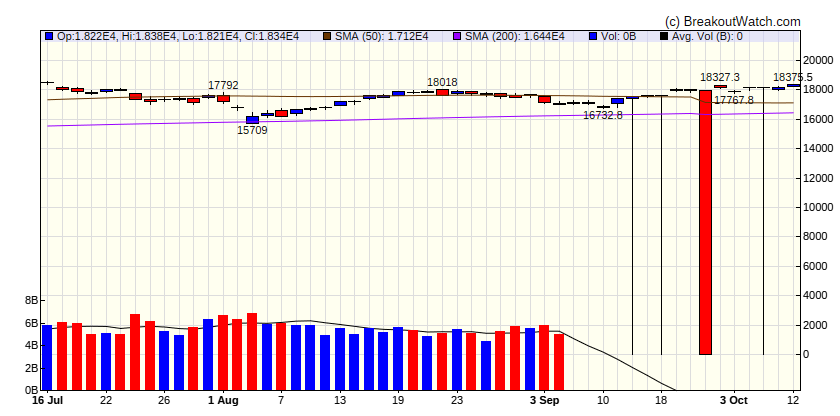

| NASDAQ Comp. | |

|---|---|

| Last Close | 18342.9 |

| Wk. Gain | INF % |

| Yr. Gain | 23.32 % |

| Trend | Up |

|

|

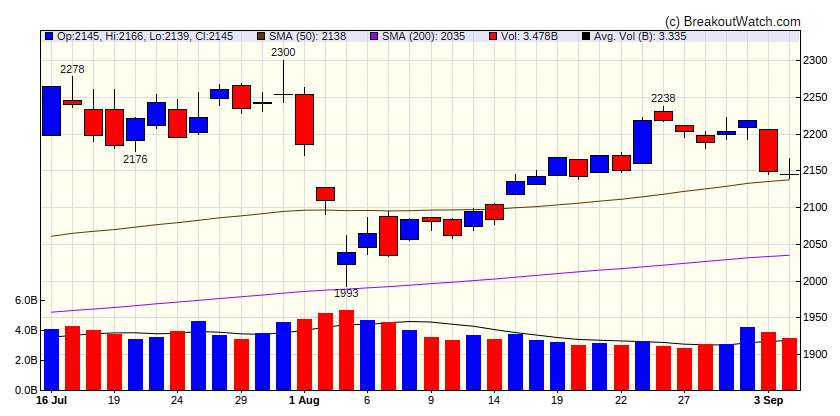

| Russell 2000 | |

|---|---|

| Last Close | 18342.9 |

| Wk. Gain | 23.32 % |

| Yr. Gain | 811.22 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 5359.36 | 5951.37 | Down |

| Consumer Staples | 9531.35 | 9450.11 | Down |

| Energy | 14937.63 | 23489.12 | Up |

| Finance | 18773.24 | 24996.32 | Up |

| Health Care | 8135.49 | 9425.32 | Down |

| Industrials | 11752.48 | 12601.96 | Up |

| Technology | 8271.17 | 8271.17 | Up |

| Materials | 14655.77 | 14655.77 | Up |

| REIT | 19591.79 | 19591.79 | Down |

| Telecom | 20935.44 | 20935.44 | Up |

| Utilities | 12901.77 | 12901.77 | Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss | There were no Breakdowns still within 5% of breakdown price this week |

|---|---|---|---|---|---|

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| LUMN | 0 | Western Digital Corporation | Utilities - Diversified | 48.00 | 56.7 | |

| NYCB | 53.9 | |||||

| VKTX | 38.6 | |||||

| TPC | 73.7 | |||||

| VERA | 47.30 | Vera Therapeutics, Inc. | Biotechnology | 95.00 | 90.32 | 40.9 |

| APGE | 60.82 | Apogee Therapeutics, Inc. | Biotechnology | 93.00 | 93.62 | 38.2 |

| BBAR | 61.2 | |||||

| MHO | 173.69 | M/I Homes, Inc. | Apparel Retail | 88.00 | 93.74 | 70.3 |

| MHK | 161.38 | Mohawk Industries, Inc. | Packaged Foods | 90.00 | 97.47 | 61.1 |

| MAX | 36.4 | |||||

| KKR | 40.7 | |||||

| ZYME | 13.27 | Zymeworks Inc. | Biotechnology | 90.00 | 99.47 | 40.1 |

| HMST | 16.10 | HomeStreet, Inc. | Household & Personal Products | 90.00 | 94.97 | 37.7 |

| EVR | 72.8 | |||||

| TBBK | 71 | |||||

| TARS | 40.5 | |||||

| PRIM | 71.7 | |||||

| SLNO | 38.1 | |||||

| SKYH | 13.25 | Sky Harbour Group Corporation Class A | Apparel Retail | 85.00 | 85.21 | 39.1 |

| BLBD | 36 | |||||

| QNST | 20.91 | QuinStreet, Inc. | Gold | 89.00 | 92.68 | 62.2 |

| WING | 433.86 | Wingstop Inc. | Residential Construction | 88.00 | 93.08 | 38 |

| BSRR | 61.7 | |||||

| CHWY | 33.18 | Chewy, Inc. | Personal Services | 86.00 | 87.7 | 37.6 |

| RYTM | 38.2 | |||||

| FISI | 68.1 | |||||

| OSPN | 16.68 | OneSpan Inc. | Utilities - Regulated Gas | 88.00 | 94.06 | 63.4 |

| EXP | 68.1 | |||||

| ESQ | 38.1 | |||||

| DASH | 39.4 | |||||

| RBB | 36.5 | |||||

| PEGA | 71.7 | |||||

| ATGE | 77.83 | Adtalem Global Education Inc. | Specialty Chemicals | 83.00 | 94.17 | 64.4 |

| AFRM | 39.7 | |||||

| PRK | 65.7 | |||||

| TMHC | 33.4 | |||||

| NVEI | 35.1 | |||||

| CALM | 72.4 | |||||

| CBAN | 55.4 | |||||

| MTH | 62.1 | |||||

| ABCB | 70.1 | |||||

| FITB | 58.7 | |||||

| ITRI | 109.56 | Itron, Inc. | Biotechnology | 84.00 | 98.85 | 66.8 |

| COOP | 36.4 | |||||

| WEAV | 13.38 | Weave Communications, Inc. | Utilities - Renewable | 87.00 | 98.95 | 41.4 |

| MC | 71.34 | Moelis & Company Class A | Beverages - Non-Alcoholic | 81.00 | 96.69 | 33.9 |

| CVCO | 63.2 | |||||

| EQBK | 35.3 | |||||

| RH | 37.9 | |||||

| DFH | 31.3 | |||||

| FTNT | 66.3 | |||||

| CNO | 62.6 | |||||

| FFIN | 63.4 | |||||

| RYAN | 37.8 | |||||

| MCB | 39 | |||||

| VFC | 21.40 | V.F. Corporation | Leisure | 88.00 | 95 | 55.7 |

| BWB | 36.5 | |||||

| SSB | 61.4 | |||||

| VBTX | 37.1 | |||||

| ARGX | 35.7 | |||||

| MTB | 55.4 | |||||

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.