Breakoutwatch Weekly Summary 10/30/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

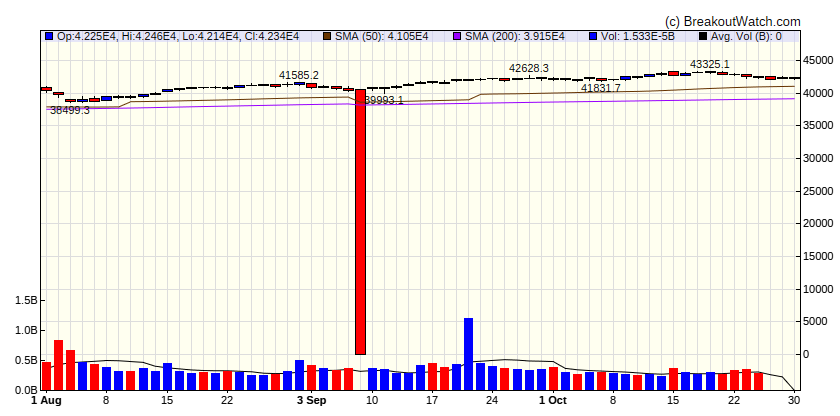

Stocks take cues from increasing U.S. Treasury yields

The broad market S&P 500 Index finished lower after posting gains in each of the six previous weeks. Equities seemed to take cues from the U.S. Treasury market, where futures market pricing now reflects a shallower Fed rate-cutting cycle. Large-cap stocks held up better than small-caps, and growth stocks outperformed value as the tech-heavy Nasdaq Composite Index gained slightly. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 42340.4 |

| Wk. Gain | -0.32 % |

| Yr. Gain | 12.71 % |

| Trend | Down |

|

|

| S&P 500 | |

|---|---|

| Last Close | 5839.77 |

| Wk. Gain | 0.22 % |

| Yr. Gain | 23.07 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 5839.77 |

| Wk. Gain | 23.07 % |

| Yr. Gain | 23.07 % |

| Trend | Up |

|

|

| Russell 2000 | |

|---|---|

| Last Close | 5839.77 |

| Wk. Gain | 162.37 % |

| Yr. Gain | 190.14 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 1627.23 | 1826.55 | Up |

| Consumer Staples | 2966.3 | 2940.44 | Down |

| Energy | 4687.48 | 7409.99 | Down |

| Finance | 5908.61 | 7889.83 | Up |

| Health Care | 2521.91 | 2932.54 | Down |

| Industrials | 3673.44 | 3943.88 | Down |

| Technology | 2565.1 | 2565.1 | Up |

| Materials | 4597.75 | 4597.75 | Down |

| REIT | 6169.21 | 6169.21 | Up |

| Telecom | 6596.98 | 6596.98 | Up |

| Utilities | 4039.33 | 4039.33 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss | There were no Breakdowns still within 5% of breakdown price this week |

|---|---|---|---|---|---|

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| JANX | 56.24 | Janux Therapeutics, Inc. | Biotechnology | 98.00 | 96.39 | 40.6 |

| DCTH | 11.66 | Delcath Systems, Inc. | Drug Manufacturers - General | 95.00 | 89.02 | 68.1 |

| APGE | 60.82 | Apogee Therapeutics, Inc. | Biotechnology | 93.00 | 92.62 | 38 |

| COGT | 12.61 | Cogent Biosciences, Inc. | Biotechnology | 93.00 | 95.16 | 39.5 |

| BV | 17.05 | BrightView Holdings, Inc. | Software - Infrastructure | 92.00 | 96.19 | 39.2 |

| CENX | 19.34 | Century Aluminum Company | Publishing | 91.00 | 92.06 | 57.9 |

| AVAV | 227.18 | AeroVironment, Inc. | Household & Personal Products | 90.00 | 97.21 | 72.8 |

| HIPO | 20.00 | Hippo Holdings Inc. | Discount Stores | 90.00 | 94.65 | 36.1 |

| TEVA | 18.56 | Teva Pharmaceutical Indus | Biotechnology | 89.00 | 99.3 | 55.1 |

| MAX | 20.71 | MediaAlpha, Inc. | Packaged Foods | 89.00 | 94.59 | 37.6 |

| LNTH | 117.47 | Lantheus Holdings, Inc. | Specialty Business Services | 88.00 | 93.72 | 40.3 |

| CLPR | 6.90 | Clipper Realty Inc. | Thermal Coal | 88.00 | 91.59 | 42.4 |

| WIX | 179.00 | Wix.com Ltd. | Utilities - Regulated Gas | 87.00 | 94.74 | 37.4 |

| HMST | 16.10 | HomeStreet, Inc. | Household & Personal Products | 87.00 | 86.46 | 37.5 |

| DDI | 16.75 | DoubleDown Interactive Co., Ltd. | Utilities - Diversified | 86.00 | 82.87 | 36.4 |

| WEAV | 13.79 | Weave Communications, Inc. | Utilities - Renewable | 85.00 | 97.9 | 41.9 |

| NVEI | 33.60 | Nuvei Corporation | Utilities - Regulated Gas | 85.00 | 99.91 | 36.7 |

| UTHR | 377.03 | United Therapeutics Corporation | Biotechnology | 85.00 | 93.57 | 70.7 |

| VIST | 54.00 | Vista Energy S.A.B. de C. | Utilities - Regulated Water | 84.00 | 93.8 | 35.5 |

| CINT | 7.60 | CI&T Inc | Utilities - Regulated Gas | 84.00 | 86.58 | 32.4 |

| FTNT | 83.77 | Fortinet, Inc. | Utilities - Regulated Gas | 83.00 | 94.75 | 64.4 |

| PM | 133.27 | Philip Morris International Inc | Insurance - Diversified | 83.00 | 98.72 | 59.8 |

| AA | 42.95 | Alcoa Corporation | Publishing | 83.00 | 95.37 | 36.9 |

| RBB | 24.50 | RBB Bancorp | Household & Personal Products | 82.00 | 93.47 | 36.6 |

| GMED | 74.86 | Globus Medical, Inc. | Drug Manufacturers - General | 82.00 | 99.24 | 36.9 |

| REVG | 29.98 | REV Group, Inc. | Telecom Services | 81.00 | 91.16 | 32.9 |

| SHOP | 84.37 | Shopify Inc. | Utilities - Renewable | 81.00 | 95.28 | 37.2 |

| SMBC | 61.70 | Southern Missouri Bancorp, Inc. | Household & Personal Products | 81.00 | 96.63 | 65.9 |

| UEC | 8.67 | Uranium Energy Corp. | REIT - Healthcare Facilities | 81.00 | 92.16 | 51.1 |

| MASI | 146.81 | Masimo Corporation | Drug Manufacturers - General | 81.00 | 96.08 | 57.8 |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.