Breakoutwatch Weekly Summary 10/23/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

U.S. Treasuries eke out marginal gains; heavy issuance in bank loan market

The S&P 500 Index advanced, paced by the utilities and real estate sectors. Energy stocks pulled back in sympathy with oil prices, which retreated as fears of possible Israeli attacks on Iran’s oil and gas infrastructure subsided. Returns were stronger down the market cap spectrum, with the small-cap Russell 2000 Index and the S&P MidCap 400 Index outperforming. [more...]

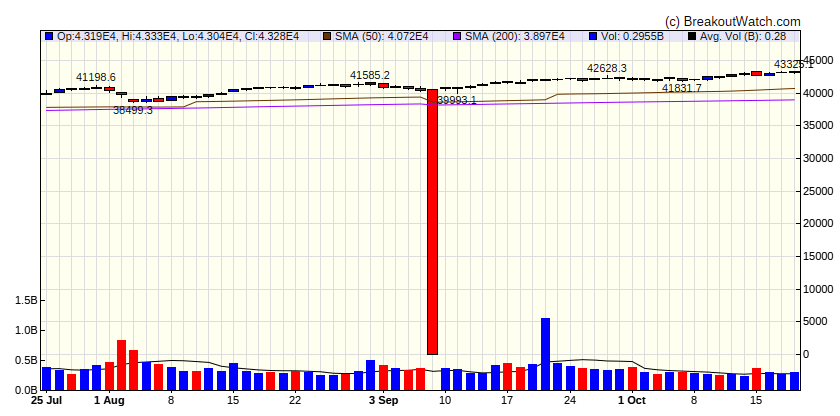

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Up |

|

|

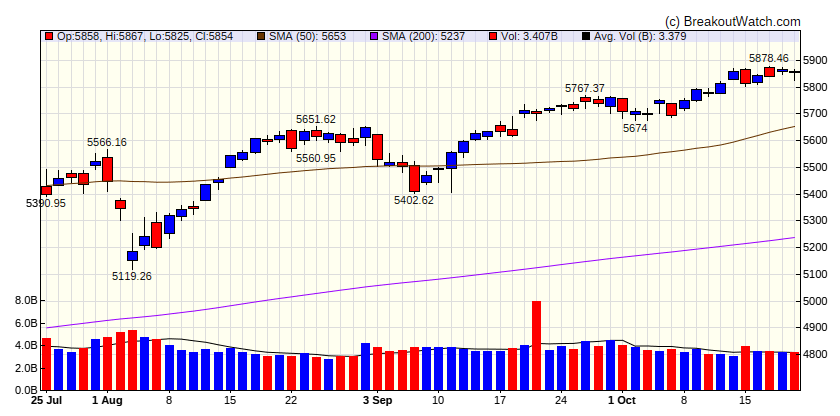

| S&P 500 | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Up |

|

|

| Russell 2000 | |

|---|---|

| Last Close | |

| Wk. Gain | -100 % |

| Yr. Gain | -100 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | -1.41 | 10.05 | Down |

| Consumer Staples | -0.45 | 13.9 | Down |

| Energy | -0.16 | 6.66 | Down |

| Finance | -1.26 | 25.02 | Up |

| Health Care | -1.18 | 11.11 | Up |

| Industrials | -1.68 | 20.18 | Up |

| Technology | -0.12 | 26.88 | Up |

| Materials | -1.56 | 12 | Up |

| REIT | -1.48 | 8.74 | Down |

| Telecom | -0.57 | 25.22 | Up |

| Utilities | -1.37 | 28.4 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | TEVA | Teva Pharmaceutical Indus | Biotechnology | 54.7 % | 1 % |

| SQZ | VRDN | Viridian Therapeutics, Inc. | Biotechnology | 43.1 % | 0.7 % |

| CWH | GRND | Grindr Inc. | Utilities - Renewable | 38.5 % | 3.7 % |

| SQZ | ASTS | AST SpaceMobile, Inc. | Utilities - Regulated Water | 38.5 % | 0.9 % |

| CWH | OPRA | Opera Limited | Packaged Foods | 37.1 % | 0.8 % |

| SQZ | RMAX | RE/MAX Holdings, Inc. | Oil & Gas Midstream | 36.4 % | 2 % |

| SQZ | PLSE | Pulse Biosciences, Inc | Biotechnology | 35.6 % | 1.8 % |

| SQZ | BNED | Barnes & Noble Education, Inc | Footwear & Accessories | 34.9 % | 1.9 % |

| SQZ | BKKT | Bakkt Holdings, Inc. | Utilities - Regulated Gas | 34.5 % | 4 % |

| SQZ | NYXH | Nyxoah SA | Other Industrial Metals & Mining | 27.6 % | 1.7 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | FEIM | Frequency Electronics, Inc. | Utilities - Regulated Water | 68.3 % | -1.6 % |

| SS | DKS | Dick's Sporting Goods Inc | Footwear & Accessories | 63 % | -3.5 % |

| SS | MHK | Mohawk Industries, Inc. | Packaged Foods | 61 % | -0.1 % |

| SS | IOVA | Iovance Biotherapeutics, Inc. | Biotechnology | 60.9 % | -1.9 % |

| SS | NGS | Natural Gas Services Group, Inc. | Luxury Goods | 60.1 % | -0.7 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| JANX | 53.18 | Janux Therapeutics, Inc. | Biotechnology | 97.00 | 99.29 | 40 |

| SG | 39.75 | Sweetgreen, Inc. | Residential Construction | 96.00 | 92.98 | 38.6 |

| VITL | 41.00 | Vital Farms, Inc. | Credit Services | 94.00 | 93.44 | 40.2 |

| VERA | 38.2 | |||||

| APGE | 60.82 | Apogee Therapeutics, Inc. | Biotechnology | 91.00 | 85.15 | 37.1 |

| BV | 17.05 | BrightView Holdings, Inc. | Software - Infrastructure | 90.00 | 94.96 | 38.1 |

| TARS | 39.8 | |||||

| AKRO | 32.15 | Akero Therapeutics, Inc. | Biotechnology | 89.00 | 92.04 | 38.6 |

| UIS | 7.20 | Unisys Corporation New | Utilities - Regulated Electric | 90.00 | 86.81 | 60.5 |

| HIPO | 20.00 | Hippo Holdings Inc. | Discount Stores | 86.00 | 94.8 | 34.6 |

| SHAK | 113.50 | Shake Shack, Inc. | Residential Construction | 89.00 | 95.79 | 36.9 |

| DESP | 15.17 | Despegar.com, Corp. Ordin | Textile Manufacturing | 89.00 | 96.9 | 40 |

| LNTH | 117.47 | Lantheus Holdings, Inc. | Specialty Business Services | 84.00 | 95.88 | 39.7 |

| KVYO | 38.50 | Klaviyo, Inc. | Utilities - Regulated Gas | 90.00 | 97.95 | 39.6 |

| ZLAB | 40.9 | |||||

| REVG | 29.98 | REV Group, Inc. | Telecom Services | 82.00 | 92.03 | 32.6 |

| CENX | 17.88 | Century Aluminum Company | Publishing | 90.00 | 94.85 | 56.7 |

| COIN | 220.26 | Coinbase Global, Inc. | Beverages - Non-Alcoholic | 87.00 | 95.67 | 32.4 |

| DDI | 16.75 | DoubleDown Interactive Co., Ltd. | Utilities - Diversified | 89.00 | 86.81 | 37.9 |

| HMST | 16.10 | HomeStreet, Inc. | Household & Personal Products | 88.00 | 90.68 | 37.9 |

| GRND | 38.5 | |||||

| UTHR | 377.03 | United Therapeutics Corporation | Biotechnology | 85.00 | 98.2 | 70.5 |

| MD | 12.99 | Pediatrix Medical Group, Inc. | Health Information Services | 89.00 | 99.31 | 50.8 |

| MHO | 176.18 | M/I Homes, Inc. | Apparel Retail | 87.00 | 89.73 | 67.3 |

| CLPR | 6.90 | Clipper Realty Inc. | Thermal Coal | 90.00 | 92.03 | 42.6 |

| KNSA | 27.18 | Kiniksa Pharmaceuticals, Ltd. | Biotechnology | 89.00 | 98.57 | 34.6 |

| WIX | 179.00 | Wix.com Ltd. | Utilities - Regulated Gas | 84.00 | 93.26 | 36.8 |

| CINT | 7.60 | CI&T Inc | Utilities - Regulated Gas | 87.00 | 91.58 | 36.5 |

| PTCT | 41.81 | PTC Therapeutics, Inc. | Biotechnology | 87.00 | 94.04 | 62 |

| RVMD | 36.2 | |||||

| INBK | 38.29 | First Internet Bancorp | Household & Personal Products | 87.00 | 95.95 | 71.8 |

| AA | 42.95 | Alcoa Corporation | Publishing | 86.00 | 97.83 | 37.3 |

| FTNT | 83.77 | Fortinet, Inc. | Utilities - Regulated Gas | 86.00 | 98.41 | 66 |

| EML | 34.36 | Eastern Company (The) | Packaged Foods | 83.00 | 95.69 | 65 |

| KROS | 62.22 | Keros Therapeutics, Inc. | Biotechnology | 87.00 | 95.36 | 35.8 |

| RBB | 24.50 | RBB Bancorp | Household & Personal Products | 82.00 | 93.06 | 36.7 |

| NVEI | 33.60 | Nuvei Corporation | Utilities - Regulated Gas | 83.00 | 99.67 | 35.7 |

| NL | 8.25 | NL Industries, Inc. | Packaged Foods | 83.00 | 96.73 | 67.5 |

| QCRH | 82.00 | QCR Holdings, Inc. | Household & Personal Products | 83.00 | 96.29 | 60.8 |

| MASI | 146.81 | Masimo Corporation | Drug Manufacturers - General | 86.00 | 97.9 | 58.1 |

| OPRA | 37.1 | |||||

| SMBC | 61.70 | Southern Missouri Bancorp, Inc. | Household & Personal Products | 83.00 | 95.88 | 66.7 |

| SNFCA | 9.94 | Security National Financial Corporation | Farm Products | 84.00 | 98.09 | 63.1 |

| JCI | 37.3 | |||||

| WING | 34.9 | |||||

| SHOP | 84.37 | Shopify Inc. | Utilities - Renewable | 84.00 | 96.73 | 39.3 |

| COYA | 38.3 | |||||

| SBGI | 17.98 | Sincl | Other Precious Metals & Mining | 82.00 | 92.83 | 59 |

| DRS | 37.2 | |||||

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.